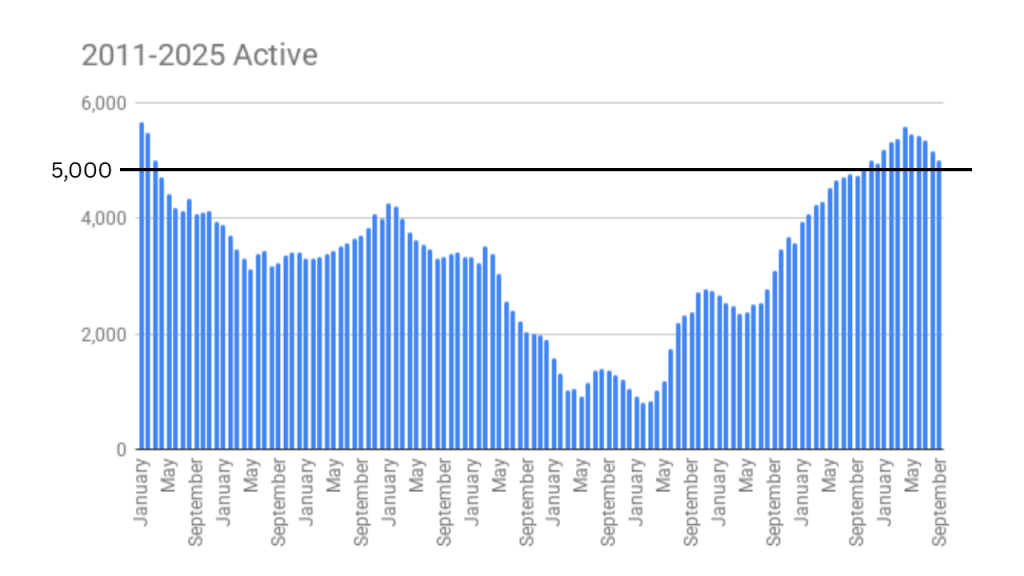

If you have been sitting on the sidelines waiting for the market to change…It’s happening now. Let me explain. While our active inventory is still over 5000 properties on the market, which is more than we have seen in the last 7+ years. We have to go back to 2011 as the last time we were over 5000 properties available for sale. While we started 2025 with over 5000 properties, our inventory peaked in April with 5575 properties in our MLS. We have been trending down since then & currently have the lowest inventory we have seen all year with 5011 active listings. If you are a Buyer, you have an amazing selection to choose from.

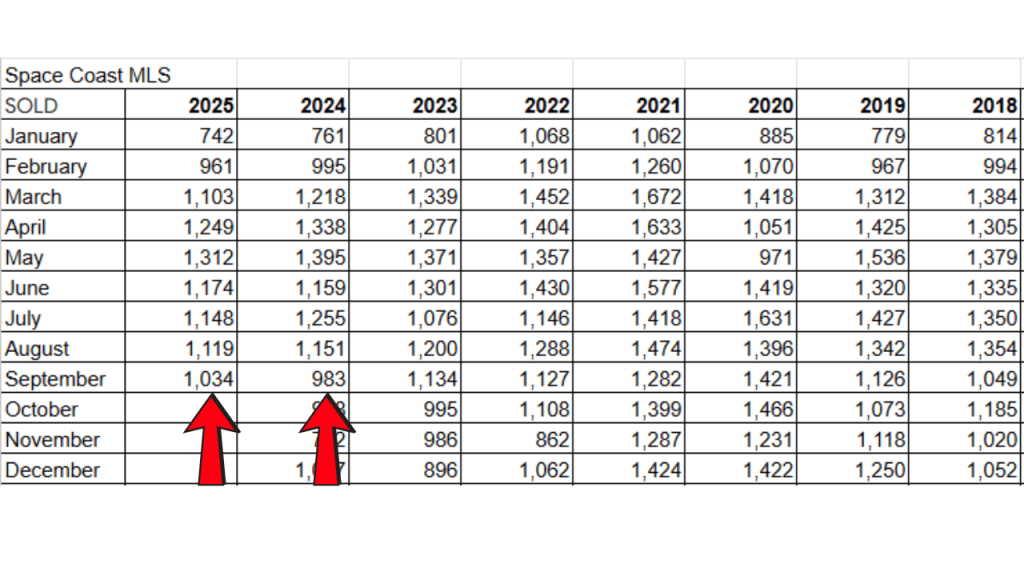

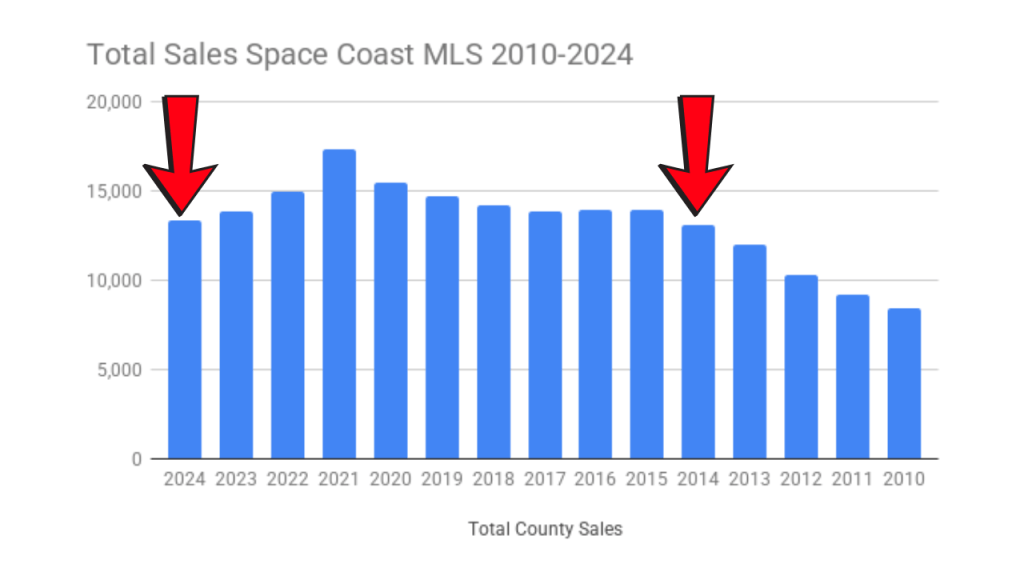

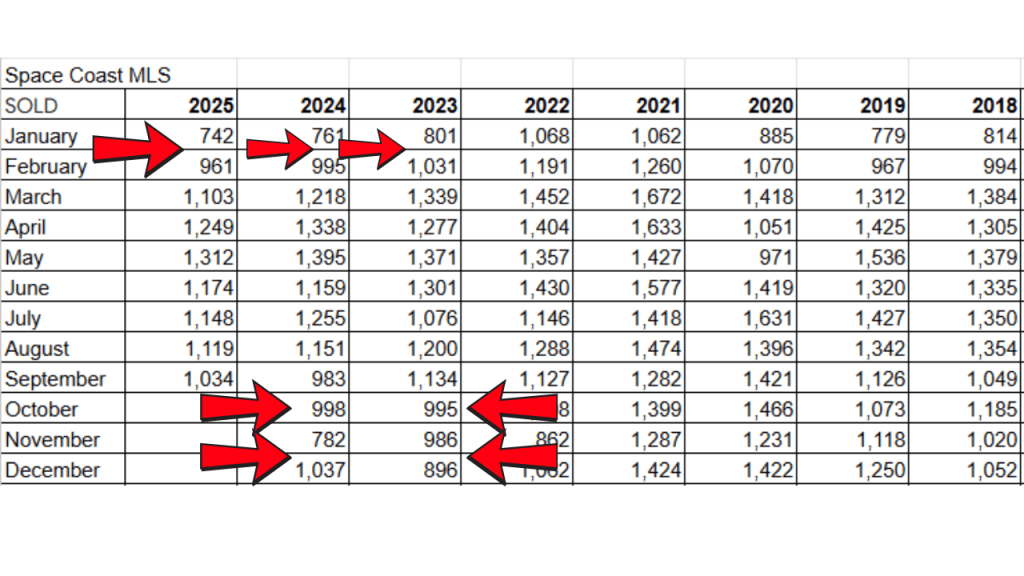

2024 was a slow year for sales. It was the slowest year we had in 10 years, with 13341 closings in our MLS. We barely beat the total sales for 2014. So far, in 2025, we have been behind our sales from 2024. Not by much, though. A couple of months we were only behind the previous year’s sales by 20 or 30 closings. September sales for 2025 beat last September with 1034 closings in our MLS. Looking at the last quarter for 2024… even for 2023…they were slow 4th quarters. There is a pretty good chance 2025 will beat 2024. The momentum that is happening now, we are in a position to close the year pretty strongly. I see this setting up the momentum to start 2026 with a strong 1st quarter.

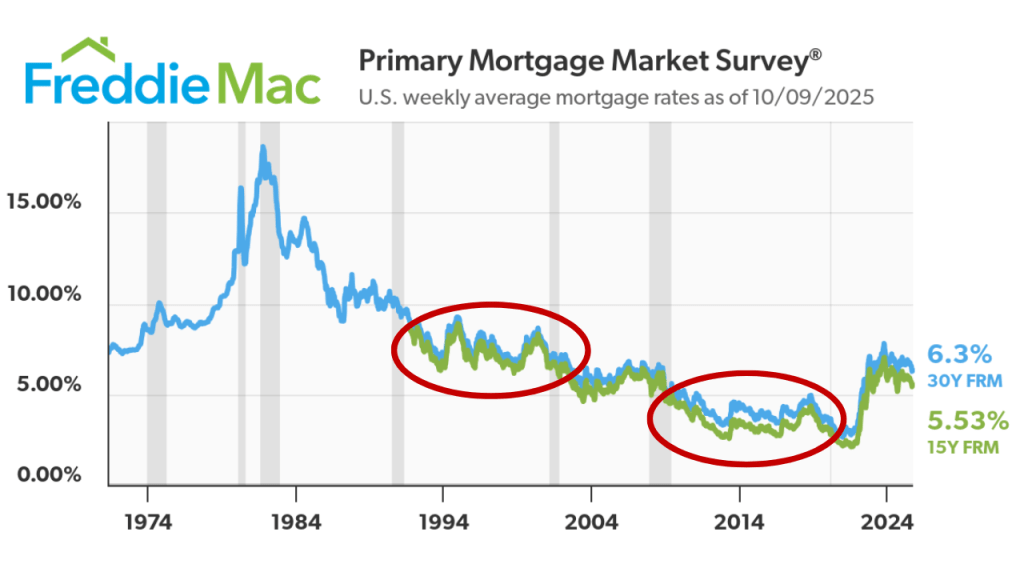

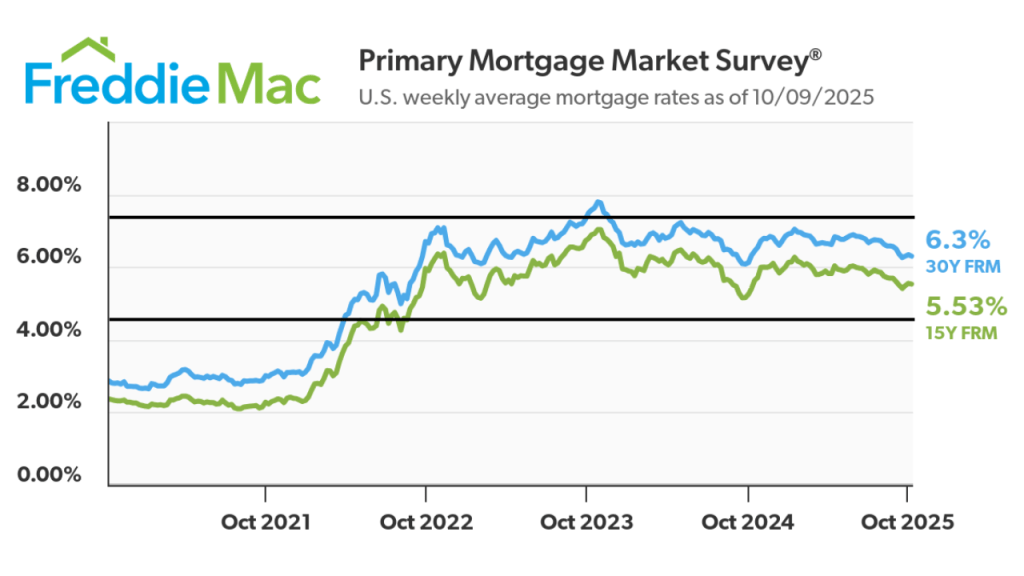

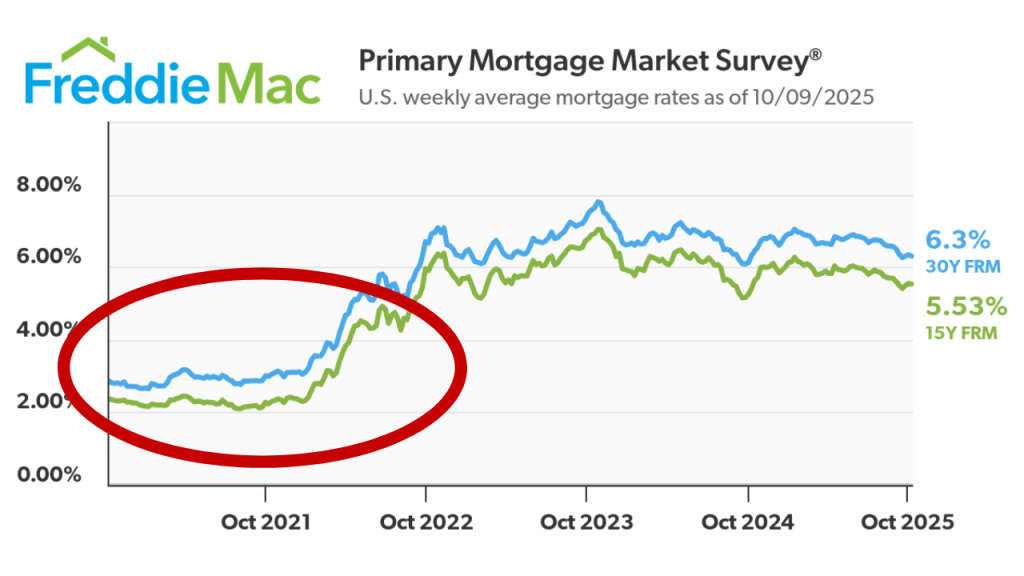

I know that interest rates have had an impact on our housing market. I know everyone on the sidelines would like to see the return of the low rates that we had from 2020 to 2022. These rates were artificially low and not sustainable for the economy. Even the rates from 2010 to 2020 were lower than what we had seen in the 1900s. If we can stay in the low 6% range to the high 5% range, similar to the early 2000s; this is a reasonable interest rate that is healthy for the overall economy. For the most part, we have been in a healthy range for the last 2 years. Rates have been trending down in 2025. It’s time to accept the new normal rate. I would love to hear your perspective on this.

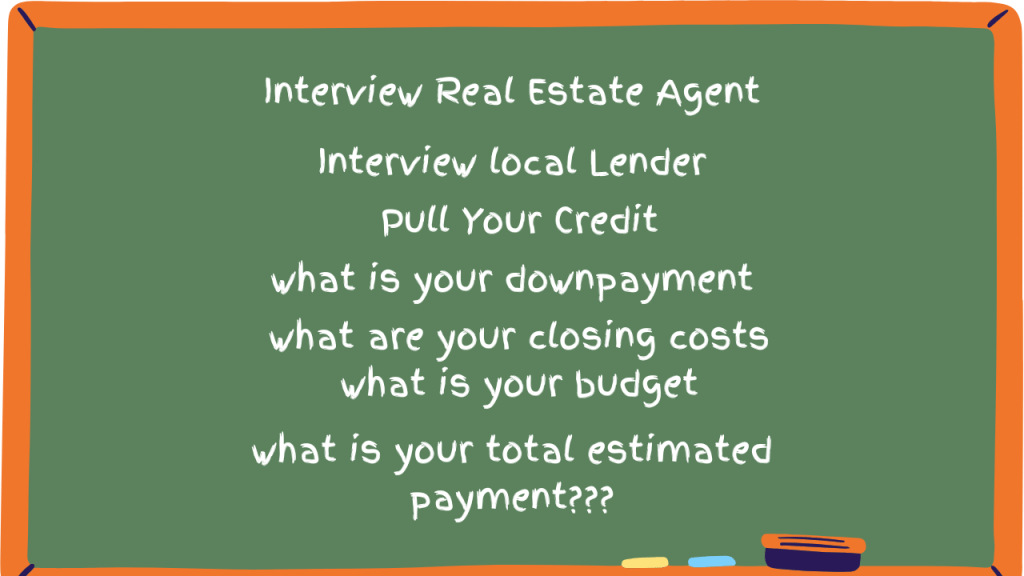

If you were planning on being a Buyer in the semi-near future, sometime in 2026. It would make sense to start the game plan in the 4th quarter of 2025. Start interviewing real estate agents. Start having conversations with local lenders. See where your credit score is. Have an understanding of what your down payment will be, what your closing costs are, and what to expect for your total monthly payment, the principal, interest, property taxes, and insurance…maybe HOA payment. Your ideal home might be on the market today. It would make sense to try and purchase your ideal property when you see it.

Right now, there are fewer Buyers looking to purchase compared to the Spring Market. Now through February is our “slow” season. Sales will be in the 800 to 1000 closings per month compared to the 1200-1400 we will see in the Spring & Summer. Fewer people looking gives you the advantage to negotiate. Work on a better price. Ask the Seller to contribute towards the closing costs. Ask the Seller to make repairs. So far in 2025, 36% of the sales the Seller provided closing cost concessions to the Buyer with an average of $8975. Repairs I have seen small items (electrical and plumbing) to large ticket items (new roofs, HVAC systems, and septic systems)

Here are a few other stats for September

Average days on market is trending up. 75 Days for September. 169 of the 1034 sales happened in 7 days or less.

We have a 4.85 month supply of property available for sale.

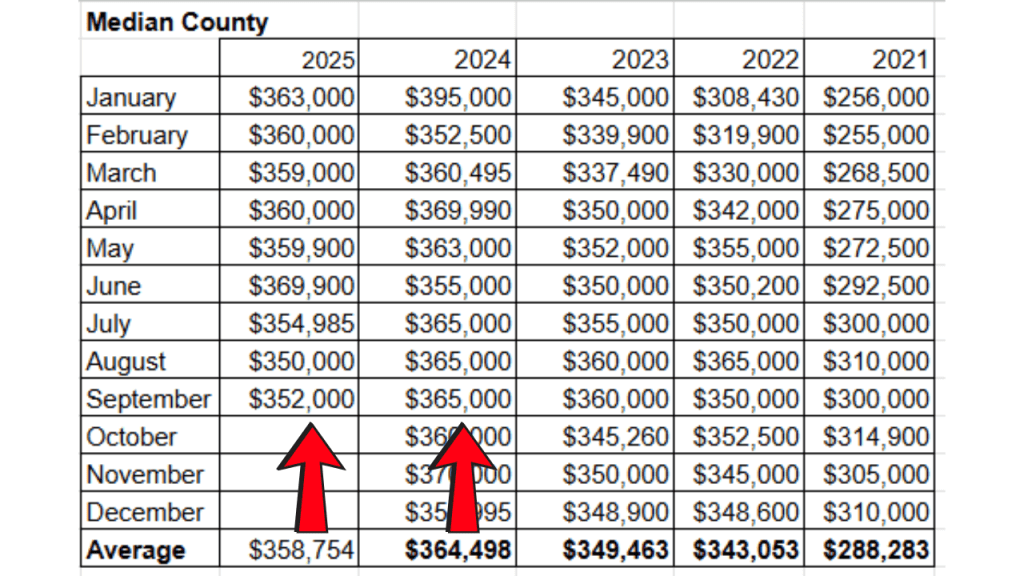

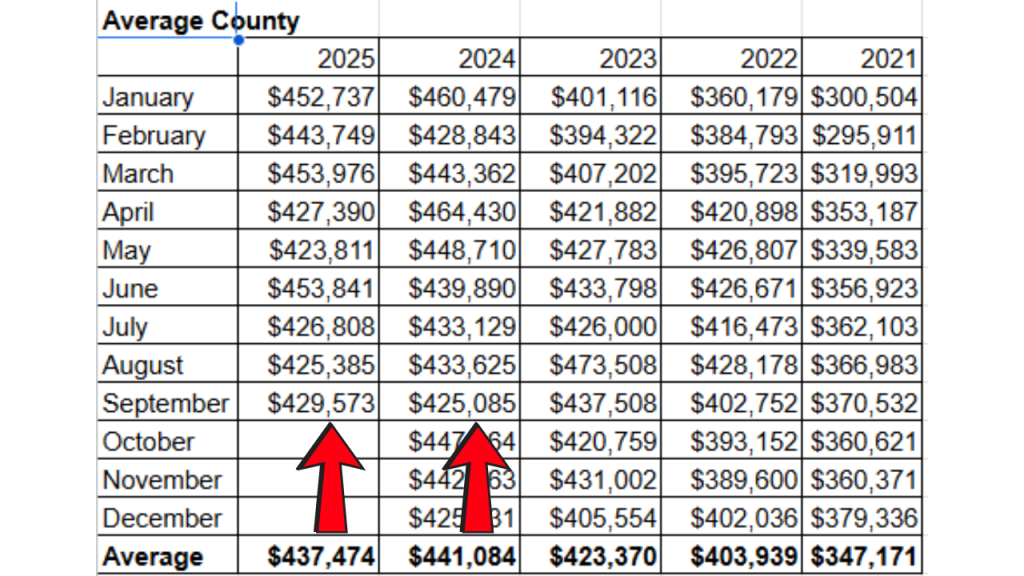

Average sales price $429,573 (slightly higher than last September)

Median sales price is $352,000 ($13K lower than last September)

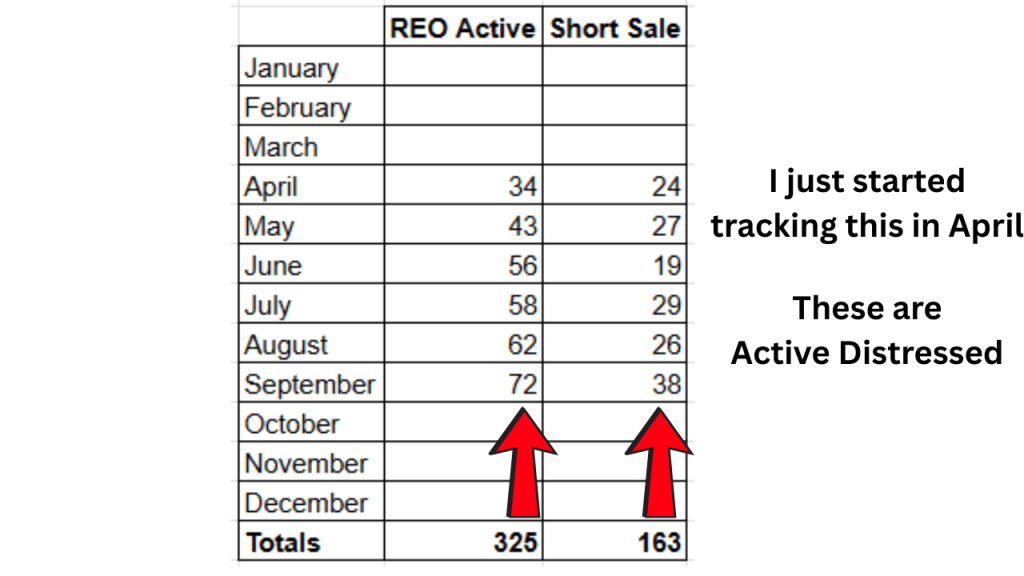

Distressed properties are up slightly. 72 bank-owned & 38 short sales active/on the market. Up from 62 & 26 in August

Distressed sales are up 12 bank-owned sales and 2 short sales. Nothing alarming yet.

The best thing I can point out for our September sales is that we did not have any hurricanes or named storms affect our housing market.

Brevard County

Active inventory 5011

Sold Property 1034

Months Supply 4.85 months

Average Price $429,573 2024 $425,085

Median Price $352,000 2024 $365,000

List/Sale ratio 93%

Average price per SqFt $226.05 SqFt

Days On Market 75.28

Property selling in less than 7 days 169 (16.5 % of the sales)

Property selling over $1M 41

Highest price sale $3.025 S Tropical Trail Merritt Island

Home sales under $200K 41

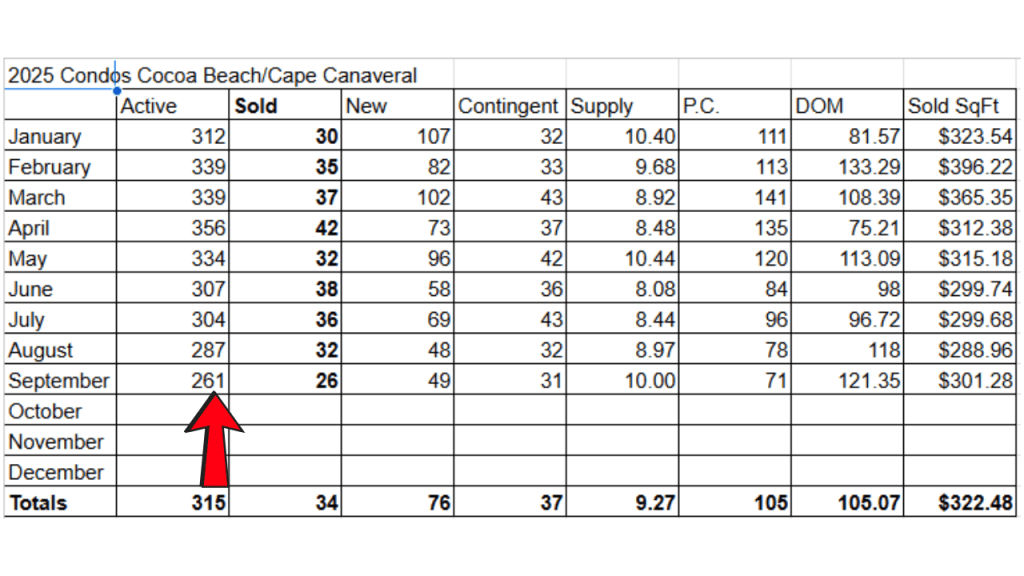

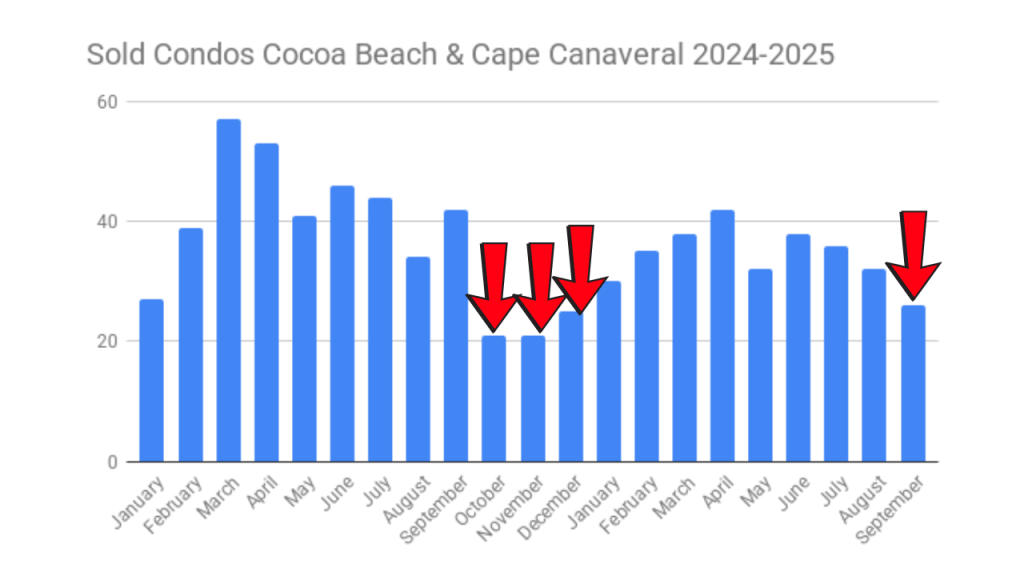

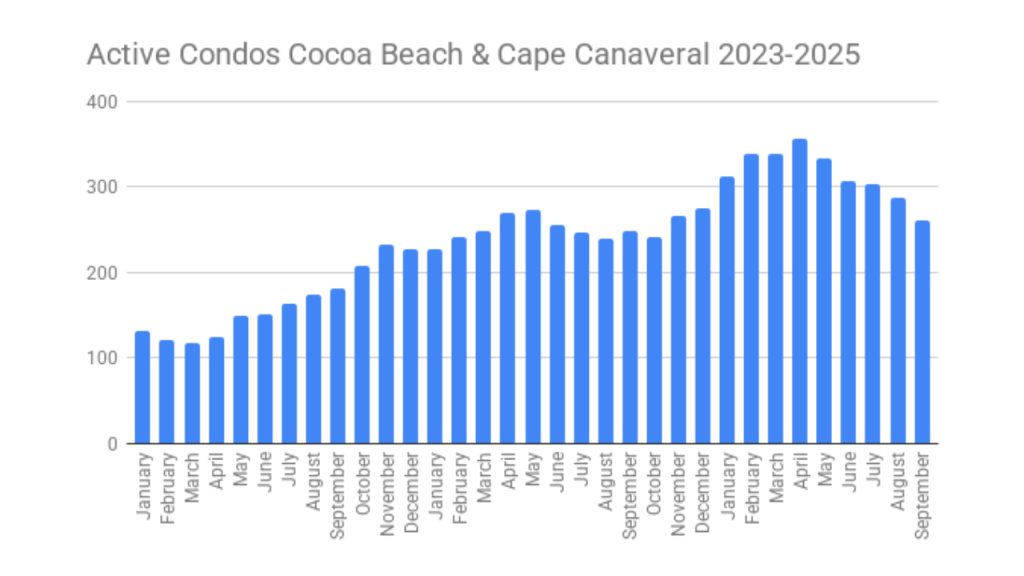

Cocoa Beach & Cape Canaveral

Condos

| A: Price range $124.9K-$3.299M | S: Price Range $ 116.2K-$1.235M |

Active inventory 261

Sold condos 26

Months supply 10 Months

Average Price $381,257 2024 $385,135

Median Price $280,000 2024 $356,000

Average price per square foot $301.28 SqFt

Days On Market 121.35

Condos selling under $200K 4

Best selling complex N/A

The condo market is still a mess. Even though inventory continues to pull back, we have 261 condos available; sales are low. There were only 26 closings for Cocoa Beach & Cape Canaveral combined. This is the slowest month of 2025, but not the slowest month we have seen in the condo market. The 4th quarter of 2024 was the slowest I have seen for the condo market. This is another area of opportunity for a Buyer who is considering a condo near the beach.

Digging into the data, looks like half the sales were cash, and the other half 10 had conventional financing, 2 were “other”, and there was 1 sale that had VA financing. Important to point out, that YES, you can use your VA eligibility to purchase a condo. However, not all condos can use a VA loan. This sale was for the Dolphin Beach condo. If you would like a list of VA approved condos, let me know.

Condo association fees were between $325-$991 per month. Median condo fee was $680.

It took on average, 121 days for the condos to sell.

There’s also a 10 month supply to choose from.

Because of the good selection of condos, the lower sales, and the 10-month supply…prices are coming down. Average sales price is down slightly at $381,257. The median sales price came down a lot…$280,000. This is in line with median prices from 2021.

Single Family Homes

| A: Price range $349.9K-$3.5M | S: Price Range $470K-$700K |

Active inventory 63

Sold homes 5

Months supply 12.6 months

Average Price $573,800 2024 $680,333

Median Price $550,000 2024 $685,000

Average price per square foot $380.34 SqFt

Days On Market 73.2 DOM

Homes selling under $600K 3

Homes selling over $1M 0

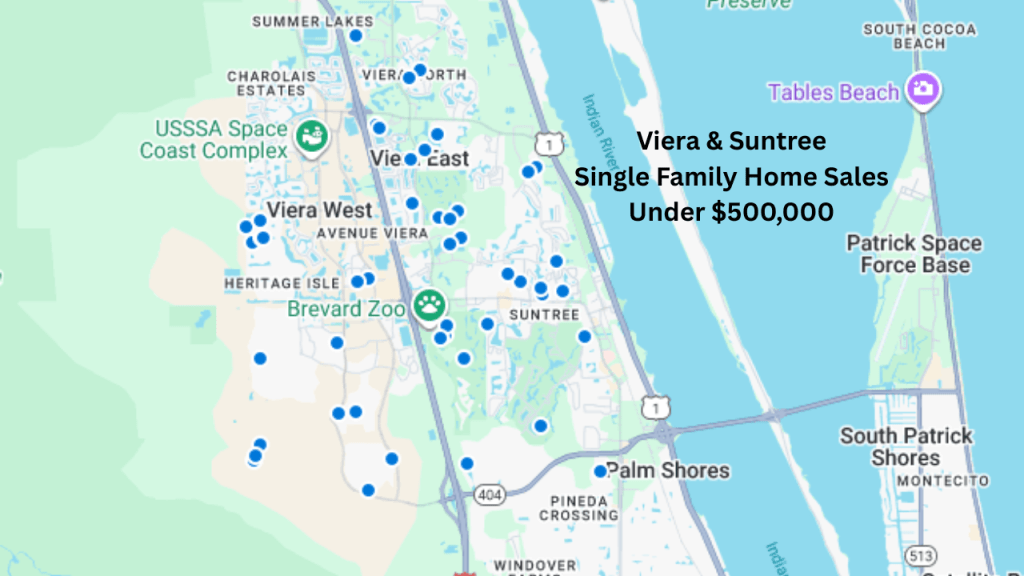

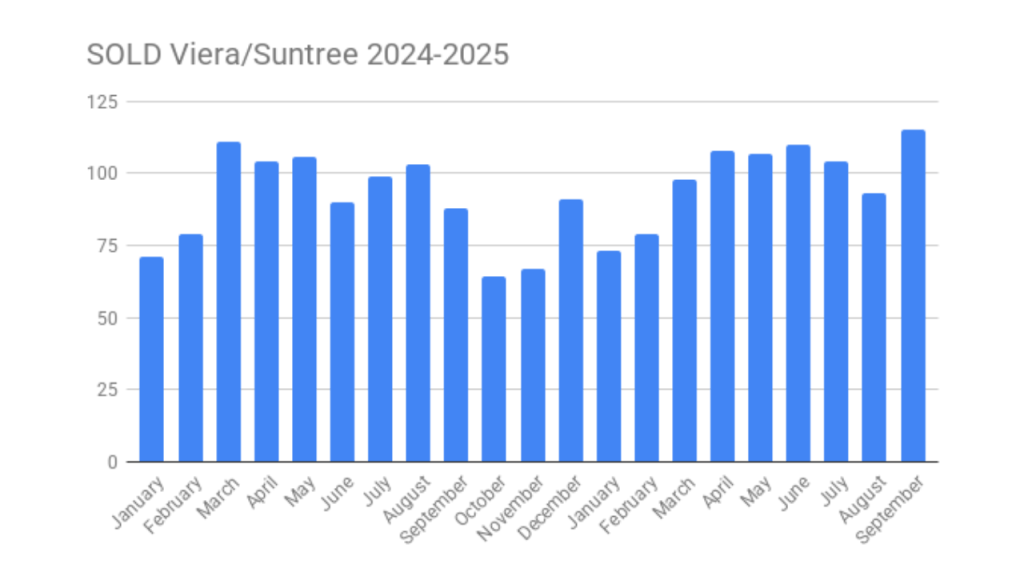

Viera/Suntree Area

Single Family Homes

| A: Price range $ 289K-$5.5M | S: Price Range $280K-$1.328M |

Active inventory 328

Sold homes 115

Months supply 2.85 Months

Average Price $612,608 2024 $649,746

Median Price $618,000 2024 $620,000

Average price per square foot $266.45 SqFt

Days On Market 49.1 DOM

Homes selling under $500K 46

Homes selling over $1M 7

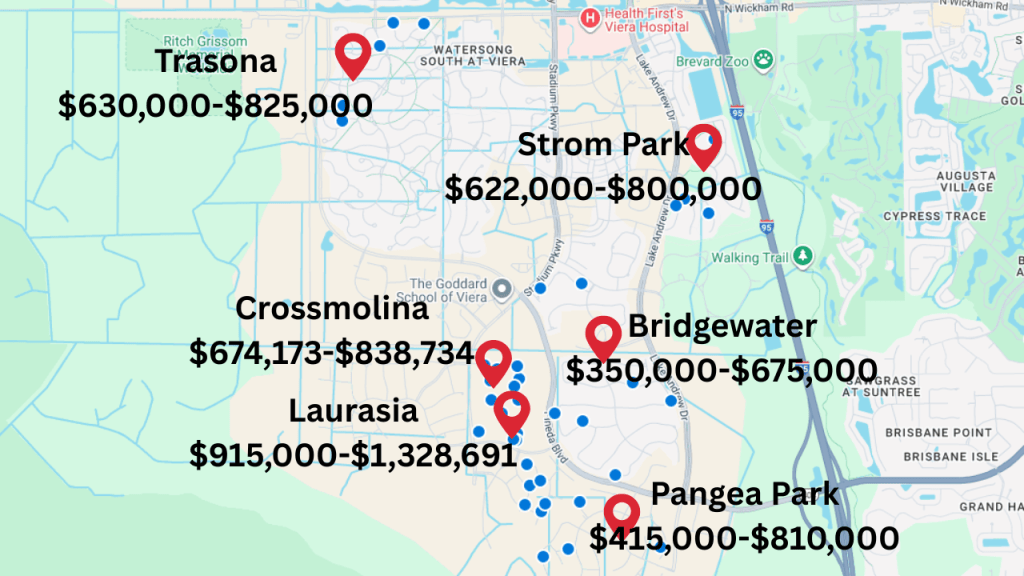

Looking at what’s happening in the Viera/Suntree area. Active inventory is actually up compared to where things were at the beginning of 2025. We ended September with 328 single family homes on the market. I am not really concerned because September was an exceptionally strong month for sales with 115 closings. This was one of the best months for sales since 2023. The average sales price is down, $612,608 compared to $649,746. Median sales price is down, too, only slightly. $618,000 compared to $620,000.

Some other interesting stats for the Viera Suntree area: 46 homes were selling under $500K. This is the most under $500k in 2025. Let me know if you would like info on the under $500K homes for sale.

It is taking a little longer to sell compared to 2024, at 49 DOM for September.

The 5 best-selling communities are all in West Viera:

Crossmolina with 14 sales $674,178-$838,734

Bridgewater with 7 sales $350,000-$675,000

Laurasia with 6 sales $915,090-$1,328,691

Trasona with 5 sales $630,000-$825,000

Strom Park with 4 sales $622,000-$800,000

That’s what is happening in the housing market on the Space Coast. Do you think there’s a chance we end 2025 strong and pull ahead of 2024? Let me know in the comments.

Questions about an upcoming move? I am here to help. Simply leave a comment below or let’s schedule a call. https://www.ericlarkin.com/schedule-a-call

Eric Larkin is a Broker Associate with Real Broker, LLC. He lives, works, and plays in the Cocoa Beach area. If you have questions about moving or relocating to Cocoa Beach and the Space Coast, let me know! I get calls, texts, direct messages & comments on my posts every day about the real estate market and things that are happening in Cocoa Beach and the Space Coast that I love answering. Ask me your questions on moving, relocating here, or anything about the community. I am here to help. I have been helping buyers and sellers with their real estate needs since becoming a real estate agent in 2003. My focus is always on helping, answering your questions, and doing everything possible to make certain you have a smooth transaction from beginning to end.

Planning a move or have questions about our area? Eric Larkin with Real Broker, LLC can help! Schedule a call here https://www.ericlarkin.com/schedule-a-call

OR leave your info here and I will call you https://www.ericlarkin.com/contact-form