Is Buying An Investment Property In Melbourne A Good Idea?

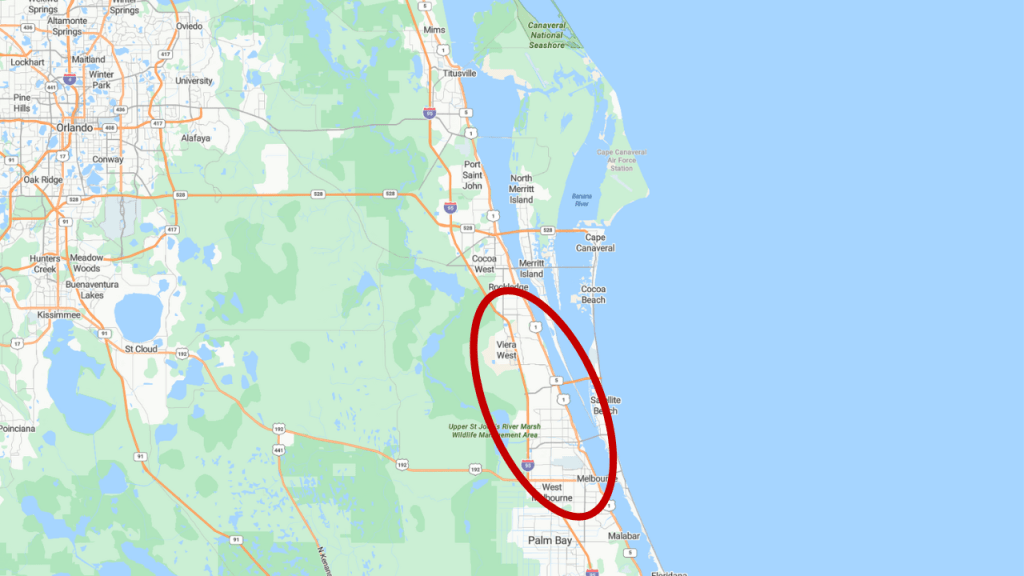

Whether you currently have an investment portfolio and are looking to add properties, or you are ready to start with your first rental property, I think looking at Melbourne, Florida, is a great place to start.

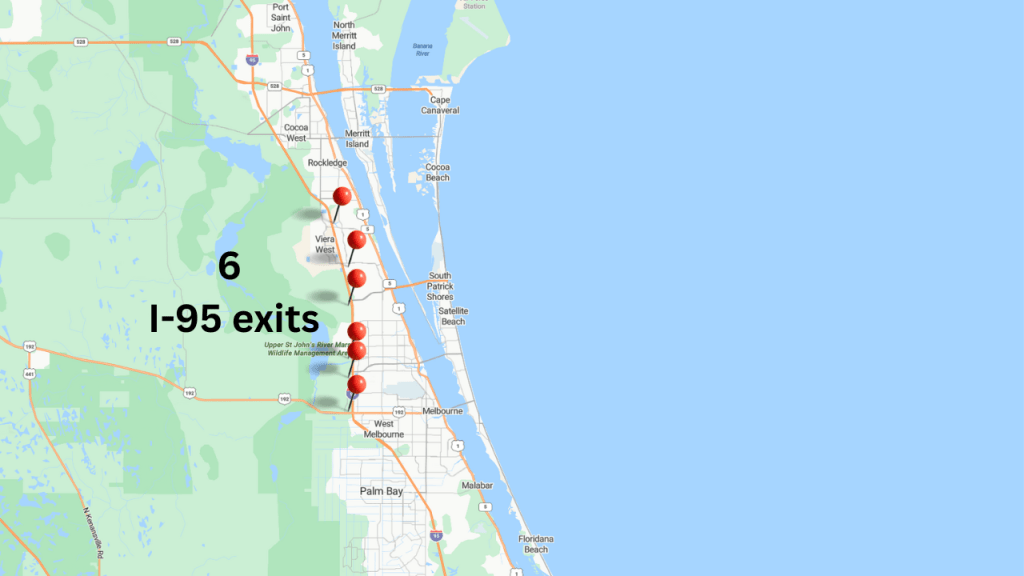

Melbourne is the 2nd largest city in Brevard County which is centrally located and offers easy access to most of Brevard County. Melbourne has 6 exits to I95, a dozen or more connections to US 1 that give the ability of your future tenants to get to work anywhere in Brevard. 3 Causeways connect Melbourne to the beaches. Plus, there is Wickham Rd, Babcock, and other thoroughfares in the city of Melbourne.

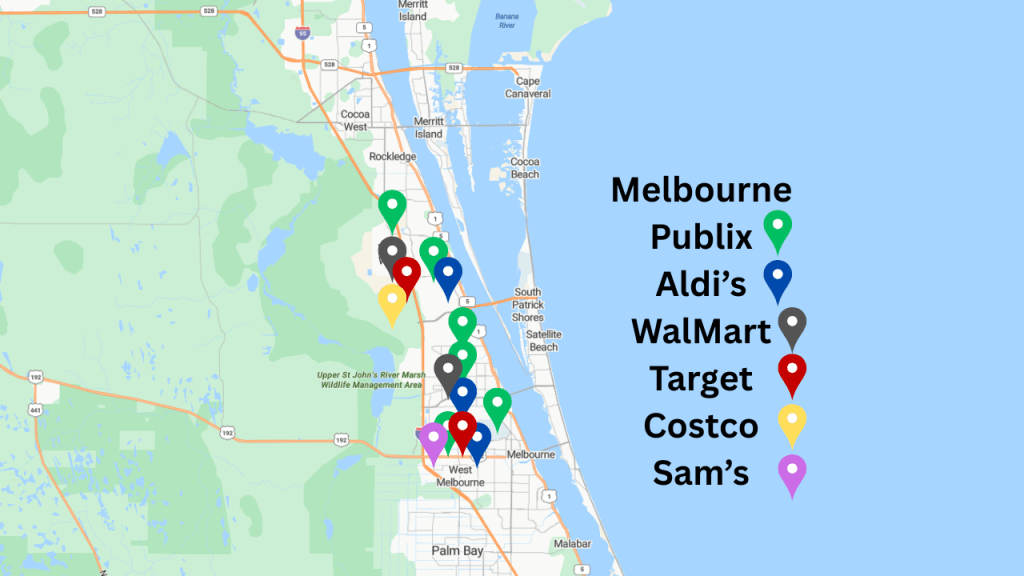

The largest field for employment in Brevard County is health & wellness. Melbourne has 4 hospitals with dozens of other medical facilities and hundreds of doctor offices. Retail is another big employer, and Melbourne has 6 Publix, 3 Aldis, 2 Super WalMarts, 2 Super Targets, Costco, and a Sam’s Club. 3 Home Depot & a Lowe’s. Melbourne also has the big government contractors, aerospace, and tech companies that include L3Harris, Northrop Grumman, Collins Aerospace, and Embraer. Melbourne also has the Melbourne Orlando International Airport.

Right now, there are 104 single family homes available for rent in the Melbourne area (32901, 32904, 32934, 32935, & 32940). Most of them are in the 32904. Rent range between $1550-$4750. The average rent price $2437 & the median is $2300.

The last 6 months (10.12.2024-4.11.2025) there were 305 homes rent in the Melbourne area, averaging 50 homes rented per month. There are 104 homes available for rent, putting our rental supply at 2 months. So, there is a good demand for single family home rentals and a low inventory.

Most of the rentals happened in the 32904, 32940, and 32935 zip codes.

Average rental price $2,435

Median rental price $2,350

Most rented between $2,000-$3,000 (183 homes)

Most do not have a pool

Average size 1770 SqFt

Median size 1795 SqFt

Average DOM 45 days

Median DOM 35 days

Costs of having a rental property: Initial purchase, down payment, cost of the loan, insurance, property taxes, inspections, & land survey. Does the home need any repairs or updates? Will you hire a property manager? What is the anticipated vacancy time between the purchase date, putting the home on the market for rent, and getting a tenant? What are your carrying costs for this timeframe?

Insurance varies based on the home. I have seen reasonable quotes of $2,000-$3,000 per year. Ive also seen $4K-$5K. You cannot get an accurate quote without the 4pt and wind mit reports unless you are buying new construction.

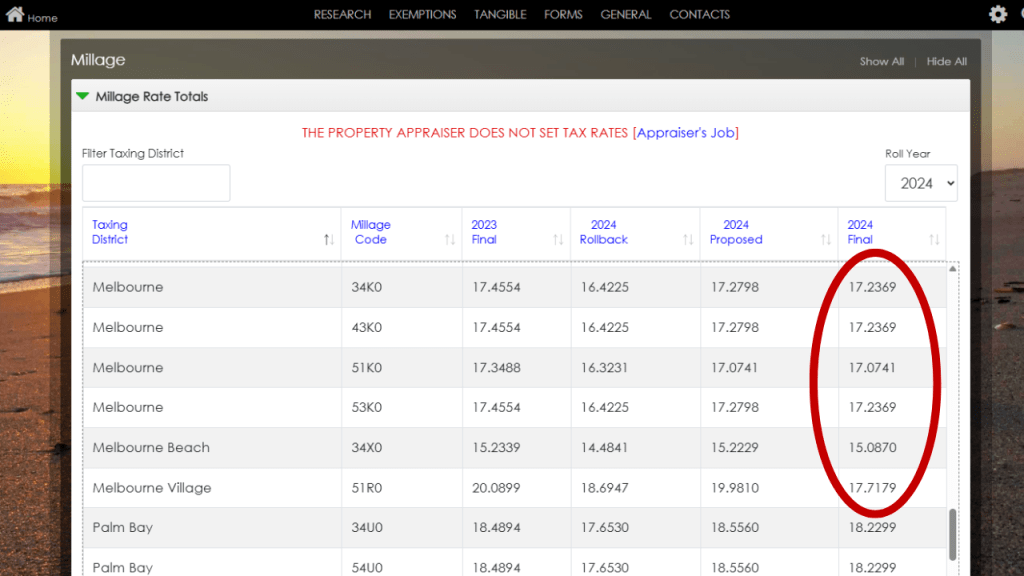

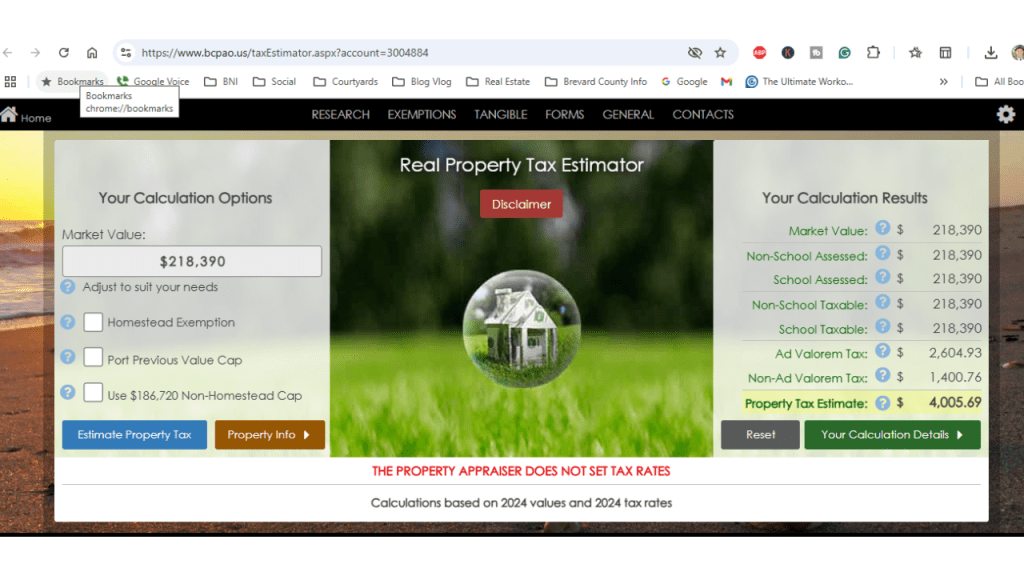

Property taxes will vary depending on the section of Melbourne you are buying in. Most of Melbourne city limits is currently at a millage rate of 17.2369. Outside the city limits is 11.959 to 12.7522. The best thing to do is go to the Brevard County Property Appraiser website and do an estimate on what the taxes will be based on the purchase price.

I highly recommend hiring a property manager to at least place the tenant in the property, and consider using them to manage the property. They already have the marketing in place to attract potential tenants with the other homes they have listed. Most have hired a real estate attorney to draft a rock-solid lease to use. Suppose you also hire them to manage the property. In that case, they have vendors on speed dial to take care of the maintenance issues that will come up (leaky toilets, AC not working, etc). Commissions and costs to hire a property manager are negotiable. This is a guideline on what you could be paying. For placement only, it can be half the first month’s rent. This is to pay the property manager and the agent who brought the tenant a commission. Suppose you are hiring the property manager to manage the property, expect the other half of the 1st months rent to set up an escrow account to pay for things that need to be repaired along the way (leaky toilet, hvac issues, etc) A good property manager will make certain the rents are collected on time. In that case, the home is being taken care of, and it will minimize vacancies in between tenants.

I know owning a rental property is not for everyone. Those who do decide to add rentals to their portfolio do so 1 house at a time and add 1 house to their portfolio every few years. I have helped some investors buy their first home to live in with the understanding that it will become a rental property in 2-3 years. They structure the mortgage payment to be equal to or less than the current rent in the area, save for their next down payment, and have the tenants pay for the mortgage as they build equity. If this sounds interesting to you, we should talk.

Eric Larkin is a Broker Associate with Real Broker, LLC. He lives, works, and plays in the Cocoa Beach area. If you have questions about moving or relocating to Cocoa Beach and the Space Coast, let me know! I get calls, texts, direct messages & comments on my posts every day about the real estate market and things that are happening in Cocoa Beach and the Space Coast that I love answering. Ask me your questions on moving, relocating here, or anything about the community. I am here to help. I have been helping buyers and sellers with their real estate needs since becoming a real estate agent in 2003. My focus is always on helping, answering your questions, and doing everything possible to make certain you have a smooth transaction from beginning to end.

Planning a move or have questions about our area? Eric Larkin with Real Broker, LLC can help! Schedule a call here https://www.ericlarkin.com/schedule-a-call

OR leave your info here and I will call you https://www.ericlarkin.com/contact-form