We are ¾ of the way through 2023 and the best way to describe our market is frozen… stifled…dormant…lethargic…stagnant…stalemat…jammed up…Has the cost of homeowners insurance and high interest rates had an effect on the Florida real estate market?

Here are the numbers for September 2023, let me know how you would describe things!

Brevard County

Active inventory 3,083

Sold Property 1,134

Months Supply 2.71 months

Average Price $437,508 2022 $402,752

Median Price $360,000 2022 $350,000

List/Sale ratio 92%

Average price per SqFt $234.17 SqFt

Days On Market 41.05 DOM

Property selling in less than 7 days 365 ( 32% of the sales)

Property selling over $1M 34

Highest price sale $4.9M

Home sales under $200K 32

Cocoa Beach & Cape Canaveral

Condos

| A: Price range $119K to $2.3M | S: Price Range $130K to $740K |

Active inventory 182

Sold condos 39

Months supply Months 4.67 Months

Average Price $390,733 2022 $436,723

Median Price $369,000 2022 $385,000

Average price per square foot $330.08

Days On Market 43.15 DOM

Condos selling under $200K 3

Best-selling complex: Several sold 2 condos: Triton Arms, Villages of Seaport, Colonial House, Stonewood, and Four Seasons

Single Family Homes

| A: Price range $580K to $5.1M | S: Price Range $580K to $1.045M |

Active inventory 41

Sold homes 7

Months supply 5.86 Months

Average Price $761,714 2022 $940,464

Median Price $709,000 2022 $735,000

Average price per square foot $388.57 SqFt

Days On Market 43.57 DOM

Homes selling under $500K None

Homes selling over $1M One

Sales are slower with only 1134 sales in September and they seem to be trending down.

Inventory is definitely rising, we officially broke the 3000 mark in September…we are at our highest inventory since the spring of 2020.

Yet, in spite of this, we are still under a 3 month supply of property available (2.71 months)

Average sales price is up 9% over last September.

Median sales price is also up over last September with a 3% increase

Average Days On Market for September was 41 days compared to 24 DOM for last September.

Even though it is taking a little longer to sell a property, there were 365 properties selling in 7 days or less…that is 36% of the property sold.

What’s crazy about ⅓ of the property selling in 7 days or less…13 of the sales were over $1M. Looking closer at the numbers, the average sales price was within 2.5% of the list price; reinforcing how important it is to price your property correctly if you would like it to sell in a timely manner.

Looking at the Cocoa Beach condo market…it is getting tough to sell a condo. We had 39 sales in September compared to 52 last year…a 25% drop in volume.

Inventory has climbed to 182 condos, which is the highest it has been since the spring of 2020.

Average sales price in September was $390,733 which is 10% lower than September 2022 ($436,273)

Median sales prices are also down…$369K in 2023 down from $385K in 2022 (4% down)

It is also taking longer to sell with the Days on Market (DOM) at 43 days.

How would you describe what is happening with our housing market? Can you add a word or two to this list?

There are 2 big factors that are affecting our housing market…insurance and interest rates.

Insurance, prices for coverage have been rising for the last 12 to 18 months. I have heard of an increase of 60% and more. Companies are going under or pulling out of Florida altogether. The only option for a lot of homeowners is Citizens, which is the State run program (& usually the last resort when nothing else is available). I currently have Citizens Insurance on my house because that’s all that’s been available. I did just receive notice from my insurance company that there is at least one option available to me with my renewal at the beginning of the year and to anticipate a 20% increase for my premium. I think having this option available is a good sign for the insurance market in Florida. Time will tell…

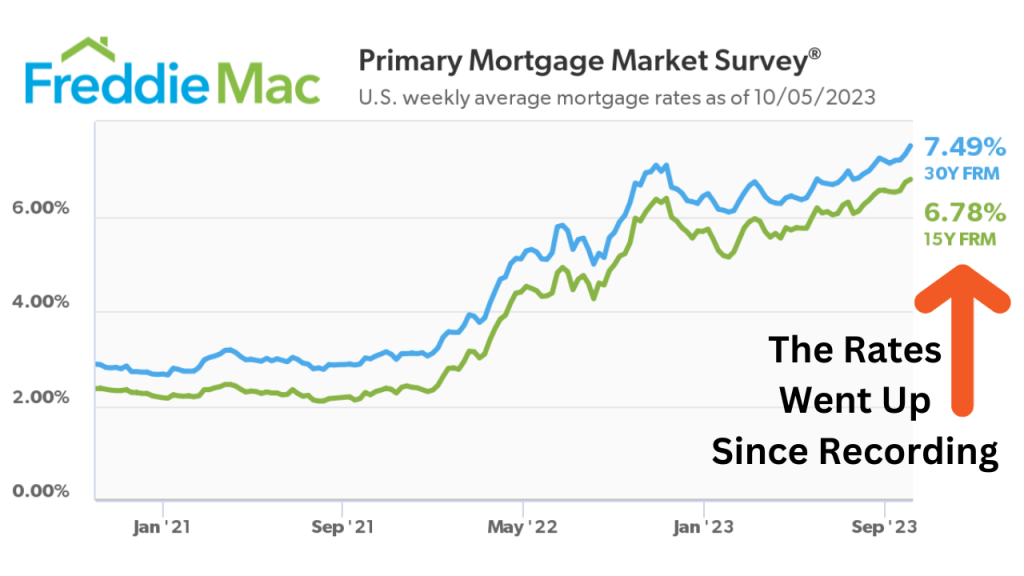

Let’s talk about the interest rates. The current rates are around 7.3% The Fed started raising the rates in the Spring of 2022 to slow down the real estate market and to also lower home prices. We are seeing a flaw in this plan today.

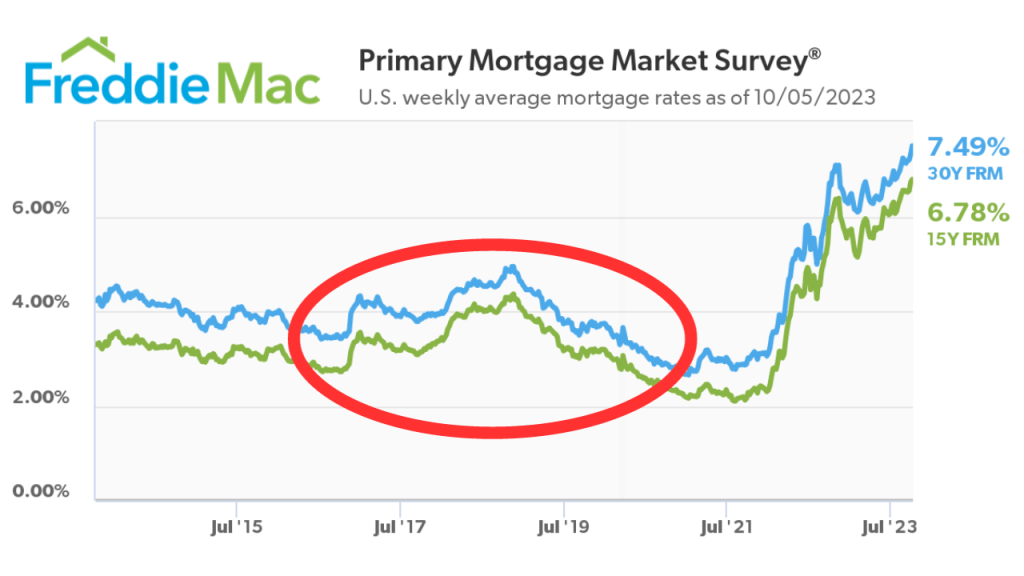

We don’t have enough Sellers wanting to sell their property. They either refinanced in 2020 or 2021 and have a low rate, or they purchased in 2017, 2018, or 2019 and have a rate at or below 4%. It doesn’t make sense for them to sell unless they have to (new job, major life event, etc)

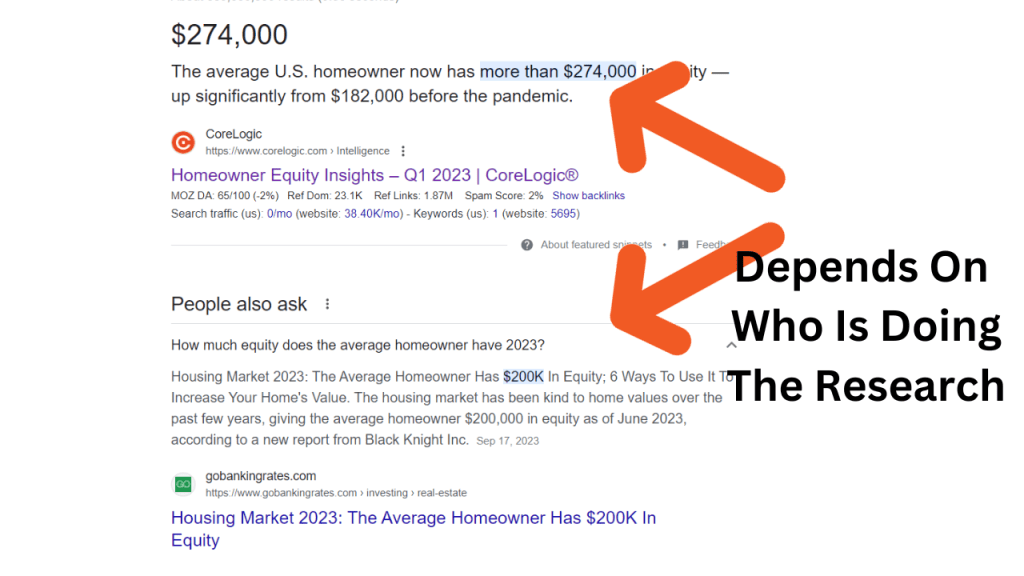

I am seeing Sellers look at the equity they have in their houses. The national average is $250,000. They are selling their homes, and consolidating their debt (paying off credit cards, cars, and student loans), and even though the interest rate is higher on their new property…their monthly commitment is lower because the 7.3% rate is less than the rates they had on their other debt (credit cards, car rates, etc)

Buyers are in a tough spot because of the higher interest rates. They cannot afford the same kind of home at 7.3% versus where rates were at just last year. Buyers need to decide do they adjust the price point shopping? Do they bring more money for a down payment or to buy down a rate? Do they stretch their monthly commitment for a higher payment to purchase what they want? Do you decide to rent until the market changes?

If you are waiting for a market crash, I don’t see that happening. The distressed properties are nonexistent in our marketplace. There are 18 distressed properties for sale today. We are averaging 6 sales per month in 2023.

When (if) the rates lower to the 6% range, there will be a flood of buyers coming back to the market. This will cause our lower inventory to disappear and prices to spike back up. Hopefully, we see more Sellers come back to the market when this happens.

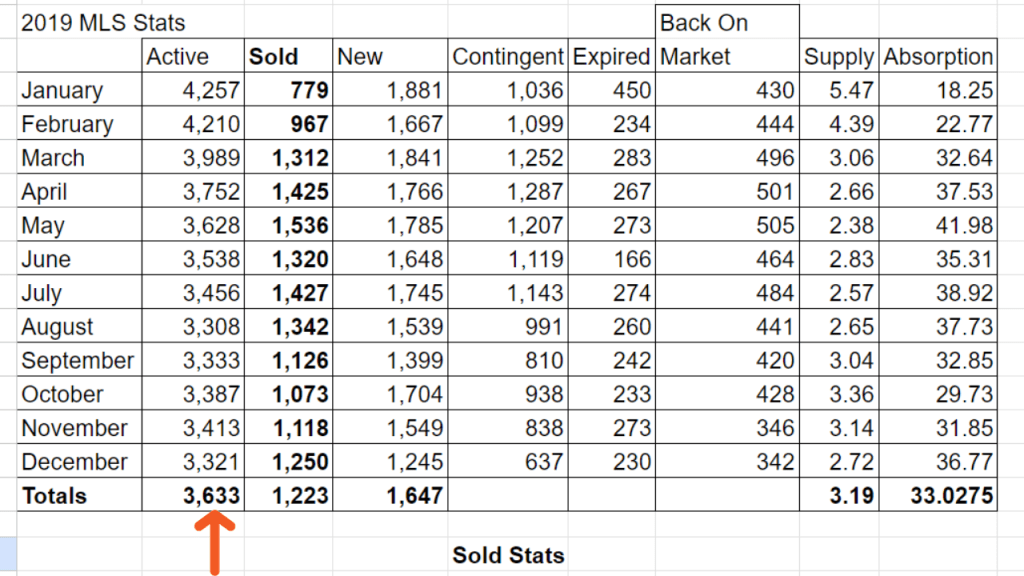

Do you remember what the real estate market was like before COVID back in 2018 or 2019?

We were averaging 3500 to 3600 properties for sale in our MLS (slightly higher than where we are at today)

We were averaging 1100 to 1,200 sales per month, which is exactly where we are at now. This is a 3 month supply and still a seller’s market.

The bottom line, you have to do what’s right for you. If you need to move, I’m sure you have questions and I am here to help. You can call or text me at 321.795.1854 or drop a comment below.