Housing market crash 2023 is still a popular search term. People searched that term 165,000 in the last 30 days. Other variations of the term are up 150-200% in the last 30 days. People are definitely looking for a housing market crash…but is it going to happen in 2023? Let’s see what July’s housing market numbers tell us.

Brevard County

Active inventory 2546

Sold Property 1076

Months Supply 2.36 months

Average Price $426,000 2022 $416,473 (2.3% increase)

Median Price $355,000 2022 $350,000 (1.5% increase)

List/Sale ratio 95%

Average price per SqFt $244.49 SqFt

Days On Market 34.49 DOM

Property selling in less than 7 days 388 ( 36% of the sales)

Property selling over $1M 39

Highest price sale $4.3M Lansing Island

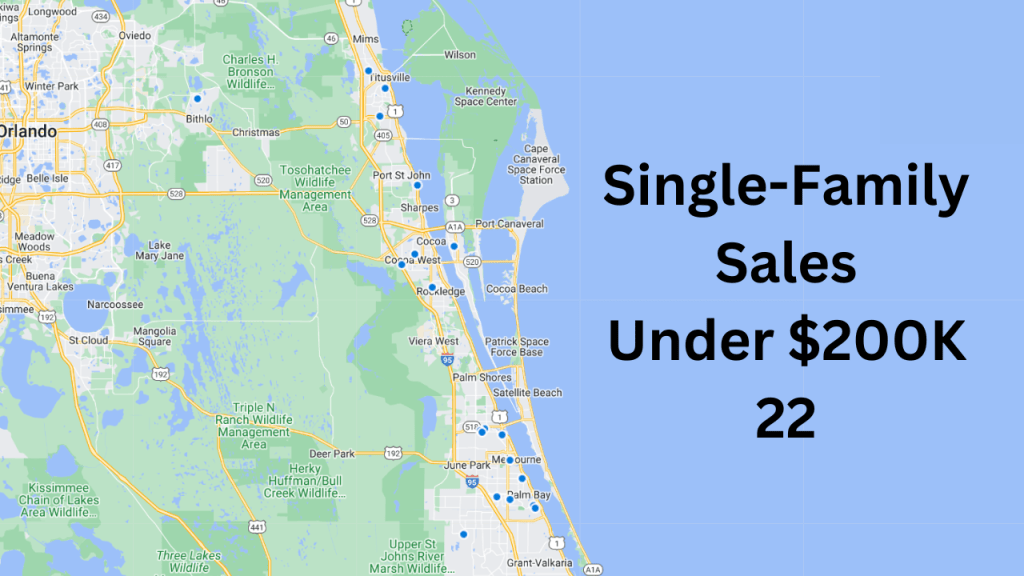

Home sales under $200K 22

Cocoa Beach & Cape Canaveral

Condos

| A: Price range $139.9K to $1.897M | S: Price Range $122K to $1.250M |

Active inventory 163

Sold condos 30

Months supply 5.43 Months

Average Price $446,650 2022 $431,891 (3.3% increase)

Median Price $380,000 2022 $360,000 (5.5% increase)

Average price per square foot $349.43 SqFt

Days On Market 52.6 DOM

Condos selling under $200K 4

Best-selling complex Canaveral Towers, Harbor Isles, Stonewood, and The Villages of Seaport all had 2 sales

Single Family Homes

| A: Price range $ 475K to $3.950M | S: Price Range $395K to $1.480M |

Active inventory 37

Sold homes 14

Months supply 2.64 Months

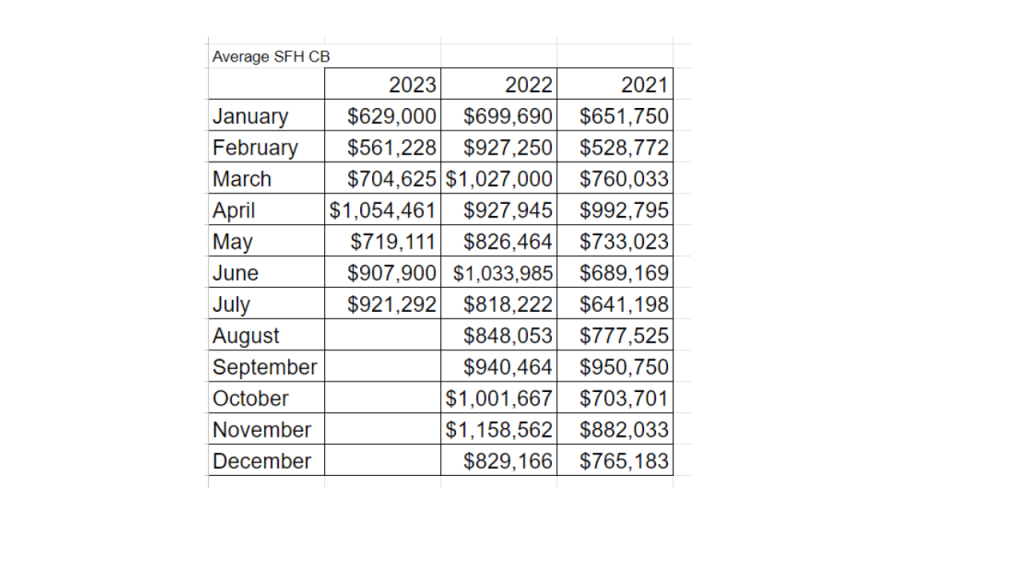

Average Price $921,292 2022 $818,222 (12.5% increase)

Median Price $939,101 2022 $795,000 (18% increase)

Average price per square foot $437.21

Days On Market 30.29 DOM

Homes selling under $500K 1

Homes selling over $1M 6

If this is the first time seeing one of my market updates, I focus on Brevard County as a whole and the condo & single-family sales in Cocoa Beach and Cape Canaveral Florida. I think tracking the active inventory and sold properties are important key factors in a housing market update.

Right now, the active inventory for Brevard County is fairly stable. No big swings up or down month over month. We are averaging just under 2500 properties on the market in 2023 and we ended the month of July with just over 2500 properties. I call that a stable inventory.

Properties selling is a little bit of a wild card. The sales are definitely trending down both for this year and compared to the last few years. July 2023 sales were down from June 2023. Sales were down comparing July 2023 to July 2022. July 2023 is the slowest July I have seen in years.

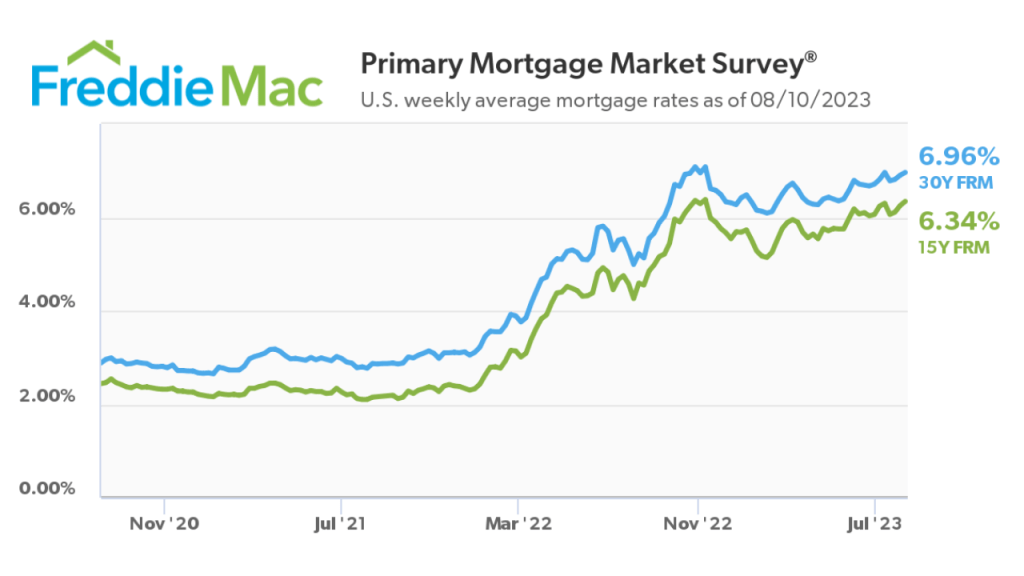

The slowdown for July and all of 2023, I believe are tied directly to the interest rates and insurance costs. The near 7% interest rates are causing buyers to rethink their strategy. They are either going to pay more per month for a particular neighborhood and/or price range OR they are going to have to adjust their price range to stick to a particular mortgage payment. Will the rates ever go down? Will the rates continue to rise? There is no way to accurately predict this. I do know if rates do drop back below 6%, there will be a surge of buyers back to the marketplace.

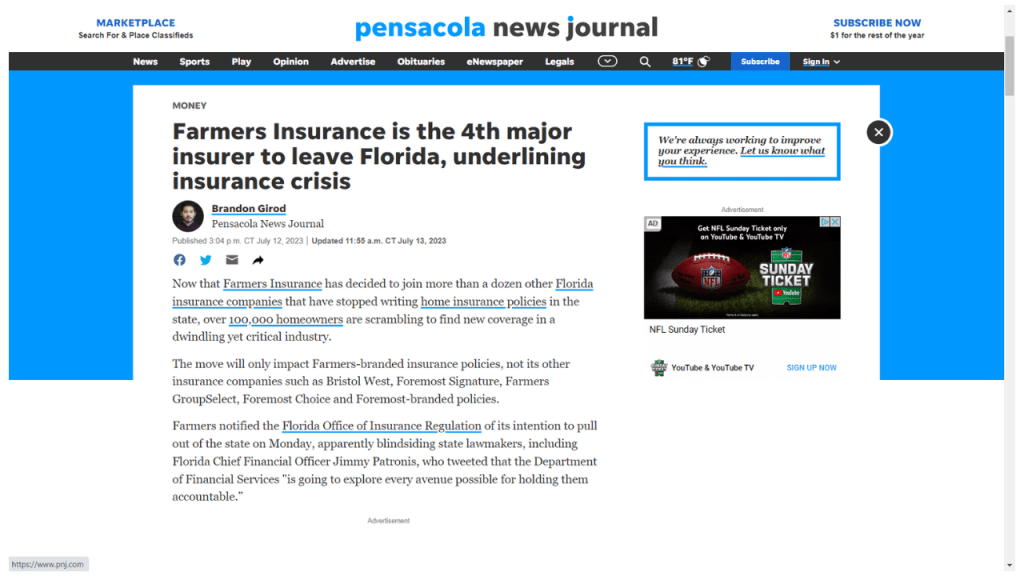

The insurance dilemma in Florida is the other impact on a buyer’s purchasing power. In July we saw another insurance company pull out of the Florida Homeowners insurance market making it more challenging to find insurance. Insurance premiums are up and there are no signs of this changing anytime soon.

You would think with the number of home sales down, the prices will be dropping. That just isn’t the case. The average and median prices for Brevard County continue to rise. July’s average sales price is up 2.3% over 2022 and is up 14% over 2021. The median sales price is also up over last year by 1.5% over 2022 and 16% over 2021. The median prices for 2023 do seem to be stabilizing.

If sales are down, you would think our active inventory would be on the rise. That hasn’t happened because we do not have enough sellers today. Actually haven’t had enough properties coming on the market for the last 3 years. Sellers were hesitant to sell from 2020 to 2022 because of the intense real estate market. There wasn’t an issue with selling their home, it was finding the replacement property. It was tough competing against 15 or more offers to purchase a property. Today, sellers are reluctant to sell because of the interest rate. Yes, they can still get a great price on the sale of their home. More than likely, they have an interest rate of around 3%. With the purchase of a new home, they are looking at a high 6% rate. The numbers do not make sense. The Fed’s strategy of raising the rates, to slow down & stabilize the real estate market; which should then lower the prices of homes…didn’t work.

Homes are taking a little longer to sell. The average days on the market for July was 34 DOM. We still had over a third of the sales happen in 7 days or less. There were 39 properties sold for over $1M in our MLS in July. The number of homes selling under $200K was only 22.

That is a macro overview of Brevard County, here is a micro view of what’s happening in the Cocoa Beach area. The single-family home inventory has been stable for the year but showed a spike in July to 37 homes on the market. Sales in Cocoa Beach also spike up to 14. This was the best month of home sales in Cocoa Beach for the year and the first back-to-back double-digit sales since the end of the summer of 2022. Home prices are still very high in the Cocoa Beach/Cape Canaveral area. It’s hard to see trends with the average or median prices since we are only looking at an average of 9 sales per month. In the last 2 months, we had several homes sell for over $1M which will skew the numbers.

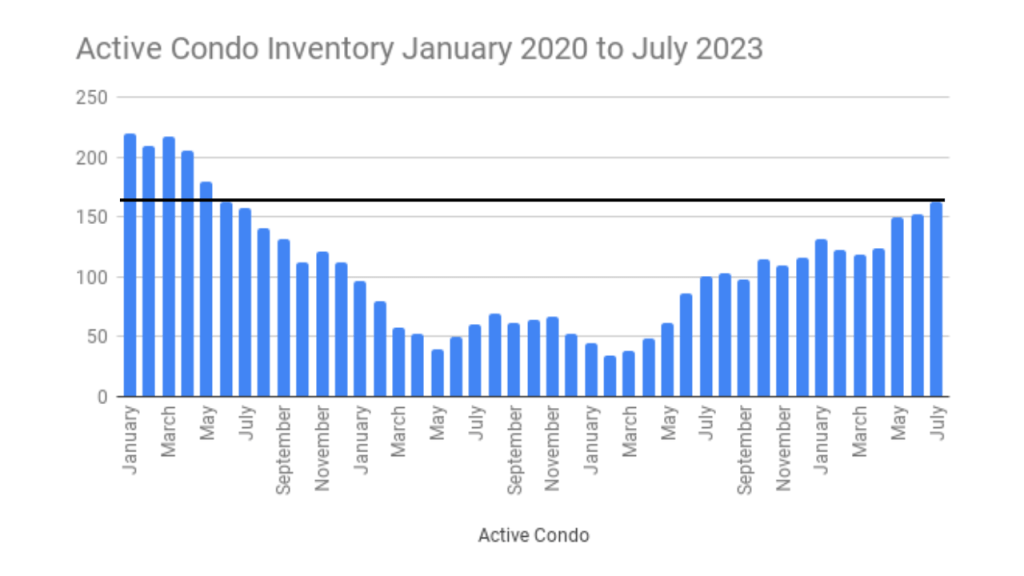

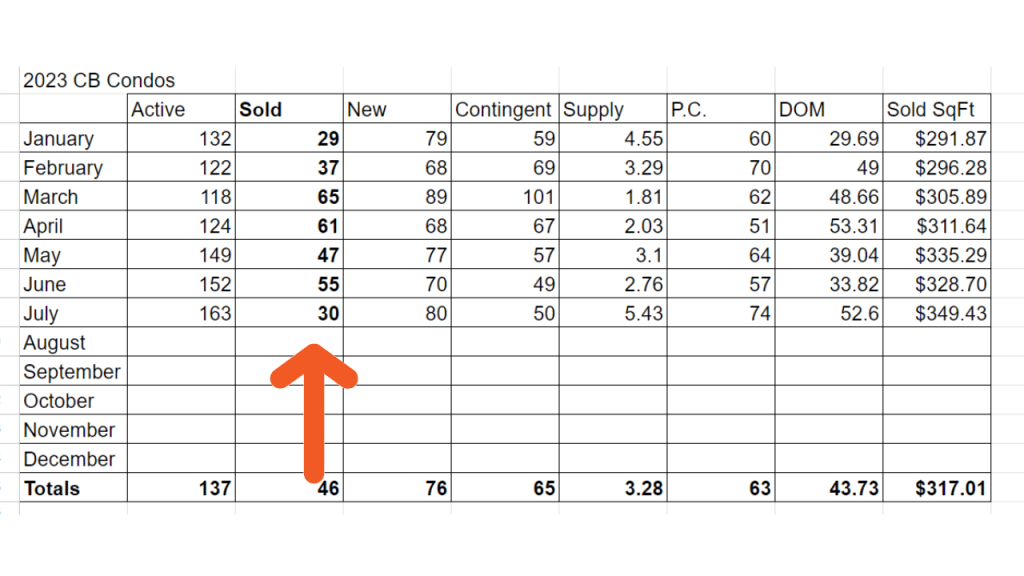

The condo market in Cocoa Beach is definitely slow compared to what is happening with the market as a whole in Brevard County. The active inventory for condos in Cocoa Beach and Cape Canaveral is rising with 163 active listings. This is the highest our condo inventory has been since June 2020. The sales have been slow this summer in our condo market, with only 30 condos selling in July. This is well below the YTD average of 46 condo sales and the slowest month of sales besides January of this year I have seen. No surprise that the average days on the market are up to 52 days and that the month’s supply of condos is also up to over 5 months. In spite of the slower month, it looks like the average sales price is up over last year along with the median sales price. Looking back at both the average price and the median prices for our condo market, these numbers have been kind of all over the place. I will be looking a little closer at the condo market in Cocoa Beach and the county to see if there is something more happening and if there are any concerns.

Really, except for some strange numbers with the condo market beachside, our housing market as a whole is pretty stable. If the home is in decent condition and priced correctly, it will sell in a reasonable timeframe. We are still seeing multiple offers happening throughout the county, just not at the 2020/2021 rate. If you have any questions about an upcoming move, I am here to help. Either give me a call or drop a message below.

Eric Larkin is a Broker Associate with Real Broker, LLC. He lives, works, and plays in the Cocoa Beach area. If you have questions about moving or relocating to Cocoa Beach and the Space Coast, let me know! I get calls, texts, direct messages & comments on my posts every day about the real estate market and things that are happening in Cocoa Beach and the Space Coast that I love answering. Ask me your questions on moving, relocating here, or anything about the community. I am here to help. I have been helping buyers and sellers with their real estate needs since becoming a real estate agent in 2003. My focus is always on helping, answering your questions, and doing everything possible to make certain you have a smooth transaction from beginning to end.

Planning a move or have questions about our area? Eric Larkin with Real Broker, LLC can help! Schedule a call here https://www.ericlarkin.com/schedule-a-call

OR leave your info here and I will call you https://www.ericlarkin.com/contact-form