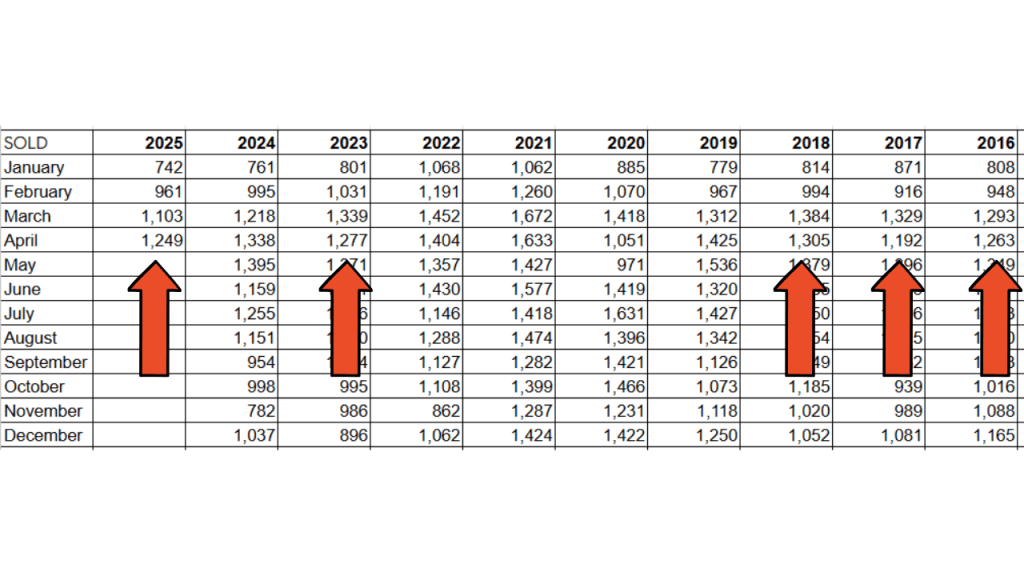

The Spring market is in full swing! April sales are up and in line with 2023 and what we were seeing pre-pandemic, with 1249 closings. Would I have preferred over 1,300? Of course…But I think there are Buyers out and looking for properties. Fortunately for these Buyers, there are a lot of properties for sale too. Inventory continues to climb, and we ended April with 5575 properties on the market. Compared to the pre-pandemic inventory levels, it’s still high. No way to sugar coat it. We have more homes on the market today than we have seen in 15 years. Am I terribly concerned about it? I have been saying for a while, as long as the Space Industry stays strong, we should be OK. Then I saw this headline that the upcoming NASA budget is looking at a 24% cut…I am a little concerned with this. More on that later in the post.

Other stats to keep an eye on from April:

New listings coming on the market are behind 2024 but in line with pre-pandemic numbers.

Price changes are way up over last year. I only recently started to track these numbers & only have data from 2021.

Days on market is another number I recently started to track. It took 12 days longer to sell a home in 2025 vs 2024.

Homes selling in 7 days or less 228 properties or 18% of the sales.

Average sales price is down April 2025 $427,390 vs $464,430 April 2024.

Median sales price is also down slightly…$360K this year vs $369,990 last year.

I have been at a couple of training events recently where there were Title Company representatives, and I asked them what trends they are seeing. They all mentioned an increase in possible short sales and that foreclosures are coming. So, I am digging into these numbers. The history I have been tracking, and there haven’t been a lot compared to what we saw from 2009-2014. So far in 2025, we have had 34 bank owned sales and 4 short sales. I am starting to track what the active inventory is doing. Unfortunately, I can’t go back in time to see what the active inventory is; I can only track from today forward. We have 34 bank owned properties on the market and 24 short sales. 58 total distressed properties out of 5575 is 1%. I will let you know how this pans out the rest of the year.

Brevard County

Active inventory 5575

Sold Property 1249

Months Supply 4.46 months

Average Price $427,390 2024 $464,362

Median Price $360,000 2024 $369,900

List/Sale ratio 94%

Average price per SqFt $230.94 SqFt

Days On Market 67.02 DOM

Property selling in less than 7 days 223 ( 18% of the sales)

Property selling over $1M 43

Highest price sale $4.9M

Home sales under $200K 35

Cocoa Beach & Cape Canaveral

Condos

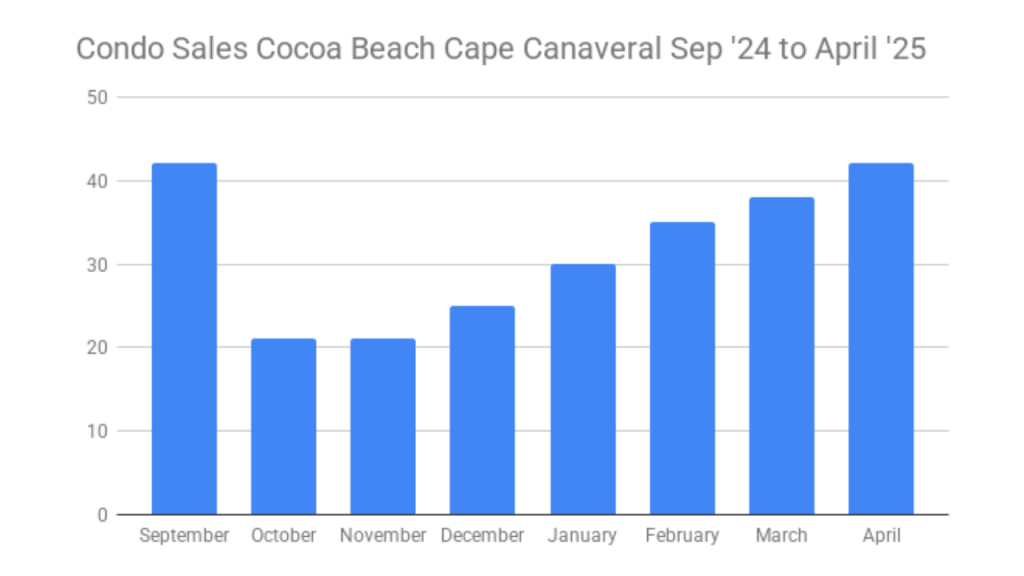

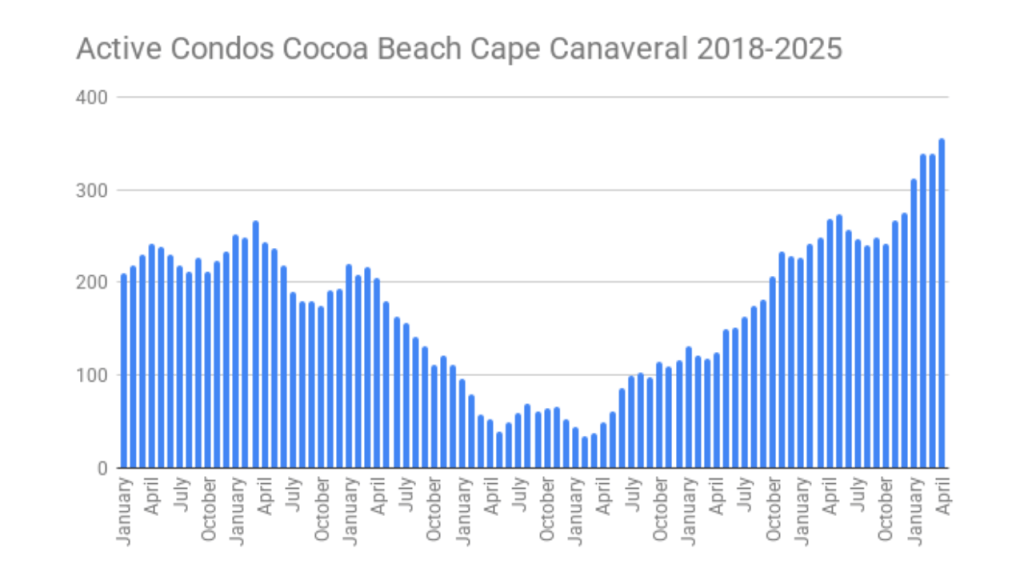

I have been waiting to see what happens to the condo market now that the Surf has closed out their condos over the last few months. No surprise that the average and median sales prices are down considerably from the last couple of months. I was pleasantly surprised that the number of closings did not drop back to the numbers we were seeing in the fall. We had 42 condos sell in April, which is the best month we have had since September. Something else that has continued to rise is the condo inventory. We are at record level highs with 356 condos available. This is an increase of 32% in the last 12 months. Prices continue to come down with condos in Cocoa Beach and Cape Canaveral. The average price in April 2025 is $423,140 compared to $451,424, and the Median price in April is $377,50 compared to $390,000 in 2024. If you have been holding off on buying a condo for the last few years, it might be a good idea to start paying attention to the condo market.

| A: Price range $110K – $3.25M | S: Price Range $124K – $1.2M |

Active inventory 356

Sold condos 42

Months supply 8.48 Months

Average Price $423,140 2024 $451,424

Median Price $377,500 2024 $390,000

Average price per square foot $312.38

Days On Market 75.21 DOM

Condos selling under $200K 5

Best selling complex all had 3 sales Solana Shores($1.2M, $627K, $600K) Royal Mansion ($435K, $335K, $335K) Oceana ($314K, $300K, $290K)

Single Family Homes

| A: Price range $ 479K-$3.3M | S: Price Range $ $480K – $2.25M |

Active inventory 78

Sold homes 7

Months supply 11.14 months

Average Price $ 1,046,785 2024 $1,344,607

Median Price $820,000 2024 $850,000

Average price per square foot $479.54

Days On Market 18.86 DOM

Homes selling under $600K 3

Homes selling over $1M 2

Viera/Suntree Area

Single Family Homes

| A: Price range $ 250k to $5.250M | S: Price Range $263K to $1.6M |

Active inventory 325

Sold homes 108

Months supply 3.01

Average Price $646,636 2024 $657,059

Median Price $592,380 2024 $580,000

Average price per square foot $271.82

Days On Market 40.08 DOM

Homes selling under $500K 34

Homes selling over $1M 8

The Viera/Suntree single family home market is an anomaly in Brevard County. Inventory is up slightly from the beginning of the year, but nothing crazy. There are 325 homes to choose from. Sales are very consistent with what we had last year with 108 closings in April. This puts our month’s supply of property at 3 months. Average and median prices are in line with last year. Days on market are also inline. If you are looking to buy in this area, it’s a little tougher to negotiate off the price. The average priced sale was 97% of the list price. If the owner agreed to Buyer concessions, the average amount was just under $5,000. As long as you are not competing with another Buyer, trying to work on the price and asking for concessions is still a good strategy.

Overall, our market is in the same trend and has similar conditions that we have been working through the last 18 months. I am very happy the crazy market of 2020-2022 is behind us, and we are in recovery mode. The thing I am concerned about is the proposed budget for NASA in 2026. Even though I was a teenager, I remember the impact of the Challenger explosion in 1986. I remember the impact of the Space Shuttle Columbia in 2003. I was in real estate in 2011 and remember the impact after the Shuttle program was retired in 2011. The local economy and the real estate market were affected. This proposed significant cut threatens to eliminate key programs and could result in substantial job losses at Florida’s Kennedy Space Center (KSC), a cornerstone of the Space Coast’s economy, and that will have ripple effects that everyone who lives here will feel. Something slightly different today, though, is the presence of SpaceX and their launch capabilities, Blue Origin and their path towards launching rockets from the Space Coast, and other private sector companies working on launches from Florida. This should prevent some of the devastating losses from past setbacks in the space program to our local economy and real estate market.

Do you have questions about our market trends or an upcoming move? I would love to hear from you. Let’s schedule a call.

Eric Larkin is a Broker Associate with Real Broker, LLC. He lives, works, and plays in the Cocoa Beach area. If you have questions about moving or relocating to Cocoa Beach and the Space Coast, let me know! I get calls, texts, direct messages & comments on my posts every day about the real estate market and things that are happening in Cocoa Beach and the Space Coast that I love answering. Ask me your questions on moving, relocating here, or anything about the community. I am here to help. I have been helping buyers and sellers with their real estate needs since becoming a real estate agent in 2003. My focus is always on helping, answering your questions, and doing everything possible to make certain you have a smooth transaction from beginning to end.

Planning a move or have questions about our area? Eric Larkin with Real Broker, LLC can help! Schedule a call here https://www.ericlarkin.com/schedule-a-call

OR leave your info here and I will call you https://www.ericlarkin.com/contact-form