We are halfway through 2024 and it has been an interesting year so far.

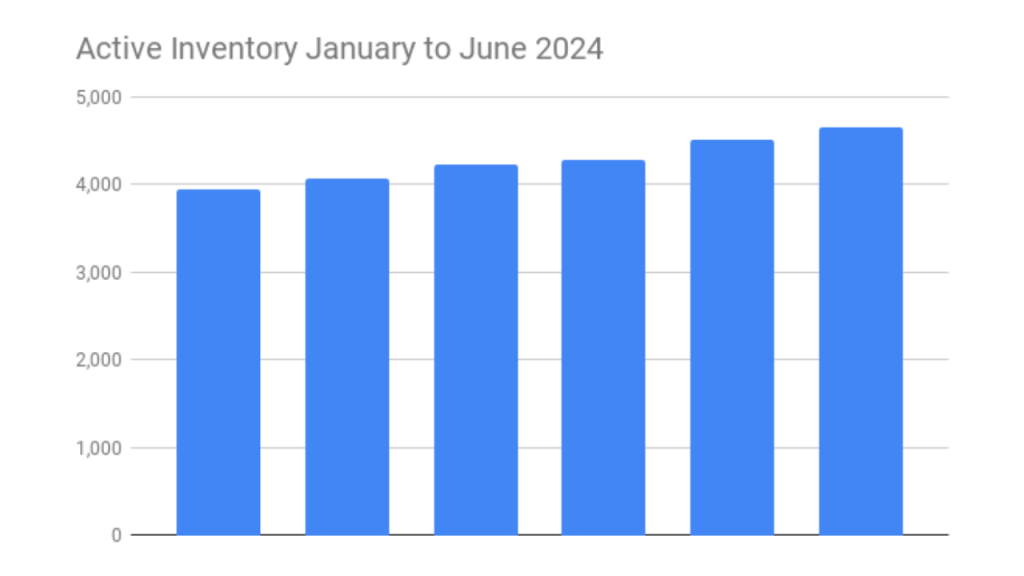

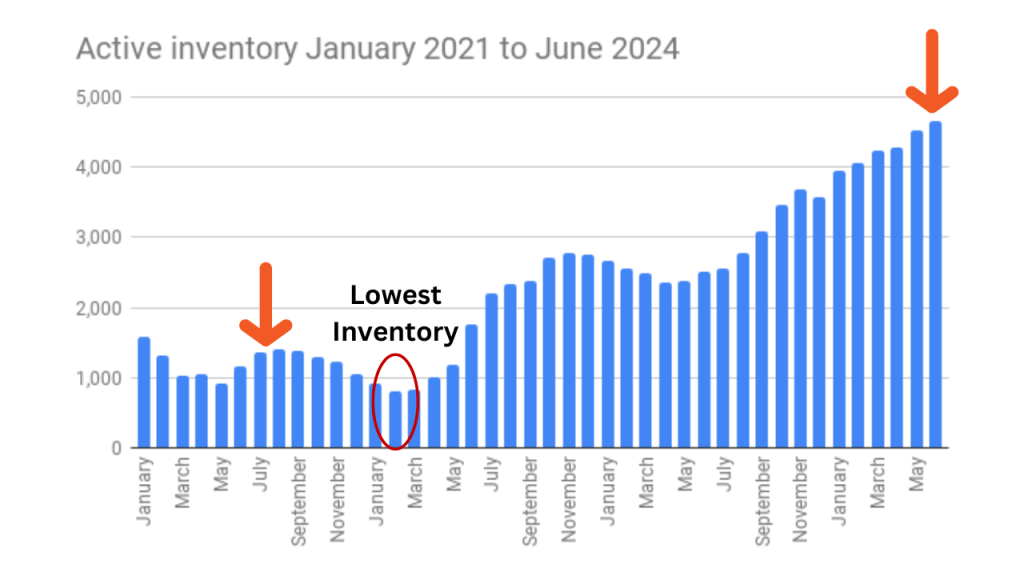

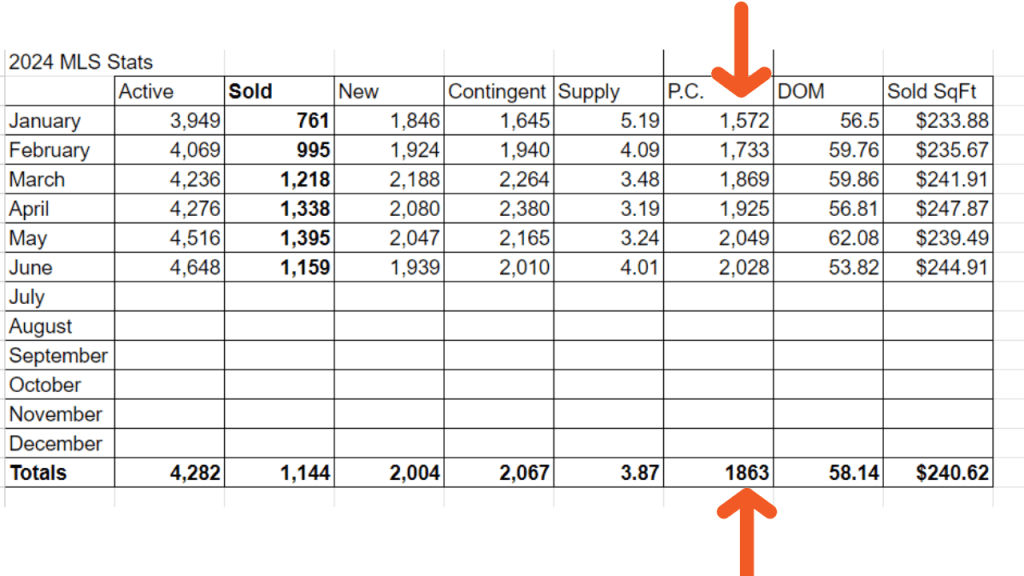

Active inventory is up 17% from the beginning of the year.

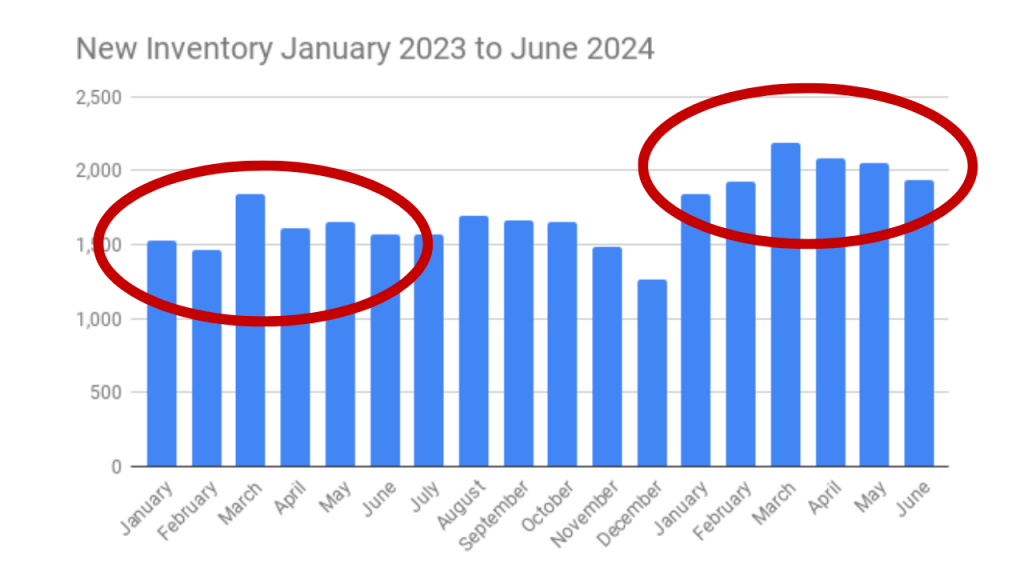

New property on the market is up 24% over the 1st half of 2023

Days on market is up 41% over the 1st half of 2023

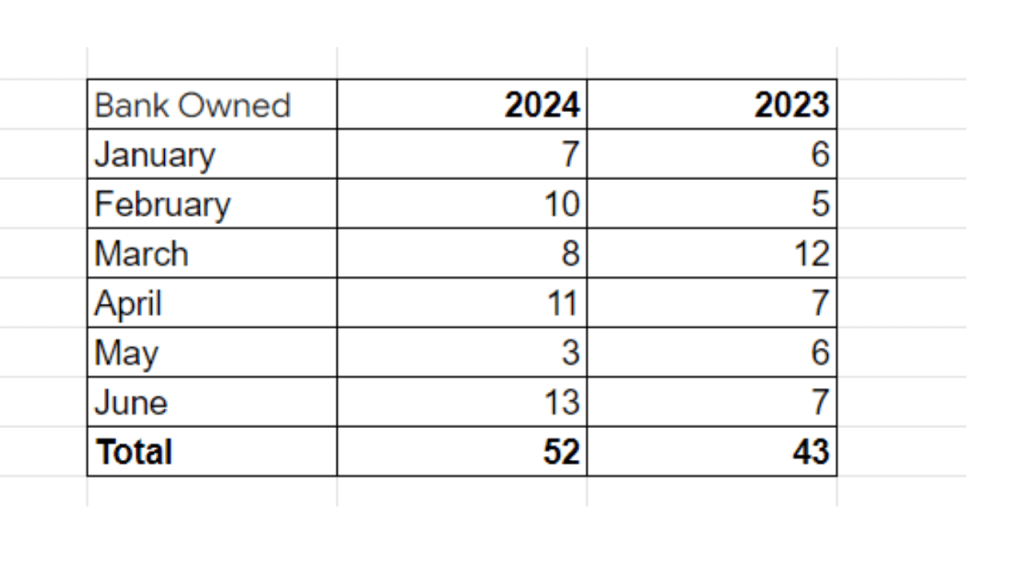

Bank Owned sales are up 20%

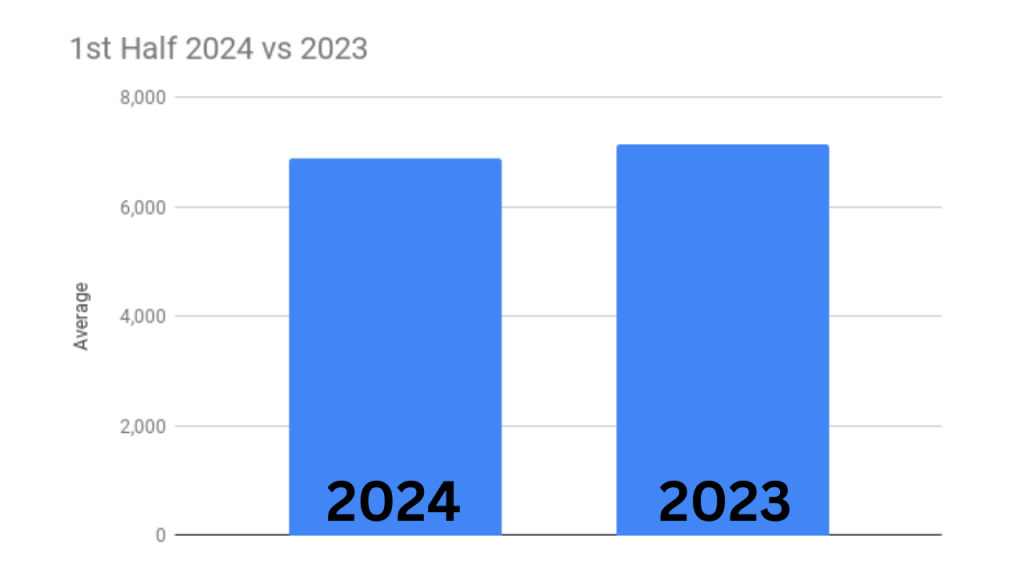

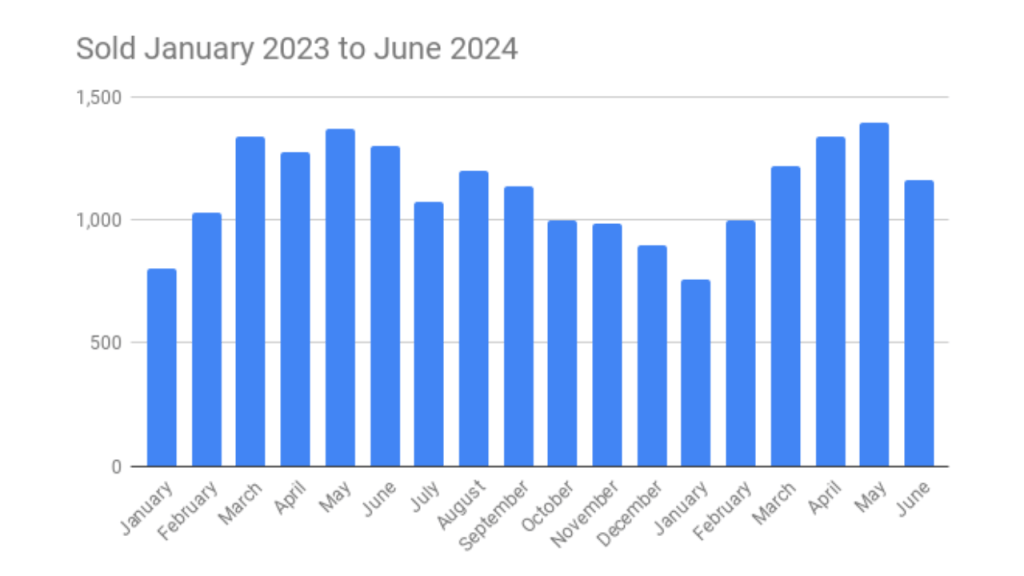

Sold property is down 4% from 2023.

But what does all this mean???

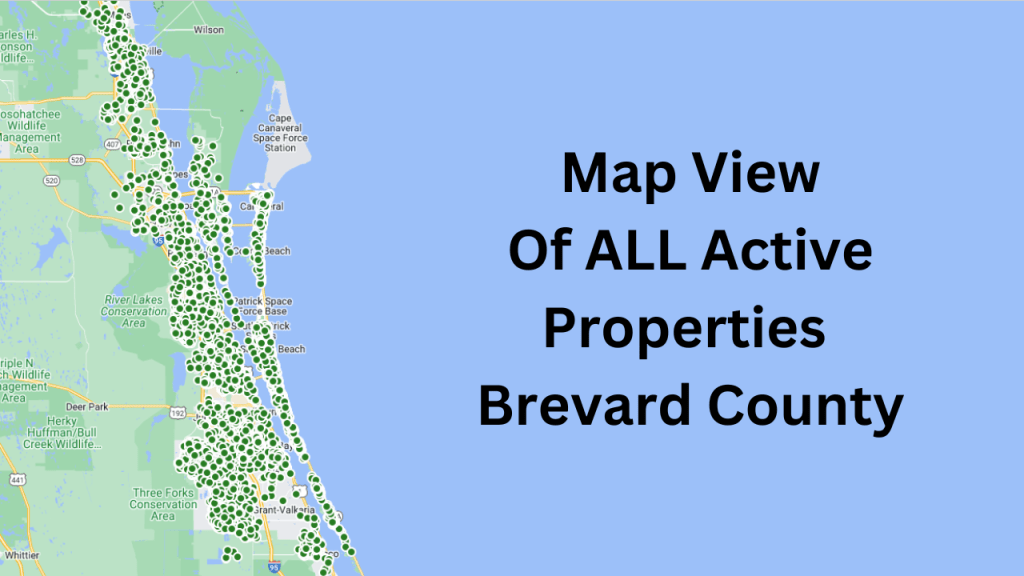

Brevard County

Active inventory 4,648

Sold Property 1,159

Months Supply 4.01 months

Average Price $439,890 2023 $433,798

Median Price $355,000 2023 $350,000

List/Sale ratio 94%

Average price per SqFt $244.91 SqFt

Days On Market 53.82 DOM

Property selling in less than 7 days 244 (21 % of the sales)

Property selling over $1M 48 properties

Highest price sale $4.425M

Home sales under $200K 34 homes under $200K

Cocoa Beach & Cape Canaveral

Condos

| A: Price range $105K to $1.999M | S: Price Range $ 77.5K to $1.175M |

Active inventory 256

Sold condos 46

Months supply 5.57 Months

Average Price $406,439 2023 $351,152

Median Price $350,000 2023 $334,000

Average price per square foot $325.16

Days On Market 71.07 DOM

Condos selling under $200K 5

Best selling complex Harbor Isles (3 sales) $310K, $320K & $394K The Villages Of Seaport (3) $$219K, $270K, & $309K

Single Family Homes

| A: Price range $ 475K – $4.699M | S: Price Range $580K -$2.5M |

Active inventory 46

Sold homes 7

Months supply 6.57 Months

Average Price $1,127,857 2023 $907,900

Median Price $725,000 2023 $799,000

Average price per square foot $535.12

Days On Market 40.43 DOM

Homes selling under $600K 1

Homes selling over $1M 2 ($2.149M and $2.5M)

So, how is the market doing? It has cooled down from what we were seeing from 2020-2022. Sales seem to be in line with what we had last year (a 4% decline isn’t that noticeable). We are in a slower paced market than what we had in 2021 & 2022. I have been comparing our current market to pre-pandemic numbers. Our year-to-date sales for 2024 look to be 3%-5% behind what we had in 2016-2019.

We are still seeing a huge uptick in new listings coming on the market. We are averaging over 2000 properties coming on the market every month in 2024. We usually average 1700 per month. This combined with slowing sales, is causing our active inventory to rise month over month in 2024

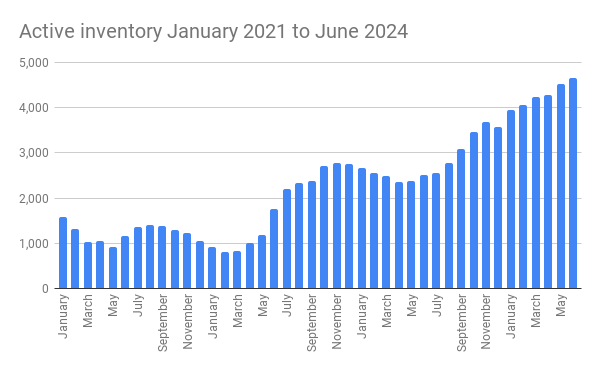

You probably have seen a click-bate real estate headline showing our active inventory is up 400% from 2021…which seems scary…and is actually true. We went from 1156 properties for sale June 2021 to 4648 in 2024…a 400% increase. That’s a big increase in a relatively short amount of time. We actually got a little lower February 2022 when our inventory went below 800 properties for the entire county.

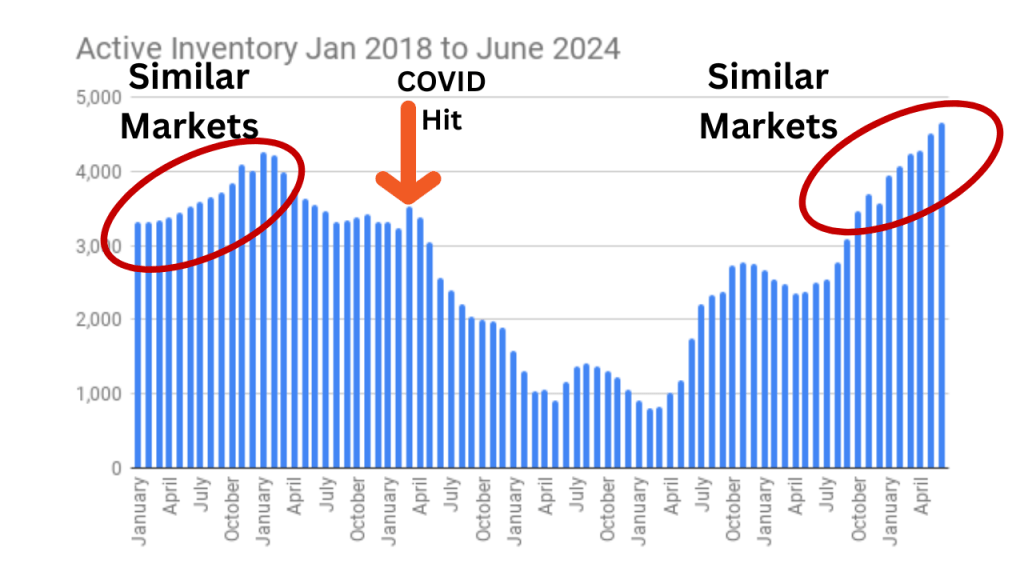

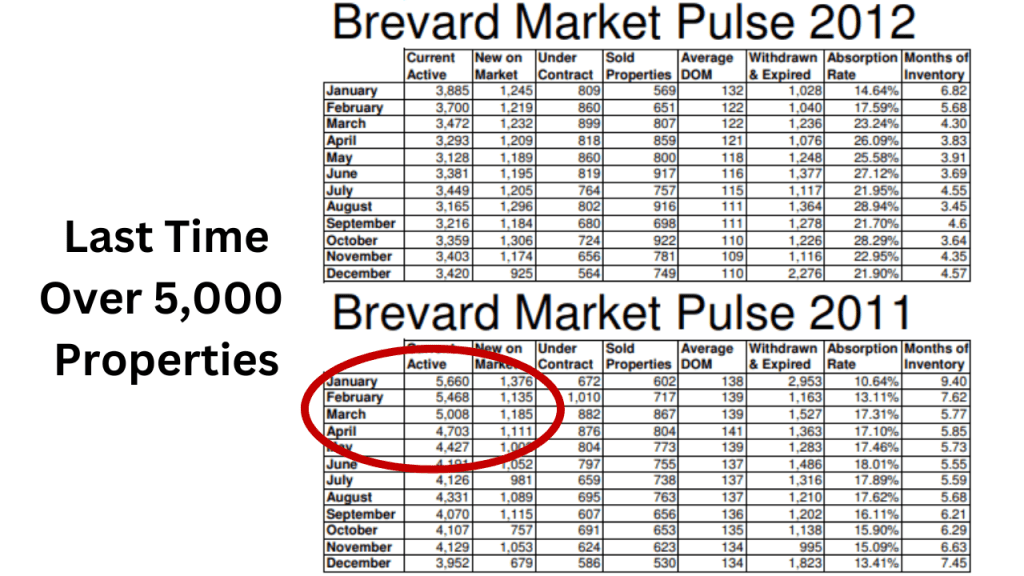

Let’s look at the 3 years prior. Inventory was certainly higher than what we experienced in 2021 & 2022. We had 3500 as a typical inventory number and we would peak around 4200 during the slower months. Our new normal in 2024 is a slow and steady increase of active inventory. We are up on average 116 properties over the previous month in 2024. If we continue at this pace, we will be around 5300 by the end of the year. We haven’t seen inventory this high since 2011 when we were recovering from the great real estate crash from the mid 2000s.

The market is always changing, usually in tiny increments up or down. The gradual increase of inventory and the slight pull back in sales has us transitioning to a balanced market in 2024. Just in case you didnt know, a balanced market is when our inventory is between 4 – 6 month supply. A buyers market is over 6 months and a sellers market it under 4 months.

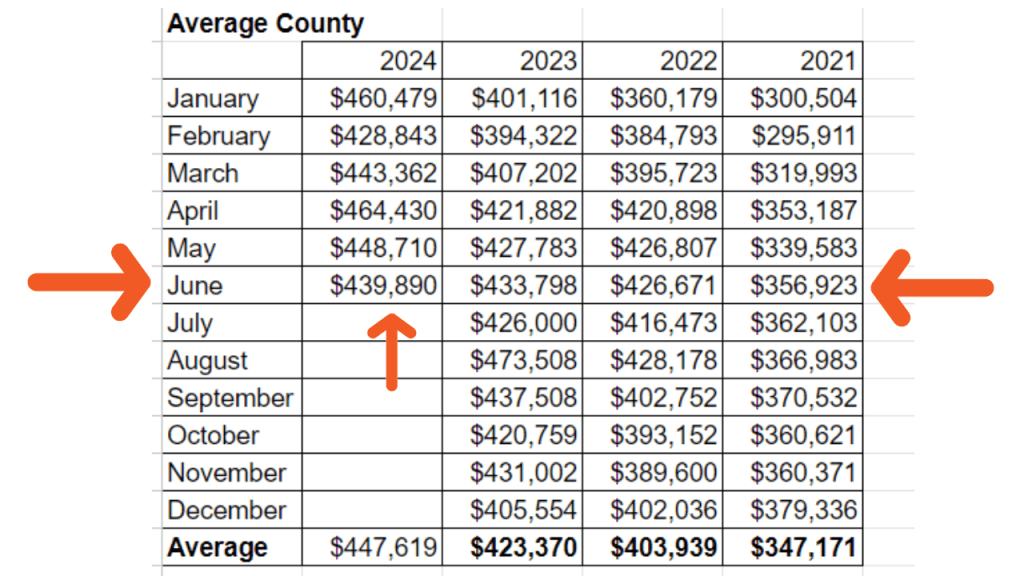

You would think with the increase of inventory, the pull back on the sales, and the higher interest rates…prices should be falling…Which they are in parts of the County. It’s just not showing up with our average sales prices. The average sales price is still going up year over year. June’s average sales price was $439,89 compared to $433,798 in 2023…$426,671 in 2022 and $356,923 in 2021. We are seeing a lot of price changes in the county, so its only a matter of time that these average and median prices start flattening and going the other direction.

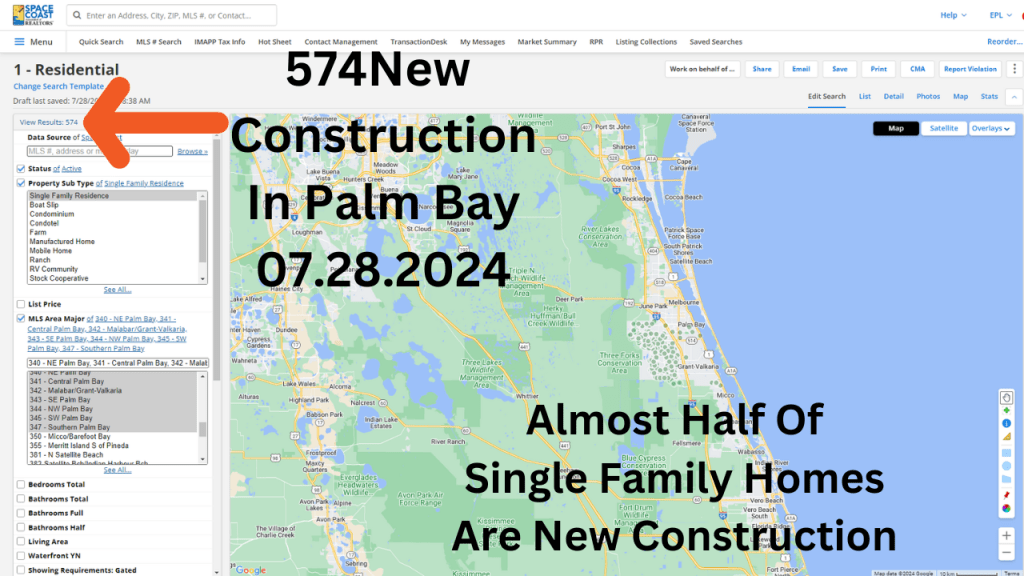

There is a lot of new construction available in Palm Bay. This over saturation is having an effect on the resales and new construction prices. Condo prices beachside are starting to drop. But then you West Viera that has a lot of new construction and resales happening and the prices are still a premium. Look at single family homes in Cocoa Beach…It is hard to find a home for sale under $600,000.

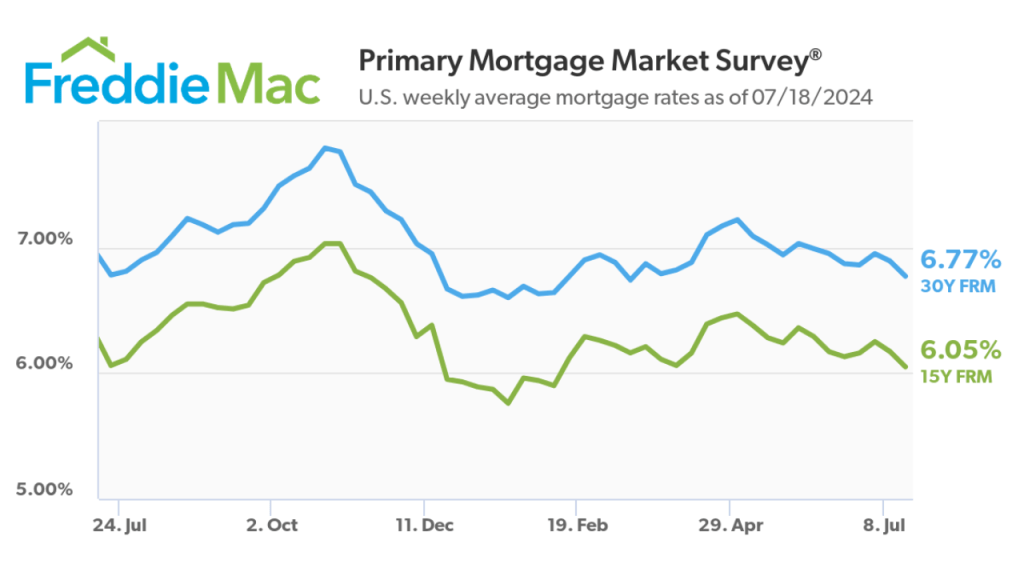

What I like about this market is that you have a selection to choose from if you are looking to make a move. Interest rates seem to be pulling back from the peaks we saw last fall. Insurance is still pretty high, but there are private companies coming back to Florida that are providing options other than Citizens…and this should start lowering the premiums.

Just know that I am a resource for you. If you have any questions about an upcoming move or what is happening in our real estate market…we should talk! Here is a link to my calendar, lets schedule a call. Or you can give me a call or a text and we can talk.

Eric Larkin is a Broker Associate with Real Broker, LLC. He lives, works, and plays in the Cocoa Beach area. If you have questions about moving or relocating to Cocoa Beach and the Space Coast, let me know! I get calls, texts, direct messages & comments on my posts every day about the real estate market and things that are happening in Cocoa Beach and the Space Coast that I love answering. Ask me your questions on moving, relocating here, or anything about the community. I am here to help. I have been helping buyers and sellers with their real estate needs since becoming a real estate agent in 2003. My focus is always on helping, answering your questions, and doing everything possible to make certain you have a smooth transaction from beginning to end.

Planning a move or have questions about our area? Eric Larkin with Real Broker, LLC can help! Schedule a call here https://www.ericlarkin.com/schedule-a-call

OR leave your info here and I will call you https://www.ericlarkin.com/contact-form