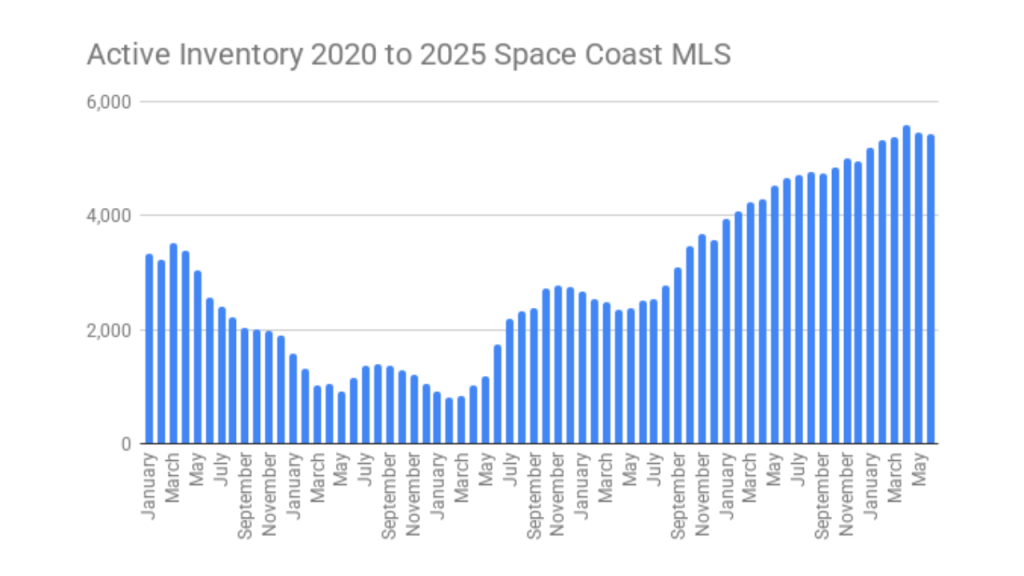

Sometimes in life, we need to hit the reset button. Rebalance…refocus…and find a way to keep moving forward. That’s what is happening with our housing market on the Space Coast. Our active inventory appears to have stabilized around the 5,500 mark. Yes, this is much higher than where we were last year, even slightly higher than January. The last 5 months, our average inventory was 5431, and we ended June at 5426. Pretty stable.

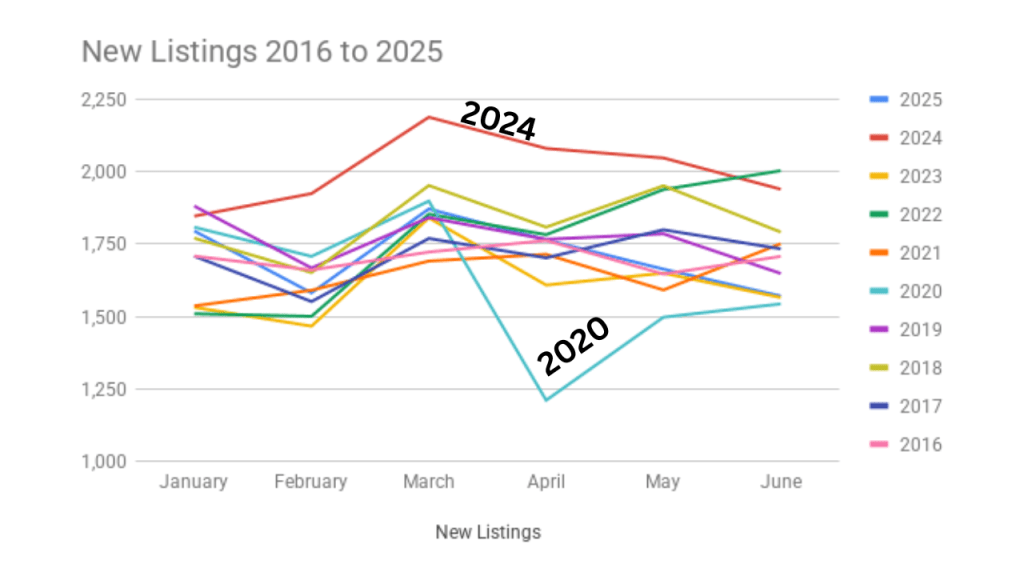

New inventory coming on the market is down from 2024. However, we are really close to the past 10 years of listings coming on the market. Last year was a record high for new listings. In 2020, things dropped off thanks to COVID.

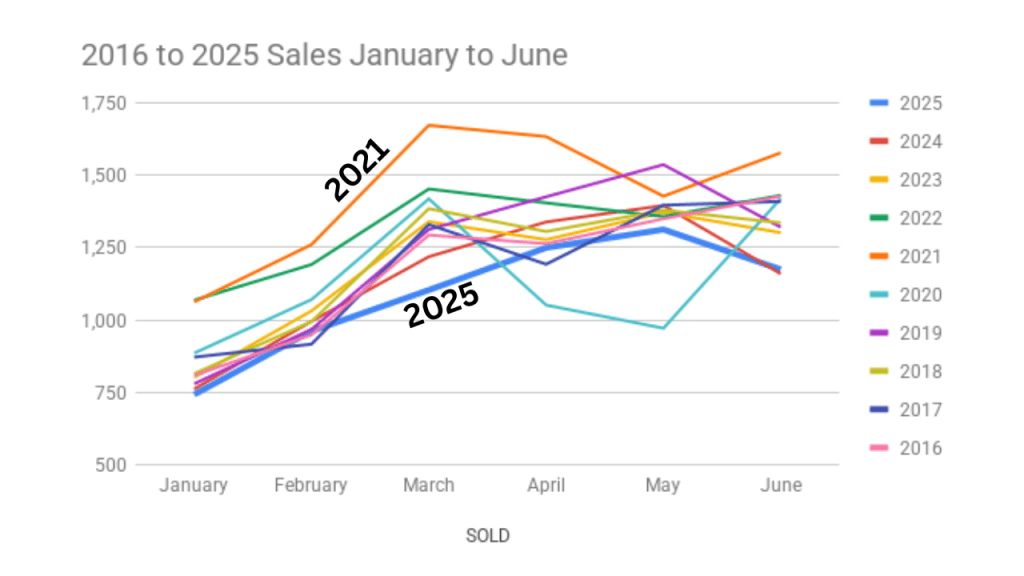

Looking at our sales, this is where we are stabilizing in the market. We are trailing 2024 sales so far in 2025. Really, looking at the sales for the last 10 years, we are way behind the 2021-2023 timeframe. We are more in line with 2016 to 2019. As you can see from the graph below, even though sales are down in 2025, we are not looking at a huge drop in sales.

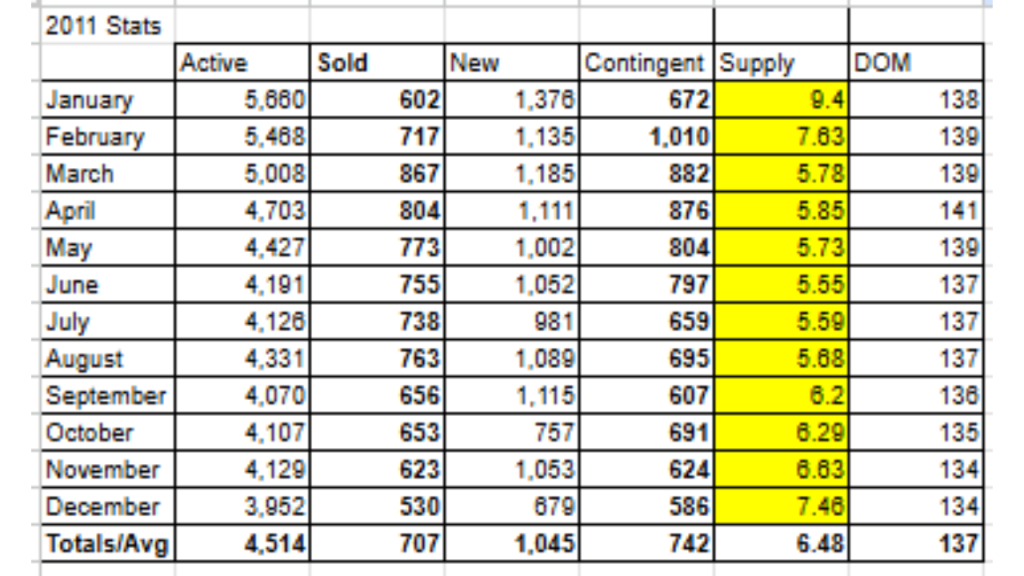

When you take the 5500 +/- active inventory and divide that by the 1100+/- sales. We are at a 5 month supply of inventory. This has only happened a couple of times in the last 9 years. It’s been since 2011/2012 since we had a regular inventory over 5 months. Hopefully, for the remainder of 2025, this is the highest we will see. We ended the month of June at a 4.69 month supply.

The time it takes for a property to sell is taking a little longer in 2025, which is not a surprise when you have an increase selection of properties for sale. So far, year to date in 2025, its taking just over 71 days for a property to sell compared to 53 days the first half of 2024. When we compare this to the 100+ days on average in 2011, we are doing OK.

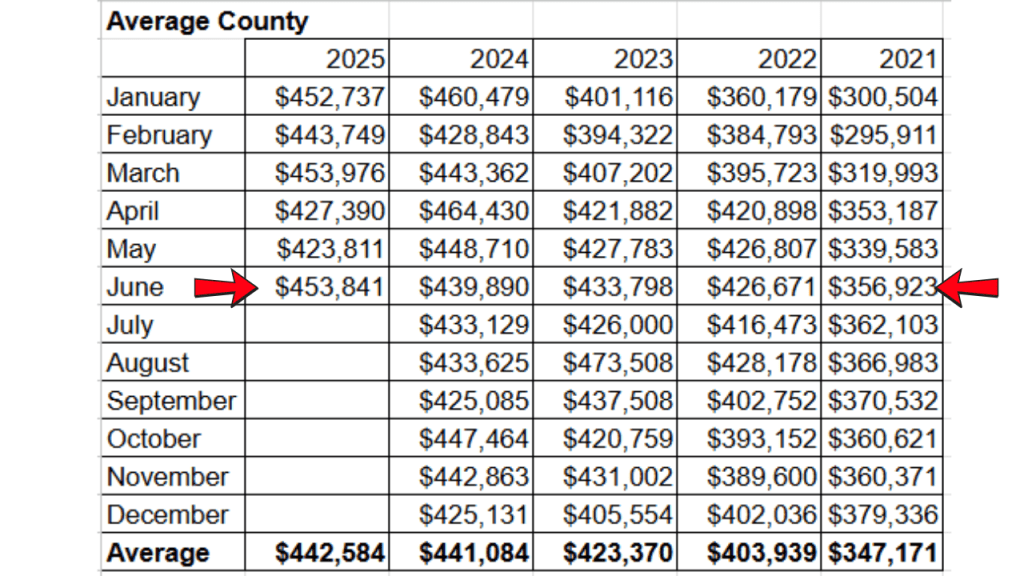

The average and median sales prices will be an indicator of the market, too. Based on what is happening in 2025 compared to 2024, we are in a stabilized market in Brevard County as a whole. The average prices are extremely close to what we saw last year and higher than the average sales prices in 2023, 2022, & 2021. Almost the same trends are happening with the median sales price. We are in line with last year and higher than 2021-2023.

Interest rates will always have an impact on our real estate market. We spiked to over 7% towards the end of 2022, where they then settled into the mid to upper 6% range. They spiked to 7.79% October 2023 to have them settle back to the mid to upper 6% range. This has been our new reality, rates somewhere in the mid to upper 6% range for the last 18 months. If they remain the same for the next 12 months, our sales will remain the same, maybe pick up with Buyers realizing this is the new norm. If they drop to lower 6% or upper 5%, Buyers will certainly be back in the market. If they jump to over 7%, we will probably see either similar sales to the last 18 months or a slight pullback. We have had higher interest rates and the threat of higher rates since October 2022.

What are your predictions for our housing market for the remainder of 2025?

Brevard County

Active inventory 5426

Sold Property 1174

Months Supply 4.62 months

Average Price $453,841 2024 $439,890

Median Price $369,900 2024 $355,000

List/Sale ratio 93%

Average price per SqFt $235.52 SqFt

Days On Market 66.41 DOM

Property selling in less than 7 days 206 (17.5% of the sales)

Property selling over $1M 52

Highest price sale $4.892M Adelaide in West Viera

Home sales under $200K 23

Cocoa Beach & Cape Canaveral

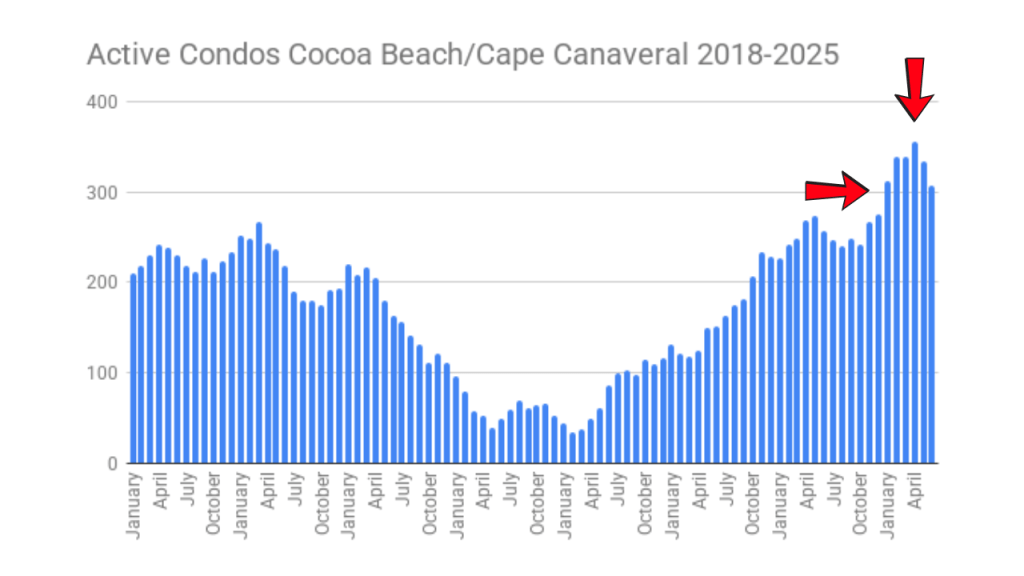

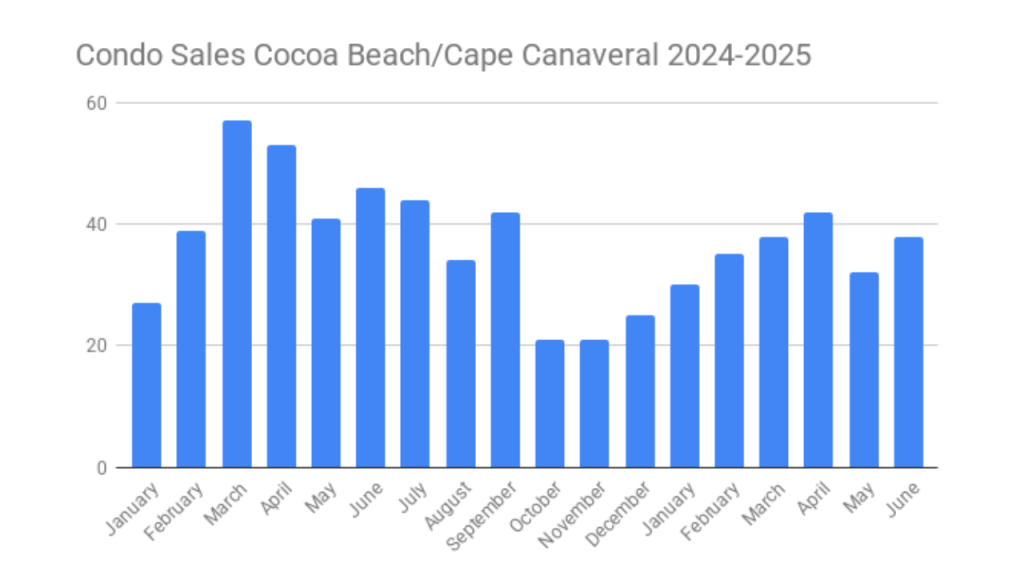

The condo market in Cocoa Beach/Cape Canaveral (really throughout the county) has taken a beating. Inventory breached the 300 level to start 2025, which is the first time I have seen it this high. Fortunately, it seemed to crest in April after hitting 359 condos for sale, and we ended the 1st half of 2025 with active condos in Cocoa Beach & Cape Canaveral.

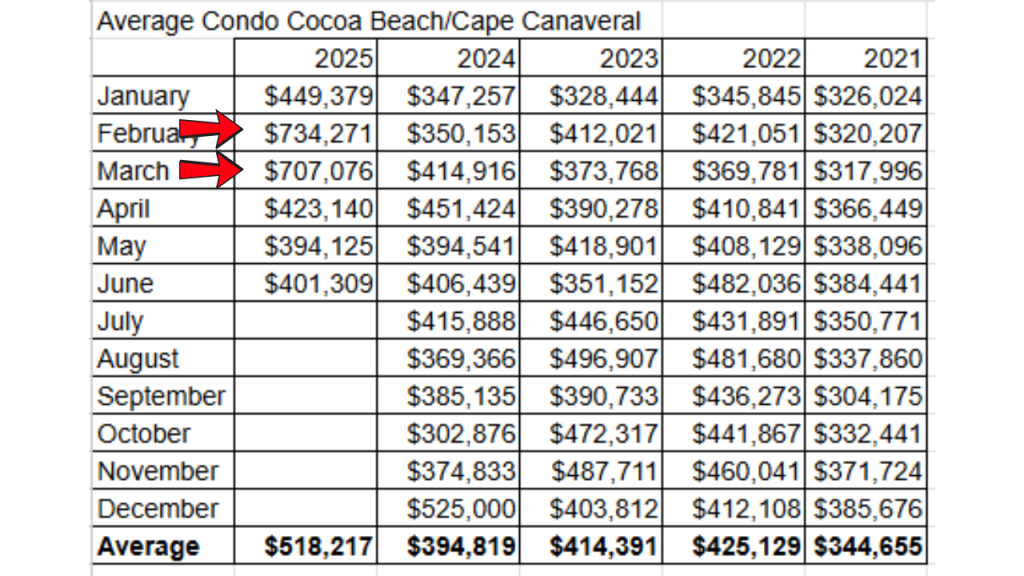

Sales are still soft compared to last year, but seem to be more consistent. The highlight of the first half of 2025 is the sales from the Surf Condo in Cocoa Beach. This was the first condo project to be completed in Cocoa Beach since 2016 (Cocoa Cabana Condos) & 2009 (Crescent Cove Condos)

Condo fees and possible assessments are really having an impact on condo sales. Even though I have seen some associations lower their monthly fees, they are still trending up. In the first half of 2024, the average condo fee for Cocoa Beach and Cape Canaveral was $646, compared to $733 in 2025. The special assessments have been for either upcoming concrete work or to fund the reserves for the complex.

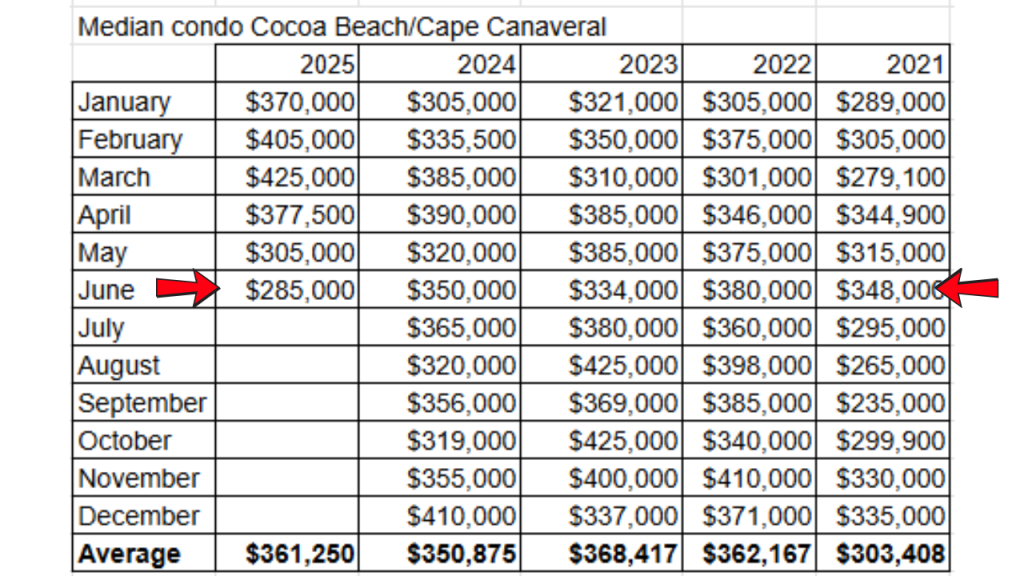

Even though the average sales price for condos spiked at the beginning of 2025, this deserves an * due to the completion of the Surf condos. Most of the 25 sales happened in February and March 2025, which caused an uptick in the average price. Looking at the median sales price, which I think is a better indication of value, prices are trending down for condos in Cocoa Beach and Cape Canaveral.

What do you think, is this a good time to consider a condo near the beach?

Condos

| A: Price range $99.9K to $3.399M | S: Price Range $105K to $1.225M |

Active inventory307

Sold condos 38

Months supply8.08 Months

Average Price $401,309 2024 $406,439

Median Price $285,000 2024 $350,000

Average price per square foot $299.74

Days On Market 98 DOM

Condos selling under $200K 7

Best selling complex Twin Towers $190K, $190K, $231K

Single Family Homes

| A: Price range $ 429K to $3.3M | S: Price Range $445K to $2M |

Active inventory 61

Sold homes 13

Months supply 4.69 months

Average Price $906,423 2024 $1,127,857

Median Price $682,000 2024 $725,000

Average price per square foot $403.32

Days On Market 88.62 DOM

Homes selling under $600K 6

Homes selling over $1M 5

Viera/Suntree Area

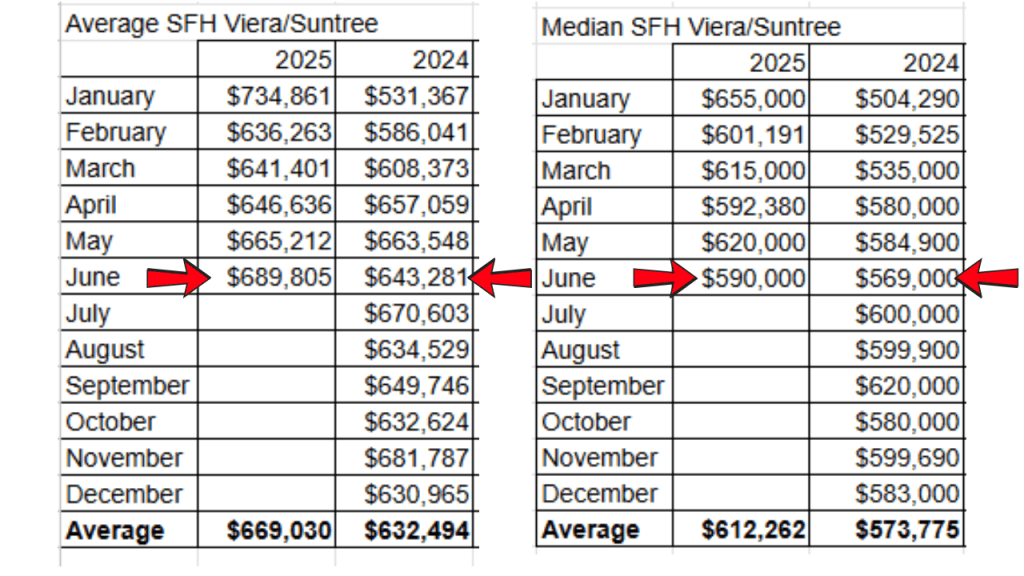

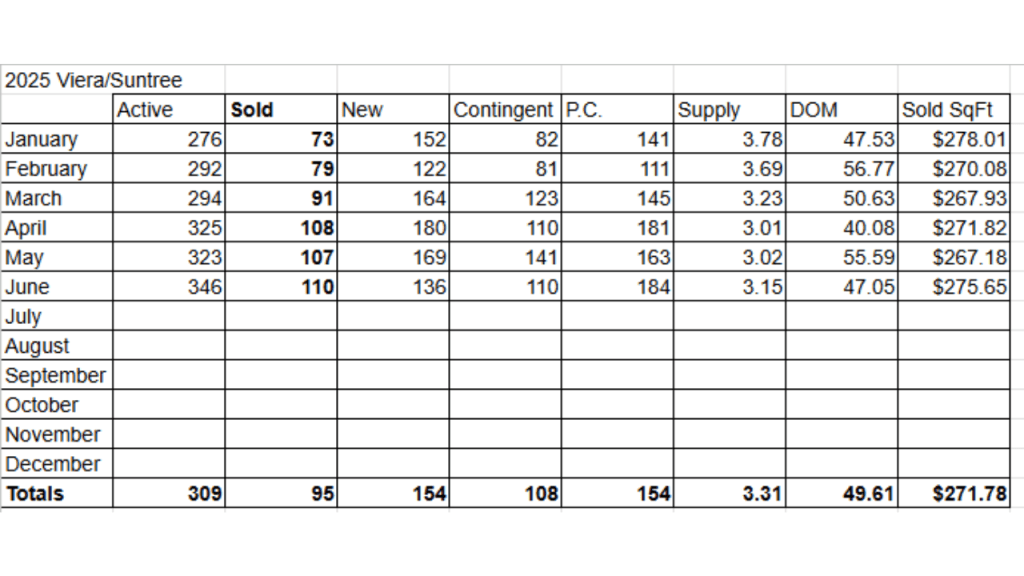

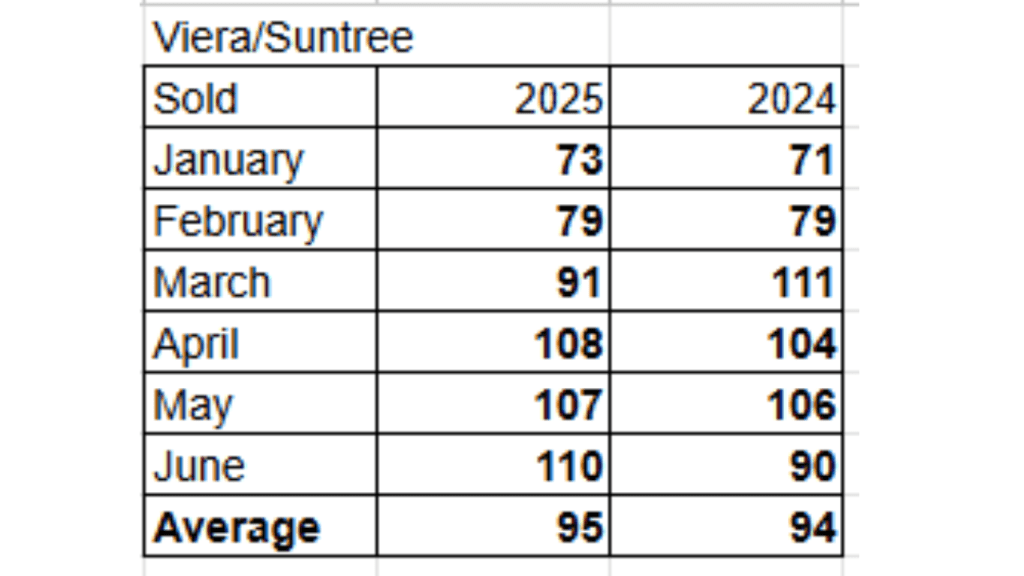

The Viera area, located in north Melbourne and south Rockledge; is a magnet for new home owners looking for either new construction or life in a master planned community. Sales are consistent, and values are steadily increasing. Inventory, like the rest of the county, is higher today than on the 1st of the year. Sales are even with the halfway point of 2024. It is taking 10 days longer on average in 2025 for a home to sell. The month’s supply is at 3.15 months ending June 2025. The average sales price is up over 2024. The median sales price is also up over 2024. Even though parts of Brevard County is showing signs of a softer market, I don’t see this happening in the Viera/Suntree area.

Single Family Homes

| A: Price range $ 230K to $5.5M | S: Price Range $224K to $4.892M |

Active inventory 346

Sold homes 110

Months supply 3.15 months

Average Price $689,805 2024 $643,281

Median Price $590,000 2024 $569,000

Average price per square foot $275.65

Days On Market 47.05 DOM

Homes selling under $500K 36

Homes selling over $1M 10

Will the market crash? There’s always that chance. I just don’t see it happening in 2025 based on the trends for the last 6 months. It appears that we are in a transitional phase. Some areas will see prices pull back. Except for the condo market, I do not see prices falling to the values we were seeing pre-pandemic. What predictions do you have for our housing market in the second half of 2025?

Questions about this info or an upcoming move? I’m here to help. Drop your info below or schedule a call here

Eric Larkin is a Broker Associate with Real Broker, LLC. He lives, works, and plays in the Cocoa Beach area. If you have questions about moving or relocating to Cocoa Beach and the Space Coast, let me know! I get calls, texts, direct messages & comments on my posts every day about the real estate market and things that are happening in Cocoa Beach and the Space Coast that I love answering. Ask me your questions on moving, relocating here, or anything about the community. I am here to help. I have been helping buyers and sellers with their real estate needs since becoming a real estate agent in 2003. My focus is always on helping, answering your questions, and doing everything possible to make certain you have a smooth transaction from beginning to end.

Planning a move or have questions about our area? Eric Larkin with Real Broker, LLC can help! Schedule a call here https://www.ericlarkin.com/schedule-a-call

OR leave your info here and I will call you https://www.ericlarkin.com/contact-form