There are a lot of people looking for a housing market crash. Even though I am not a doomsday predictor, I am seeing signs it might be coming in one area of our housing market…Beachside Condos. I will have a detailed breakdown of why I think this is happening at the end of this post.

Here is a breakdown of the numbers for November 2023

Brevard County

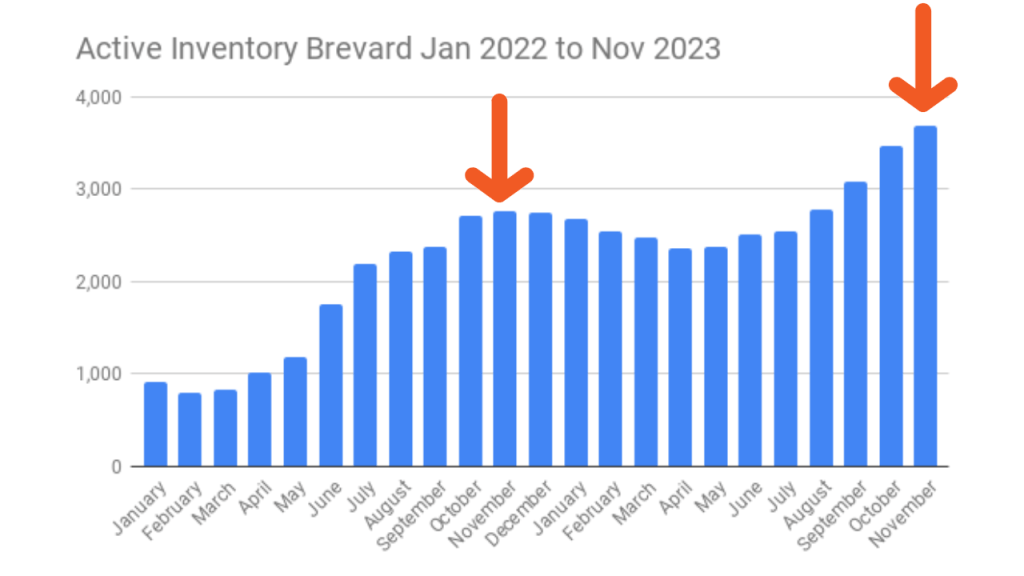

Active inventory 3688

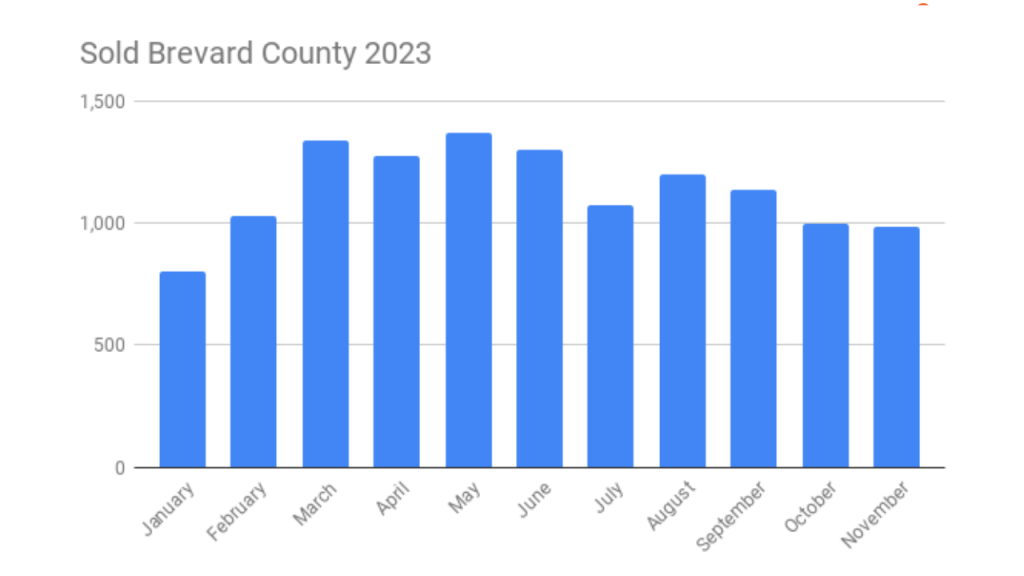

Sold Property 986

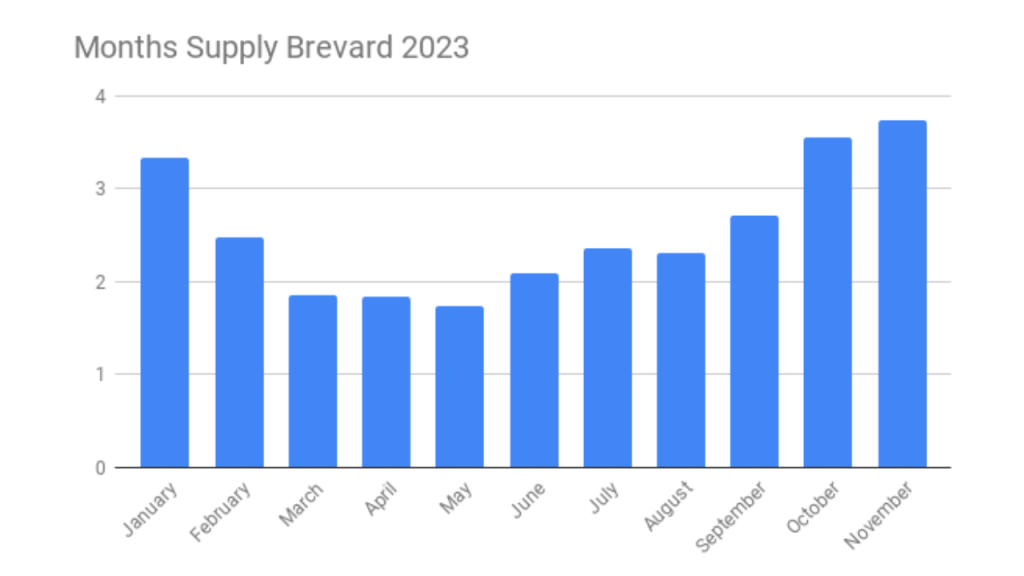

Months Supply 3.74 months

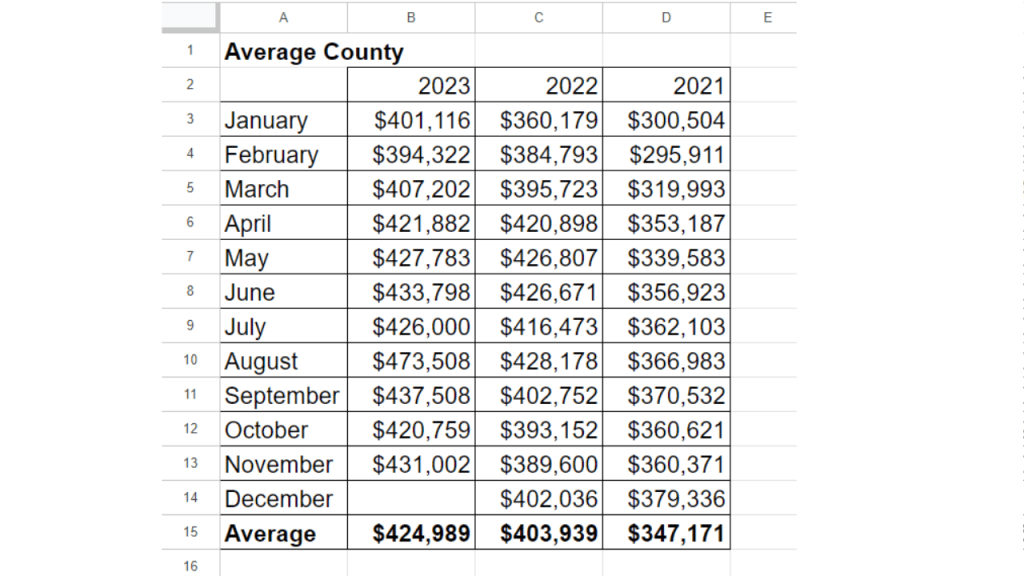

Average Price $431,002 2022 $389,600 (10% Increase)

Median Price $350,000 2022 $345,000 (1.4% Increase)

List/Sale ratio 94%

Average price per SqFt $240.81 SqFt

Days On Market 41.72 DOM

Property selling in less than 7 days 294 (30% of the sales)

Property selling over $1M 38

Highest price sale $4.2M Cocoa Beach Ocean Front Home

Home sales under $200K 28

Cocoa Beach & Cape Canaveral

Condos

| A: Price range $125.9K to $2.3M | S: Price Range $112.5K to $2.0M |

Active inventory 233

Sold condos 27

Months supply Months 8.63 Months

Average Price $487,711 2022 $460,041 (6% Increase)

Median Price $400,000 2022 $410,000 (2.5% Decrease)

Average price per square foot $322.04 SqFt

Days On Market 51.37 DOM

Condos selling under $200K 4

Single Family Homes

| A: Price range $ 415K to $4.950M | S: Price Range $ 270K to $4.2M |

Active inventory 33

Sold homes 12

Months supply 2.75 Months

Average Price $1.262M 2022 $1.158M (9%)

Median Price $990,000 2022 $857,500 (15%)

Average price per square foot $506.84 SqFt

Days On Market 71.18 DOM

Homes selling under $500K 1

Homes selling over $1M 6

Here is how I am interpreting the numbers for November. Our Active inventory for Brevard County is rising, but not at an alarming rate. We are around 3600 properties for the county, which is up from October’s 3400…but we usually see inventory rise the last couple of months of the year. Yes, this is significantly higher than where we were last November (2767) it just reinforces our market has been trending away from the hyperactive Sellers market from 2020, 2021, & 2022.

The number of closings we are seeing is down and will probably continue to trend down over the next few months. Which, just like our rising active inventory; is in line with this time of year. Granted the back-to-back under 1000 closings aren’t something we see in October/November. It is actually more sales than we saw in these same months in 2022. Looking at December sales, I think we are doing OK if we have around 1000 closings (time will tell)

I recently found a piece of real estate history from 2011/2012 that helped me realize our current market isn’t too bad when we compare it to what was happening then. We were just coming out of the great real estate crash. We were still dealing with foreclosures and short sales. This was the bottom of the market. Active inventory was as high as 5600 properties. Closings were as low as 530 per month and averaged 745 closings per month between 2011/2012. The monthly supply was as high as 9.4 months in January 2011. The summer of 2012 is when we transitioned from the extreme buyers market to a balanced market that led to the Seller’s market run that we are still experiencing today.

Our Months supply today is 3.74 months, which is a Seller’s market. A balanced market is between 4-6 months, and a buyer’s market is 7+ months supply. We might tip to a low 4-month supply next month or even at the beginning of the year (January/February), which is OK. We usually have a 4-month supply starting a new year and then it drops back to a 3-4 month supply from March through the summer. You can see that this is what we usually experience looking back at 2018 & 2019.

Some crazy stats I am continuing to see are the average and median prices. These are both trending up over last year for the county. My consensus is that our overall market for Brevard County is relatively stable and healthy. If rates start to maintain or drop a little more are indications our 2024 market will be just like our 2018/2019 market…which is a seller market.

The crash I alluded to at the beginning of the post is because of what is happening with the condo market beachside. These numbers are showing are pretty interesting. Most, I am expecting…then there’s the anomaly.

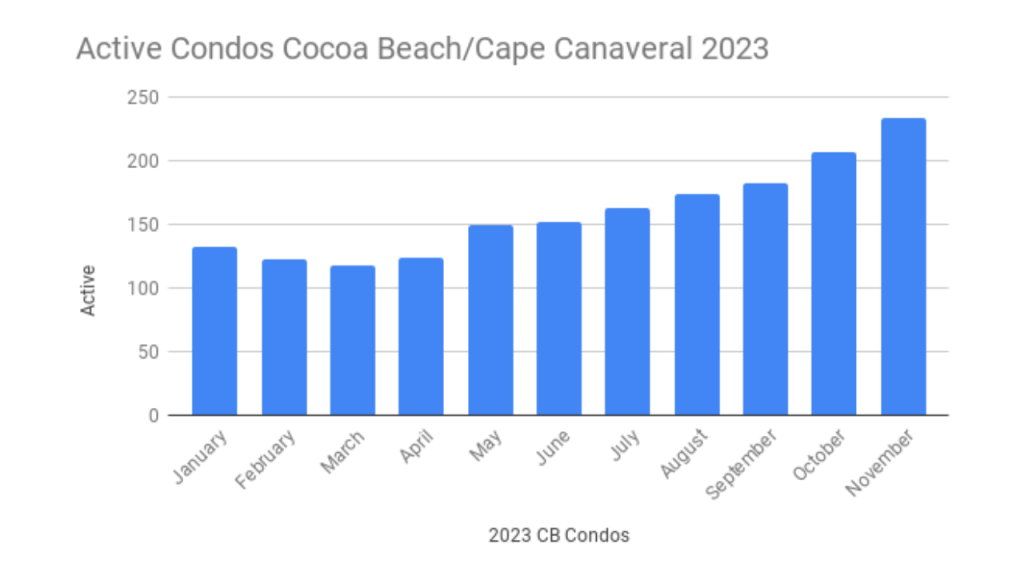

The condo active inventory is rising…a lot…Our active inventory has risen 75% since the beginning of the year. Our current active inventory of 233 condos is in line with what our condo inventory was like in November/December 2018 (224 to 234 condos) I would not be surprised if this number climbs to over 275 condos available in January 2024. We are seeing 70 to 80 new condo listings coming on the market each month.

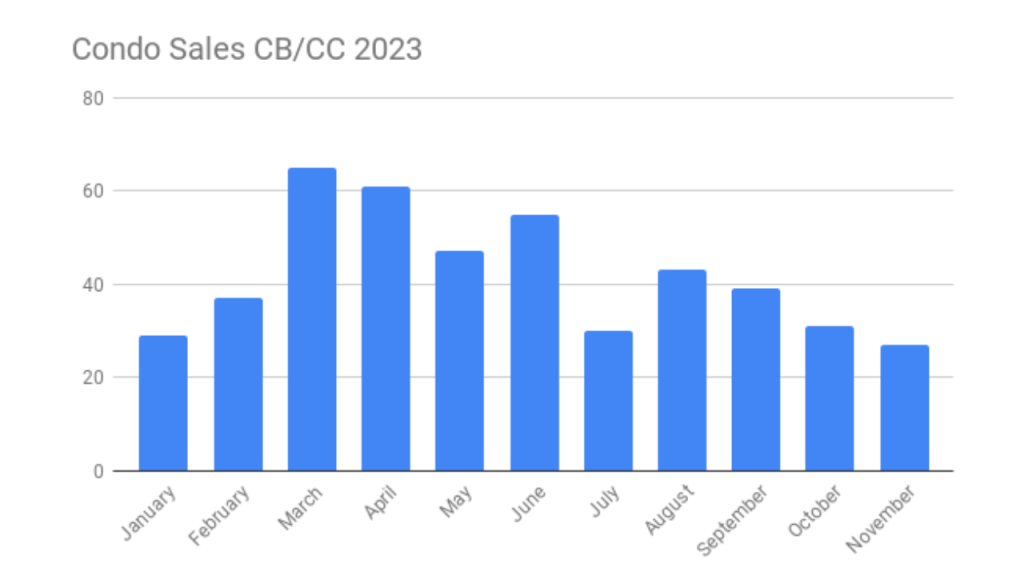

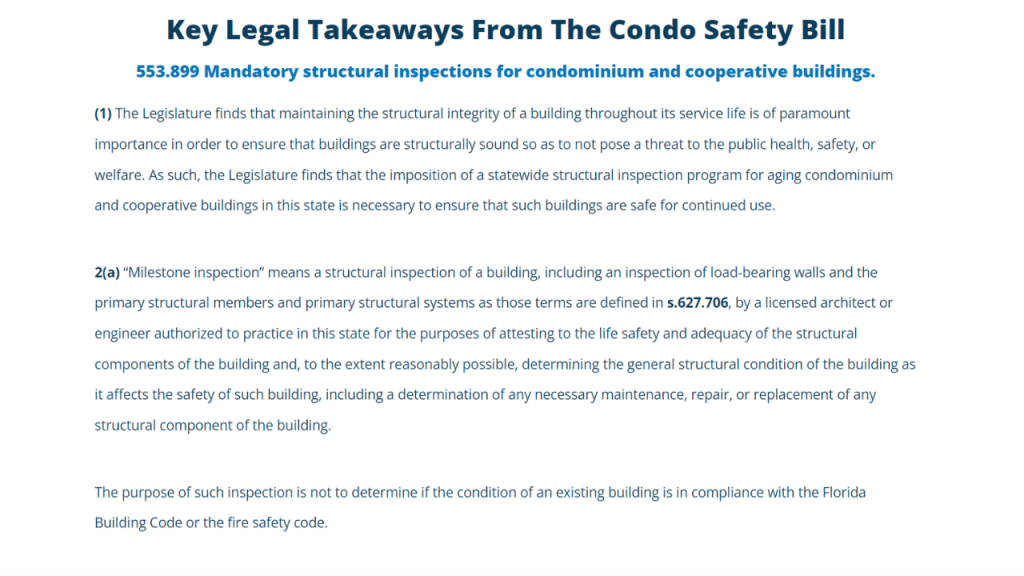

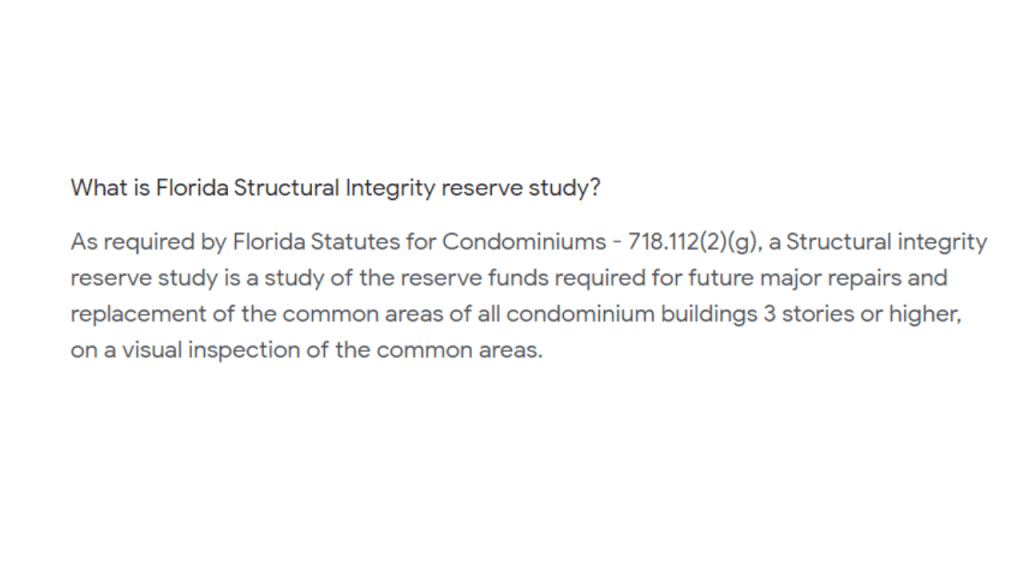

The condo sales have been flat or subpar for all of 2023. The best months this year were during the spring with 50 to 60 sales per month. November we only had 27 closings. Compare this to the sales we had in 2018/2019 where we were averaging over 50 per month. The reason for the slower sales is tied directly to the increases we have been seeing in the monthly condo dues. Insurance costs for condo associations are going up drastically for the premiums, which is causing the monthly fees to go up too. Condos are also working towards becoming 100% funded with their budgets. They have to be there by the end of 2025. The other factor that is having an effect comes with the Milestone Studies that condos have to do if they are 25 years or older. If these studies show integrity issues with the building and a phase 2 study is required…concrete work will need to be done; which is expensive. More than likely the complex will have large assessments for the work to be completed.

This will not be a concern for every condo complex. Some complexes will not be phased or affected by the Milestone inspections, potential concrete work, or bringing their reserves to 100% funded because they were a well-run complex that had the foresight to do these things without a state law in place forcing them to do so. One and two-story complexes might not be affected. But, the condo communities that are seeing their association fees go from $480 to over $800 are being affected. The complexes that are discovering they need concrete work done and are facing a $50K or more assessment will be affected. There will be a lot of condos being listed in these communities and the prices will start dropping.

With that being said, here is the anomaly…Yes, prices are definitely going down in some complexes. BUT…looking at the average prices…values are still going up…The median prices have seen a slight pullback, but nothing drastic yet. Time will tell how the condo market plays out. With the increase of inventory happening, the number of closings dropping, and the monthly association fees still going up…I am anticipating a big change in the condo market soon.

Questions about this information or an upcoming move? I am here to help.

Eric Larkin is a Broker Associate with Real Broker, LLC. He lives, works, and plays in the Cocoa Beach area. If you have questions about moving or relocating to Cocoa Beach and the Space Coast, let me know! I get calls, texts, direct messages & comments on my posts every day about the real estate market and things that are happening in Cocoa Beach and the Space Coast that I love answering. Ask me your questions on moving, relocating here, or anything about the community. I am here to help. I have been helping buyers and sellers with their real estate needs since becoming a real estate agent in 2003. My focus is always on helping, answering your questions, and doing everything possible to make certain you have a smooth transaction from beginning to end.

Planning a move or have questions about our area? Eric Larkin with Real Broker, LLC can help! Schedule a call here https://www.ericlarkin.com/schedule-a-call

OR leave your info here and I will call you https://www.ericlarkin.com/contact-form