October sales are in the books, it is time to take a deep dive into the numbers to see what changes are happening in our housing market. Looks like we are going back in time to our 2018/2019 housing market.

Brevard County

Active inventory 3468

Sold property 987

Months Supply 3.49 months

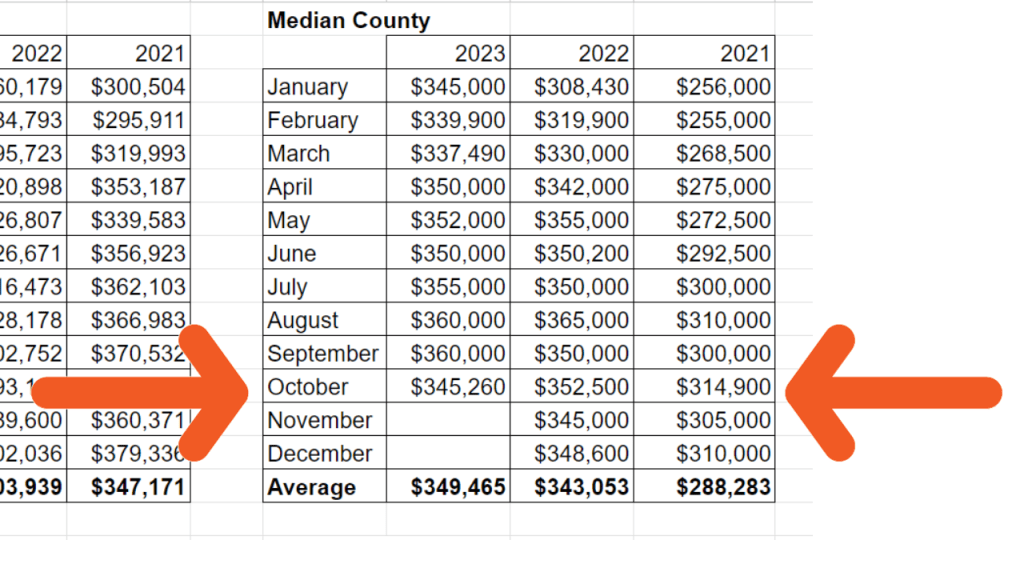

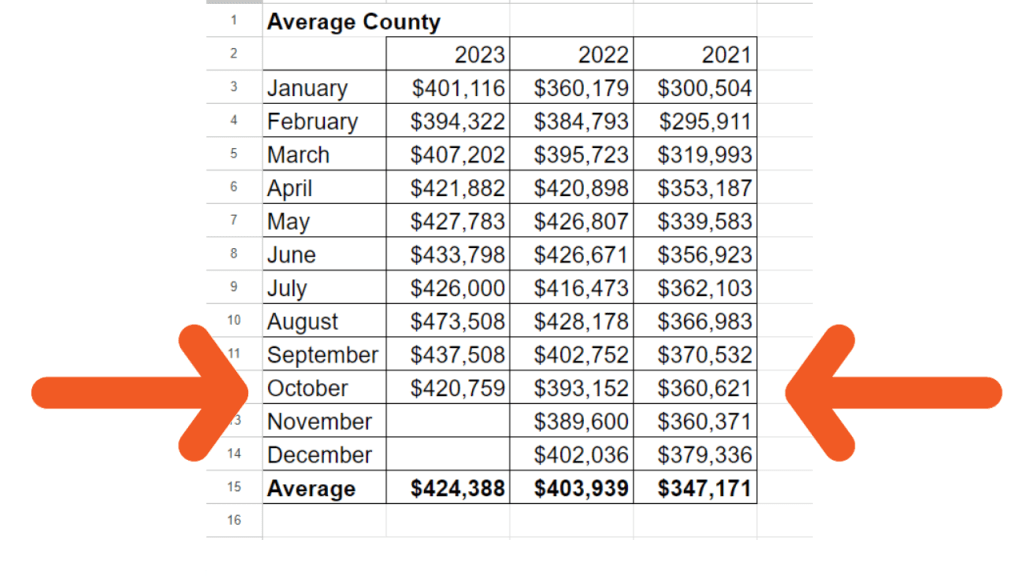

Average Price $420,759 2022 $393,152 (7% Increase)

Median Price $345,260 2022 $352,800 (2% decrease)

List/Sale ratio 95%

Average price per SqFt $236.74 SqFt

Days On Market 40.98 DOM

Property selling in less than 7 days 303 (31 % of the sales)

Property selling over $1M 34

Highest price sale $5.5M Indialantic Riverfront Estate

Home sales under $200K 30

Cocoa Beach & Cape Canaveral

Condos

| A: Price range $115K to $2.3M | S: Price Range $111K to $1.545M |

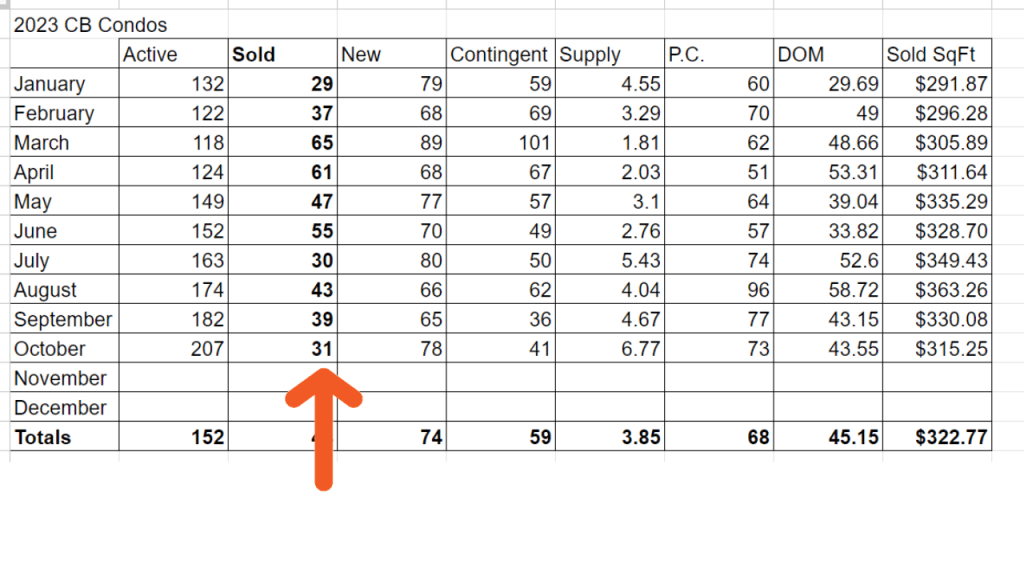

Active inventory 207

Sold condos 31

Months supply Months 6.77

Average Price $472,317 2022 $441,867 (7% Increase)

Median Price $425,000 2022 $340,000 (25% Increase)

Average price per square foot $315.25

Days On Market 43.55 DOM

Condos selling under $200K 6

Best-selling complex Cape Shores with 3 sales ($232K. $257K, and $310K)

Single Family Homes

| A: Price range $ 439.9K to $5.1M | S: Price Range $510K to $1.8M |

Active inventory 35

Sold homes 10

Months supply 3.5 Months

Average Price $980,900 2022 $1,001,667

Median Price $780,000 2022 $750,000

Average price per square foot $456.62SqFt

Days On Market 70.6 DOM

Homes selling under $500K 0

Homes selling over $1M 3

Let’s take a look back at the 2018 and 2019 housing market stats. In the summer of 2018 rates started climbing towards 5% and it slowed things down just enough to have our inventory climb to 4000 properties and sales to pull back a little. Our inventory hit a 5 month supply in January 2019. Then the rates started pulling back down into the low 4% range in the spring of 2019 and were back in the low to mid 3% range by summertime and we were back to a 3 month supply.

Fast forward to today. Rates recently broke the 8% mark. Inventory is climbing about 10% per month. We have around 3500 properties for sale in Brevard County, the highest we have seen since March 2020 when the pandemic hit. I am expecting this to continue through the end of the year. Not really because of the rates, but because this is typically what happens in the last quarter of the year.

Sales are declining. This is the first time we had sales under 1000 properties in October in some time. The last time this happened was in 2017 and that was because of Hurricane Irma coming through and causing damage. Anytime a major storm affects Brevard County/Central Florida, our sales pull back. Looking at our YTD averages, we are closer to 2018 sales numbers than anything we have seen in the last few years.

In spite of the active inventory climbing, the sales slowing down, and the higher interest rates, the “numbers” still consider our market a seller’s market because our month’s supply is under 4 months. This is only on paper. The reality is buyers are very cautious due to the rates, the active inventory climbing, and the uncertainty of our housing market. Even though the average prices are continuing to rise over last year’s numbers ($420K this year compared to $393K last October), the median prices are not ($345K this year compared to $352 last October). I see the median prices trending down as an indication prices are softening in parts of the county and will probably continue to do so in the next few months. However, if rates start coming down, which they are now back below 8%; this will have an impact on our market. The spring market always has more activity than the last quarter of the year. Waiting until then will probably get you a better interest rate, but will also put you in a more active market…more buyers looking, more offers being presented, and a higher probability of being in a multiple offer scenario.

If you are planning to sell a property, this is not the right market to test the market and price your home higher than the sales that are happening in the area. Pricing has always been important and you have to price your property correctly in our current market.

Condition is important and buyers have been quick to cancel the contract during the inspection period. We had 451 properties go back on the market in October. Fix the things you know are not right. It might make sense to have a home inspection done to see if there are any issues that can be addressed or to get quotes to negotiate with the buyers. It also makes sense to have a 4-point inspection done. These can be provided to the new buyer so they can get an accurate insurance quote. There could be something on the 4-point inspection that prevents the buyer from getting coverage too. Remove some of the furniture, and work on the curb appeal (a little lipstick goes a long way).

You also need to keep in mind that Builders are offering great incentives for Buyers. Besides getting a brand new home, the Builders are offering $10K to as high as $24K to the buyers to go towards closing costs, buying down the rates, or for upgrades. If your home is in a similar price point or near some of these communities, you will need to be able to compete with this.

Some interesting stats from October.

31% of the property sales happened in 7 days or less

The list-to-sell ratio is 95%

The average days on the market are 40 days

Over $1M in sales are strong with 34 sales

We are still seeing multiple offers

The beach-side condo market is still the biggest red flag I am seeing with some interesting anomalies. Inventory is climbing in the Cocoa Beach area, they are back over 200 condos on the market. Sales are down with only 31 closings in October. This puts it at a 6.7-month supply of condos available. I consider this a buyer’s market (7 months or more is a buyer’s market) The higher condo fees along with the interest rates are having an impact on the condo market. Even though I am seeing prices coming down on condos, the average price in October is up ($472K compared to $441K October 2022) and the median price is way up ($425K compared to $340K October 2022) which is the anomaly…

What is your gut telling you about the housing market? Are we setting up for a huge crash? Are you seeing signs that it’s balancing out? Do you have plans to make a move in 2024? Remember, I am here to help. Let’s schedule a call to answer your questions to see if a move is right for you and your family.

Eric Larkin is a Broker Associate with Real Broker, LLC. He lives, works, and plays in the Cocoa Beach area. If you have questions about moving or relocating to Cocoa Beach and the Space Coast, let me know! I get calls, texts, direct messages & comments on my posts every day about the real estate market and things that are happening in Cocoa Beach and the Space Coast that I love answering. Ask me your questions on moving, relocating here, or anything about the community. I am here to help. I have been helping buyers and sellers with their real estate needs since becoming a real estate agent in 2003. My focus is always on helping, answering your questions, and doing everything possible to make certain you have a smooth transaction from beginning to end.

Planning a move or have questions about our area? Eric Larkin with Real Broker, LLC can help! Schedule a call here https://www.ericlarkin.com/schedule-a-call

OR leave your info here and I will call you https://www.ericlarkin.com/contact-form