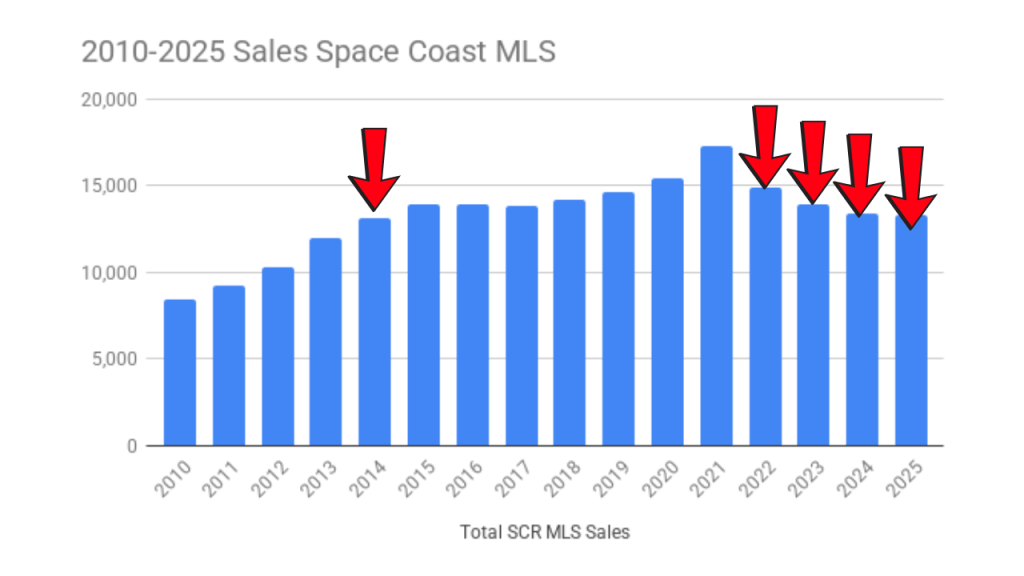

What actually happened in our real estate market in 2025? Distressed sales could be making a comeback. They were up 43% in 2025 over 2024. Plus, our sales were down. Not only were our sales behind 2024, it was our slowest year since 2014. In fact, this is the 4th year in a row for our sales trending down in the Space Coast MLS…but not by much. As of January 9th, our total sales for 2025 13,343 compared to 13,383 in 2024. We were that close…

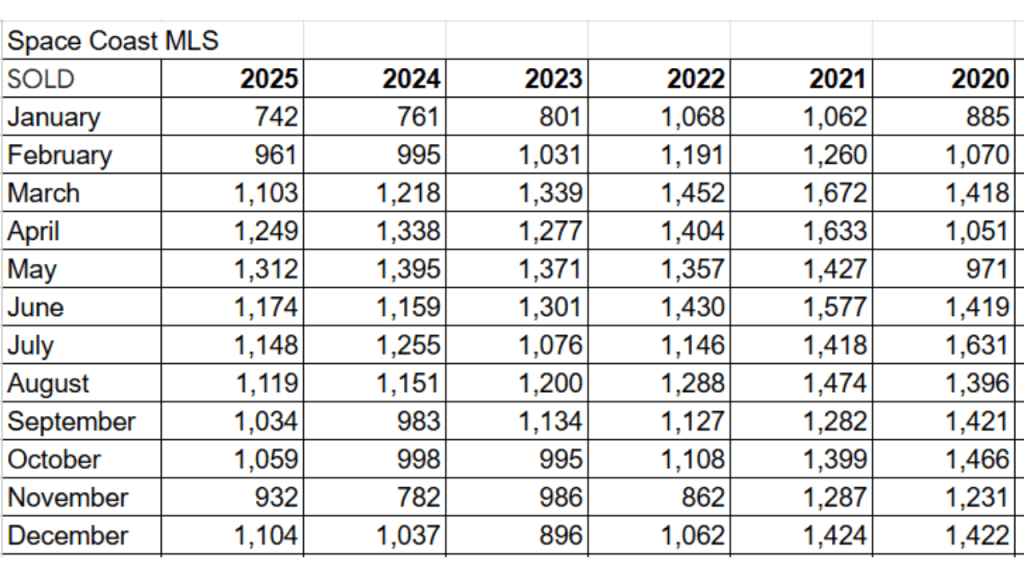

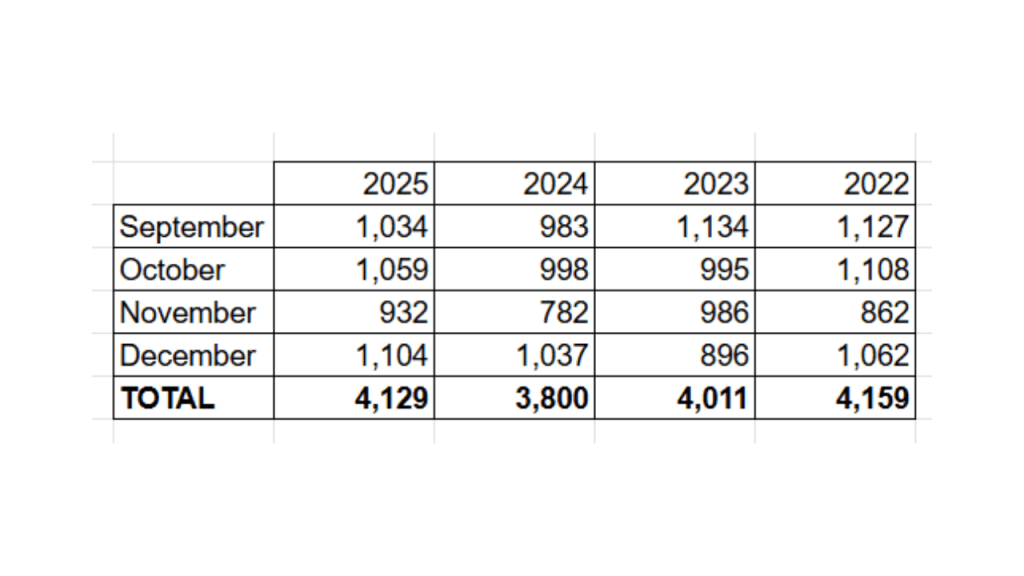

Here is what’s interesting. The first 8 months of 2025, our sales could not keep up with 2024 sales…we were down 5% in total volume That changed in September. The last 4 months of the year the sales smoked the previous year sales by 10% finishing 2025 strong. We were up over 2024, 2023, and almost 2022. Our momentum is pretty strong coming into 2026.

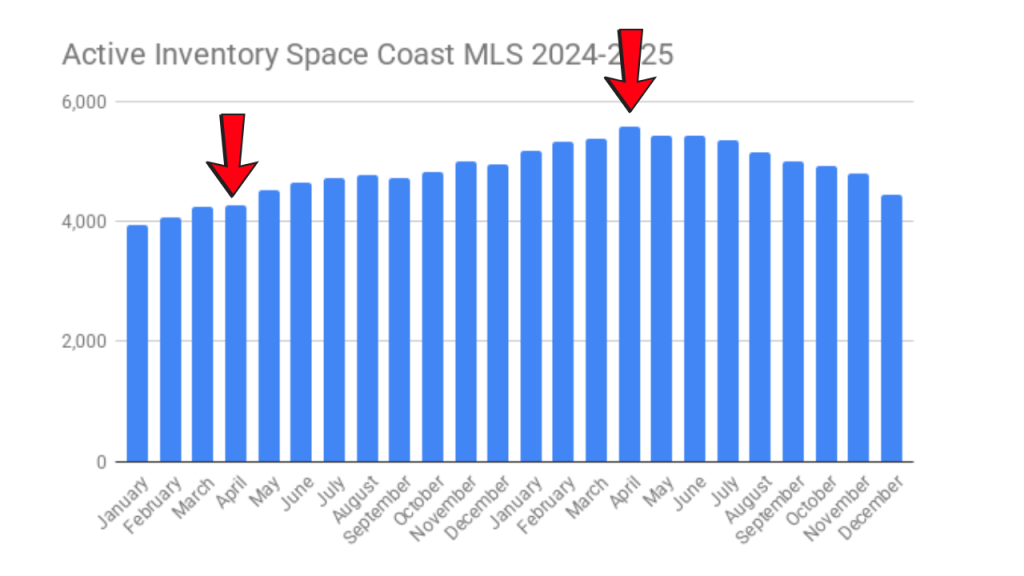

Our active inventory is still high. We ended the year with 4,448 properties for sale in the Space Coast MLS. This is the lowest we have seen since April 2024. This is 20% lower than our peak in 2025. I do anticipate the inventory to grow in January and February because it always happens. We will have to see how strong our spring market is in 2026.

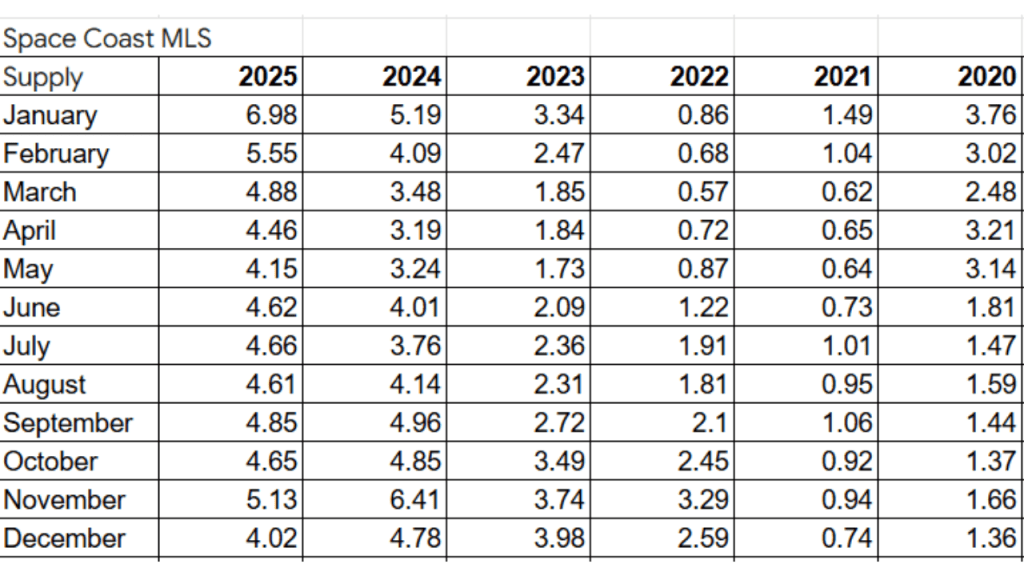

The month’s supply of inventory was exceptionally high in 2025. That is expected when you have over 5,000 properties available for most of the year and sales 5% behind the previous year. The last 4 month’s bump in sales did help lower this number and we ended the year at a 4.02 months supply.

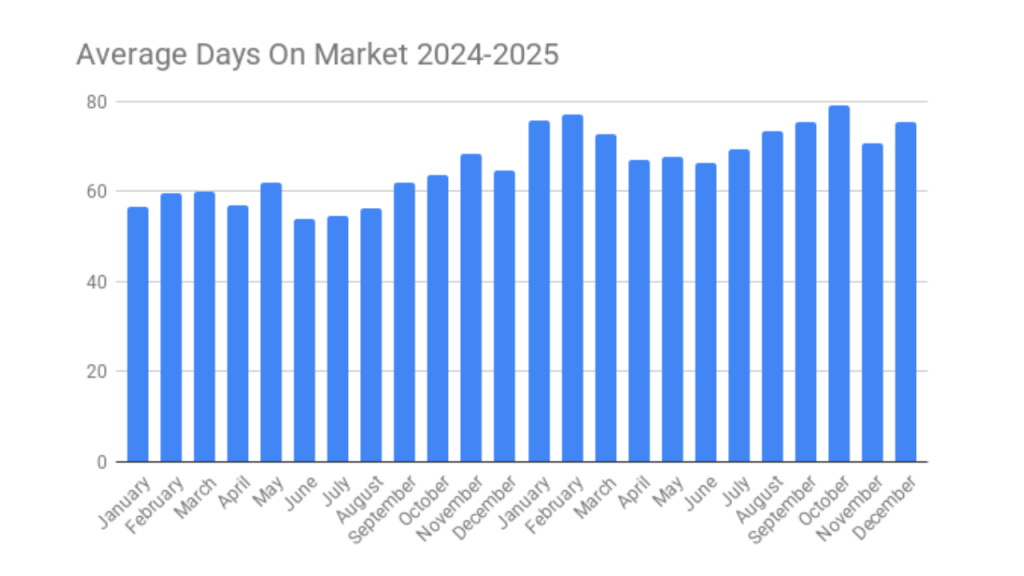

Because of the higher inventory, it only makes sense its taking a little longer for a property to sell. Average days on market for 2025 72.2 days. This was a 21.3% increase over last year’s 59.5 days on market. With that being said, 2,256 properties sold in 7 days or less…almost 17% of the sales.

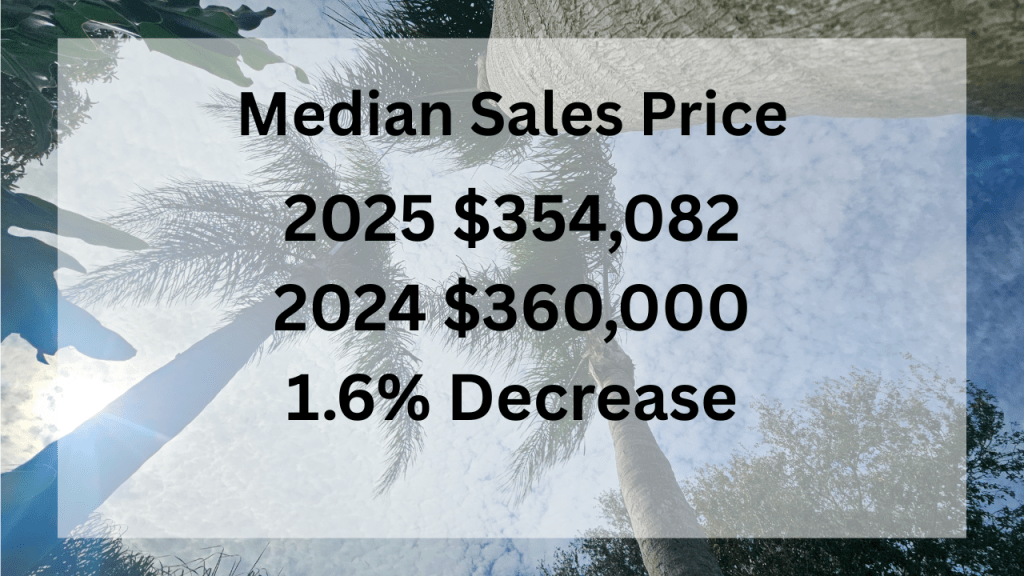

A little more inventory that takes a little longer to sell will affect prices. Both the average and median prices came down in 2025.

2025 average sales price $432,314 vs $438,534 in 2024. This is a 1.4% decrease

2025 median sales price $354,082 vs $360,000 in 2024. This is a 1.6% decrease.

2025 average price per square foot $230.01 vs $237.88 in 2024. This is a 3.3% decrease.

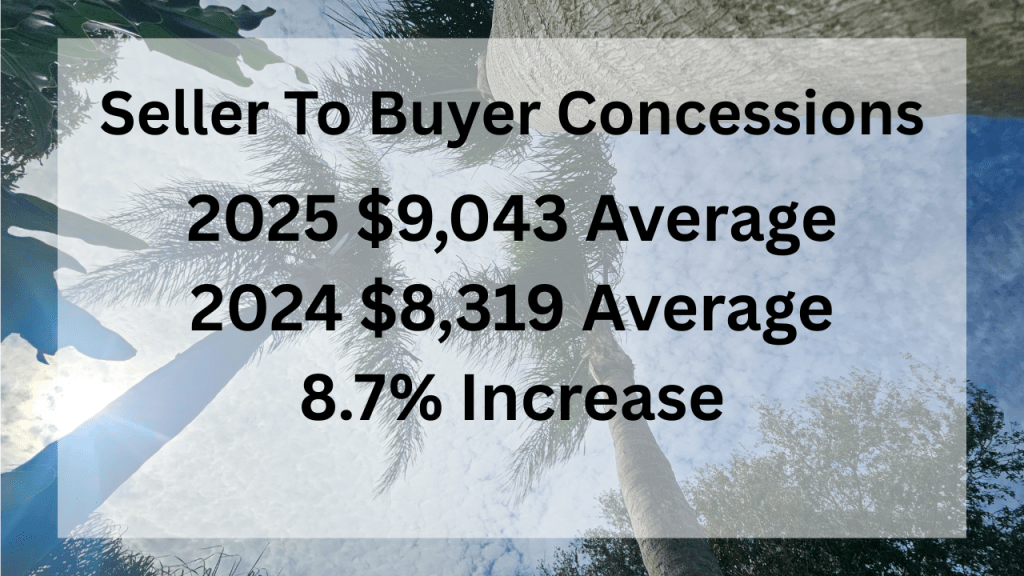

Seller concessions are happening a little more frequently. 36.4% of the sales in 2025 had some type of concessions vs 35.0% in 2024. 1.3% increase.

The concession amount is up 8.7%. 2025 $9,043 vs $8,319 in 2024.

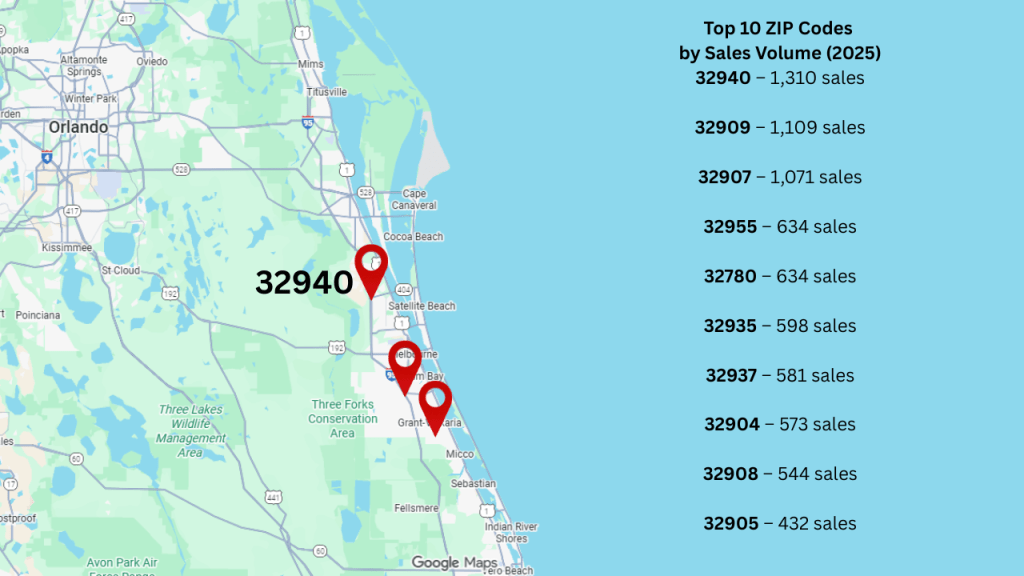

The best selling zip code is the 32940 again! Viera is the hot market again in the new year. Followed closely by 32909 & 32907

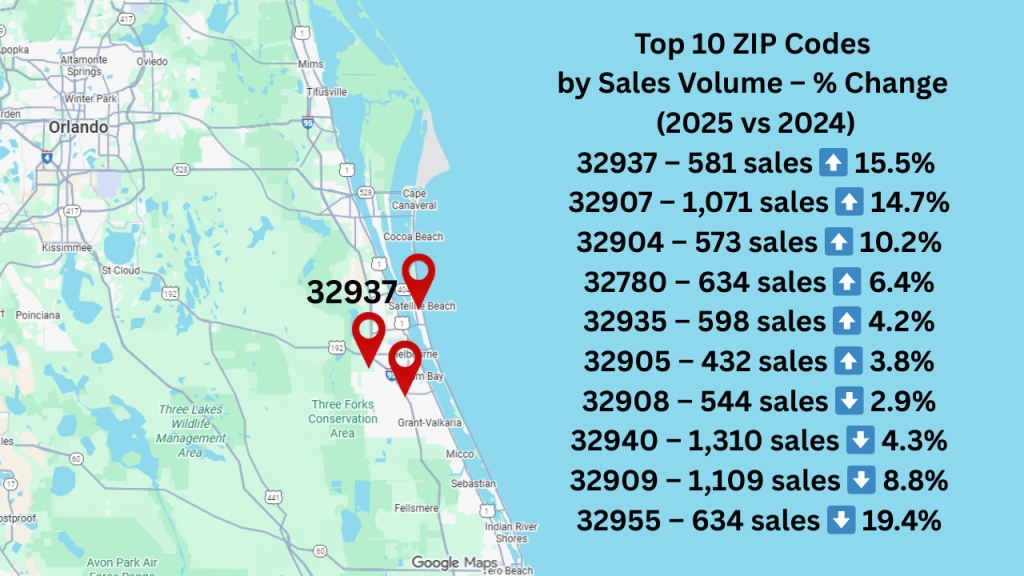

Here are the zips with the largest increase in sales:

32937 15.5%

32907 14.7%

32904 10.2%

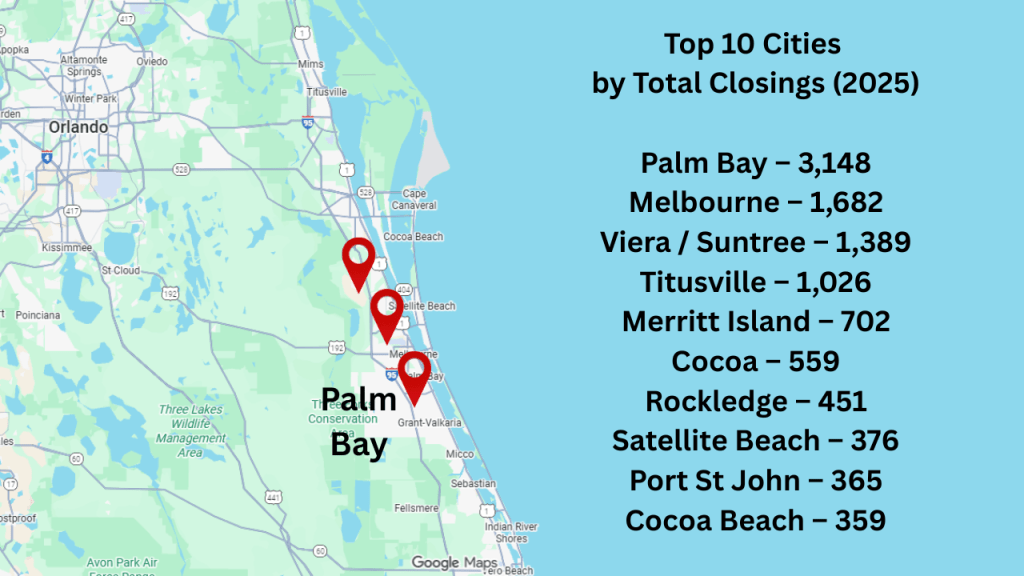

Palm Bay is the king of sales, followed by Melbourne, Viera/Suntree, Titusville, & Merritt Island.

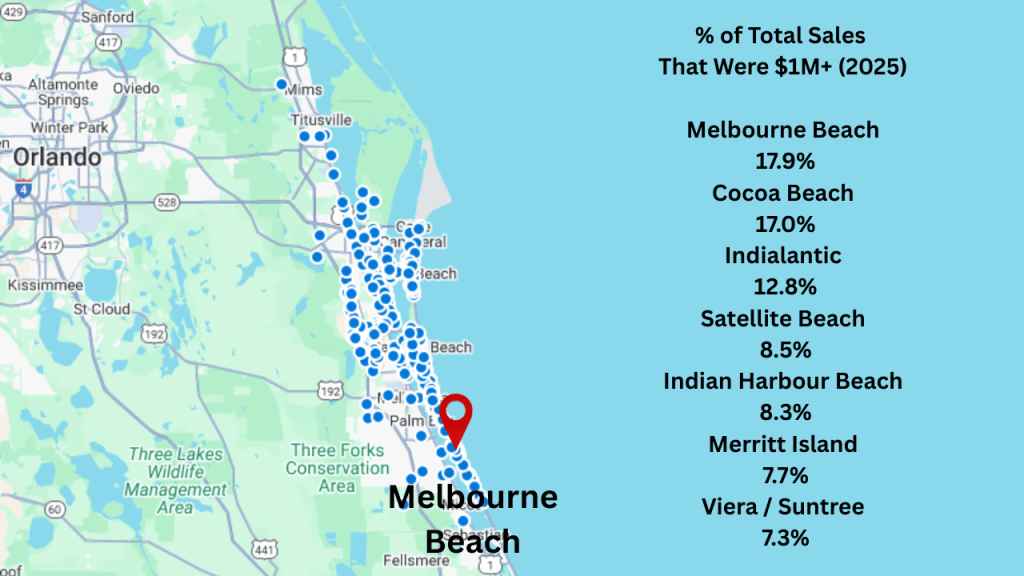

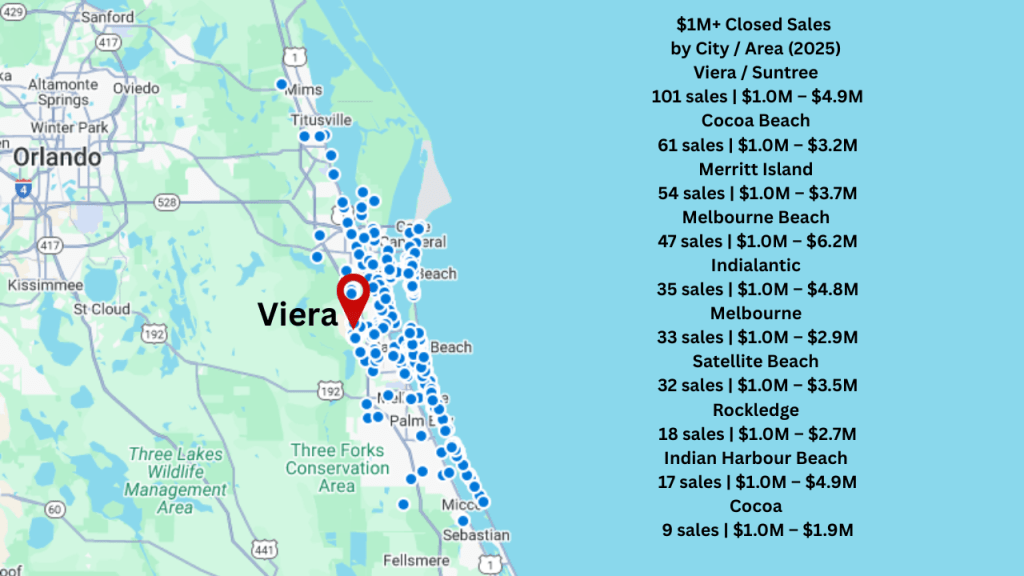

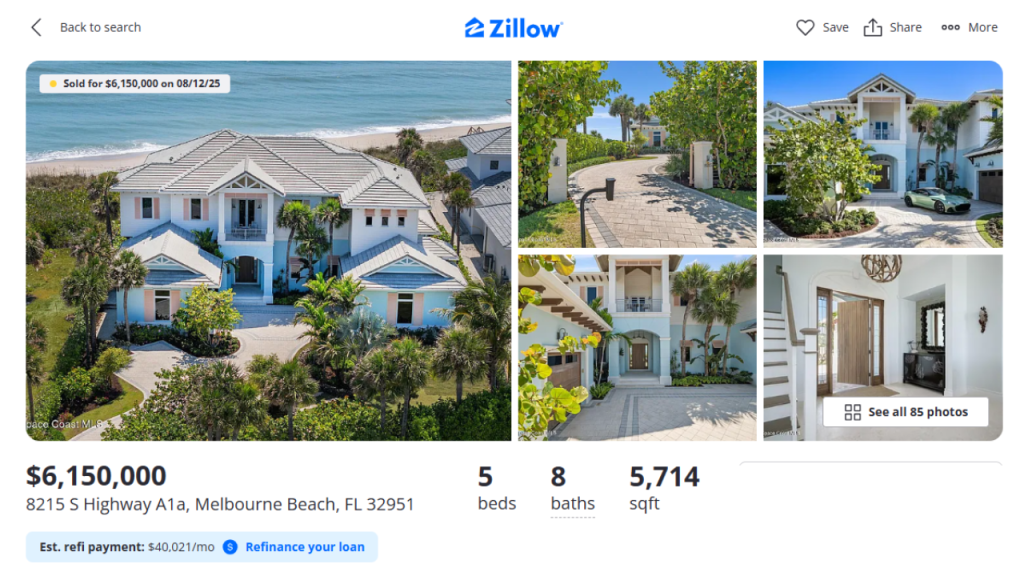

Looking at the luxury market and sales over $1M. Melbourne Beach lead 2025 with the highest priced sale in Brevard County. $6,150,000 for a modest 5 bedroom, 5 bathroom, 5714 SqFt ocean front home that was built in 2020. Overall $1M+ sales were down slightly in 2025 (512 vs 532).

There were $1M+ sales throughout Brevard County. Viera lead the way with the number of sales over $1M.

Beachside & the barrier islands lead the way with the highest percentage of sales that were over $1M compared to the overall local sales.

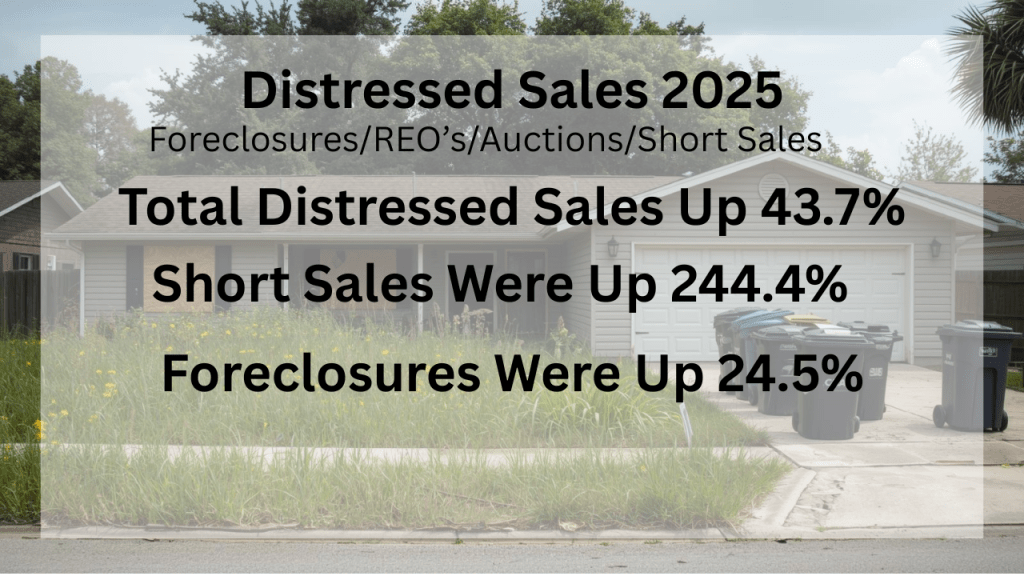

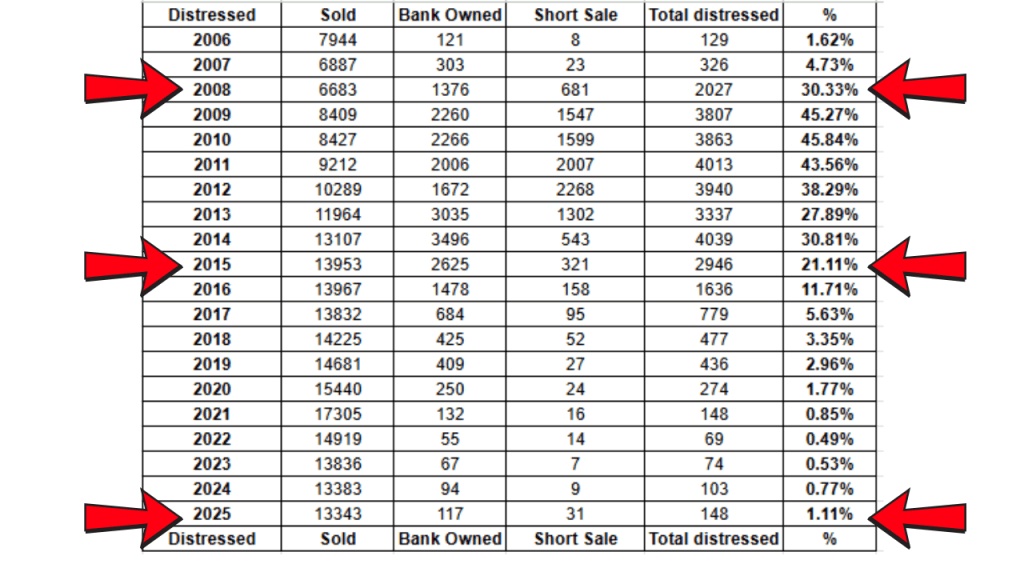

Since there is a lot of talk and headlines talking about the return of the foreclosure sales and distressed market…let’s see what happened in 2025.

Short sales were up 244.4% in 2025

Foreclosures were up 24.5% in 2025

Total distressed sales were up 43.7%

The actual numbers are 31 short sales in 2025 up from 9 in 2024

REO/foreclosures 117 in 2025 up from 94 in 2024.

Total distressed sales were 148 in 2025 up from 103 in 2024.

The percentage of increase are kind of scary. Looking at just the total distressed sale numbers, they are reasonable when compared to what we had from 2017-2020. Nowhere close to the market meltdown that occurred in 2008-2015. As long as the percentages stay in the low single digits; we will be OK. I will be keeping up with the distressed sales in 2026, so keep an eye out for the updates.

What do you think about this review of 2025 housing market on the space coast? In line with what you were expecting or were there a couple of surprises? Any predictions for 2026??? Let me know in the comments.

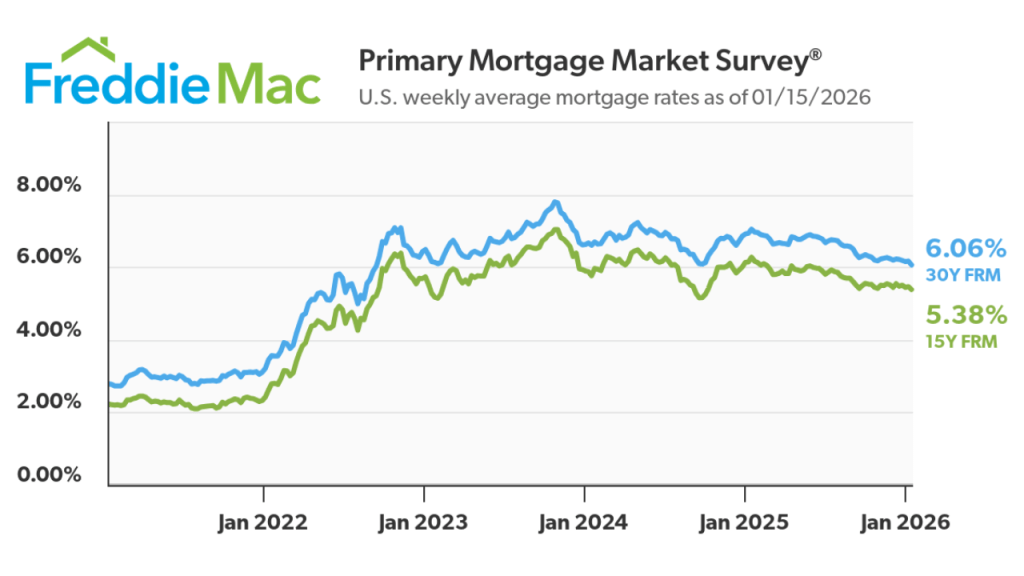

I believe the trends from the 4th quarter will carry into 2026. Interest rates have lowered some and are leveling out in the low 6% range to upper 5%. Buyers have come to accept this is the new normal. Inventory in the mid to upper 4000 range provides a nice selection for Buyers to choose from and still gives them leverage to negotiate price, concessions, and even repairs. If you have been on the fence about purchasing, I recommend considering it before our sales pick up in the spring and summer of 2026. More buyers means less negotiating power. If you are selling, its very important to make sure your home is in good shape and priced competitively. This is not the market to test a higher price for to long of a timeframe. You need to be quick to adjust your price to get the Buyers attention. Any questions about this information or an upcoming move, I am here to help.

Eric Larkin is a Broker Associate with Real Broker, LLC. He lives, works, and plays in the Cocoa Beach area. If you have questions about moving or relocating to Cocoa Beach and the Space Coast, let me know! I get calls, texts, direct messages & comments on my posts every day about the real estate market and things that are happening in Cocoa Beach and the Space Coast that I love answering. Ask me your questions on moving, relocating here, or anything about the community. I am here to help. I have been helping buyers and sellers with their real estate needs since becoming a real estate agent in 2003. My focus is always on helping, answering your questions, and doing everything possible to make certain you have a smooth transaction from beginning to end.

Planning a move or have questions about our area? Eric Larkin with Real Broker, LLC can help! Schedule a call here https://www.ericlarkin.com/schedule-a-call

OR leave your info here and I will call you https://www.ericlarkin.com/contact-form