Buying a condo is not like buying a single-family home. If you are planning on purchasing a condo this year, you have to be aware of the difference, or it could cost you money and it will bring you frustration. Fortunately, this post will bring you up to speed on what to expect.

As you know, condominiums have rules & regulations, there are condo docs and by-laws, and there could be amendments to these documents. When you purchase a condo; Florida Statues gives you time to review these along with the financials. With a resale condo, you have 3 business days for the review once you receive all the documents & with new construction, you have 15 days to review the documents. The Seller, at the Seller’s expense, will provide this information to you…if you ask for it…These required documents and much more is part of the FAR/BAR Condominium Rider that is used when we work together and present an offer on a condo. It’s a 3-page document that covers a lot. If you would like to have a copy to review, let me know in the comments.

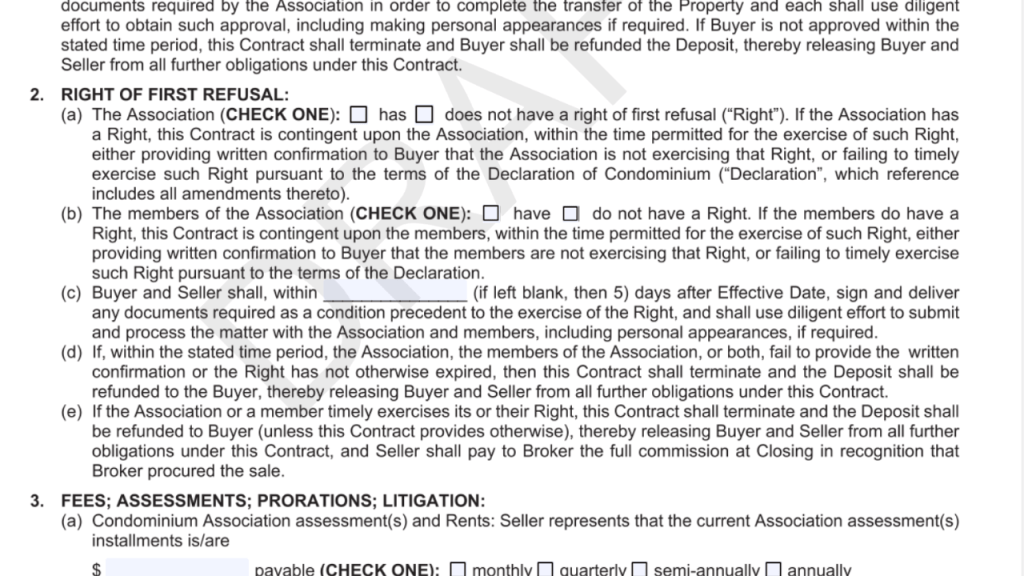

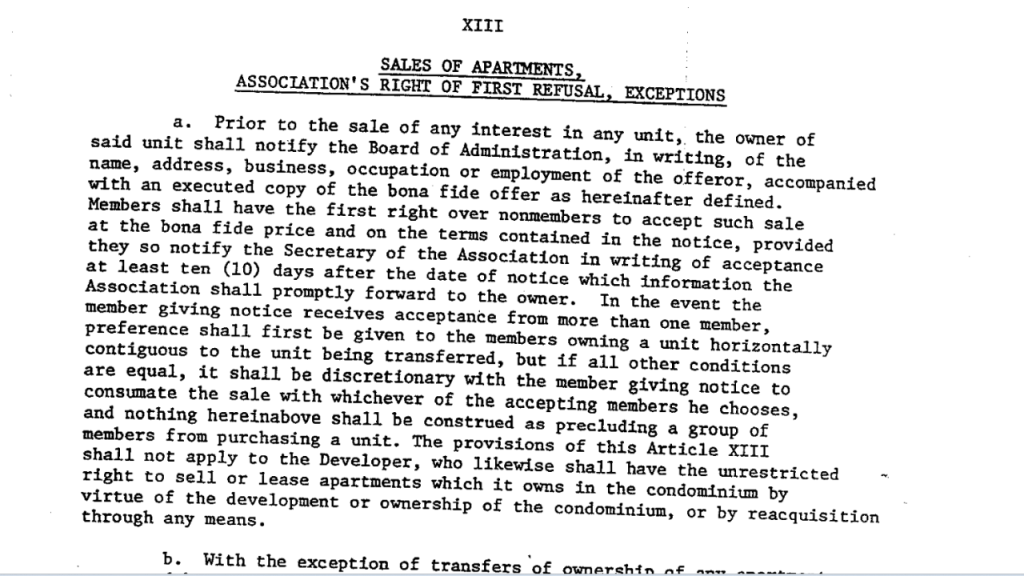

Right of First Refusal. This is more common in condos built in the 1960’s & 1970’s. It’s also fairly common with condos in Cocoa Beach and Cape Canaveral (which is why I am mentioning it)

Once a condo is for sale and goes under contract with a bonafide buyer, the sales contract is then presented to all the owners and they get to decide if they would like to exercise their right and purchase the condo for the terms you and the seller agreed upon. Depending on the complex, the timeframe an owner has to decide is anywhere from 10 days to 30 days. This means you as a buyer, after house hunting, finding a property, figuring out the offer, either arranging for your mortgage or freeing up the cash for the purchase; have to then wait to see if you are going to be the new owner of the condo. If you do happen to be a buyer submitting the offer, make certain you have a real estate agent who is familiar with the first right of refusal because you have to structure your offer with this in mind. If you are reading this post, hopefully you will just call me to help find a condo and you will have one less thing to worry about.

Here are some things you might want to include in your offer:

All the timelines in the contract, the escrow, the inspection period, loan application, loan approval, etc will all start after we are through the first right of refusal timeline. I cannot recommend having a condo inspected if there is a chance you are not going to be the owner.

Increase your escrow deposit to as much as you are comfortable doing. Since the owner who exercises their right to purchase has to honor the terms of the contract, they will have to put that much into escrow if they decide to purchase the condo.

Pay cash. If you can pay cash for the condo, write it up as a cash purchase. If the owner does not have the funds to write a check, it is less likely they will exercise their right of first refusal. (unfortunately, though, most owners who get condos through the first right of refusal end up paying cash for the condo)

Make the closing as quickly as possible. If the owner is not able to meet the closing date as written, it could also be a deterrent for them to buy your condo.

Yes, trying to buy a condo that has the first right of refusal as a condo rule can be nerve-racking. If you do make it through this process and end up buying the condo, it does put you in a pretty good position to get a second or third condo when a good deal happens in your condo complex.

If you are getting a loan to purchase a condo…brace yourself. When you are buying a single-family house, getting a loan is pretty easy if you can qualify for a loan. There are a few more steps when you are buying a condo. You still need to qualify for the loan. The condo also has to qualify for the loan. Your lender has a condo questionnaire form that will need to be completed by the condo association or their property management company. This will be reviewed by the underwriters. The Fannie Mae condo questionnaire is 8 pages long. These are some of the questions they have:

What’s the owner-to-tenant ratio?

What does the master insurance policy cover?

What are the reserves like? Are they completely funded?

They want to review the condo minutes for the last 6 months.

Are there any repairs noted in the minutes?

Are these repairs a safety issue?

Have they been repaired?

Is there a milestone inspection report?

Is there a structural integrity reserve study?

Are there any upcoming assessments?

If there are assessments, are any owners behind on paying the assessment?

Are any owners behind on paying the regular monthly condo fees?

In the past, you had an option of putting a higher downpayment (25% or more) for a limited review of the condominium. Unfortunately, that is no longer an option.

Some things I think are important when you are reviewing the condo docs. Pay attention to the restrictions in the complex and make certain you are comfortable with them. Most condos have some type of pet restrictions. They could limit the number of pets and they could also limit the size of your pet. Some condo docs will say you cannot have a certain kind of pet, like birds or snakes for example. They might just say a domestic dog or cat only. Whether you currently have pets or not, please check the pet restrictions.

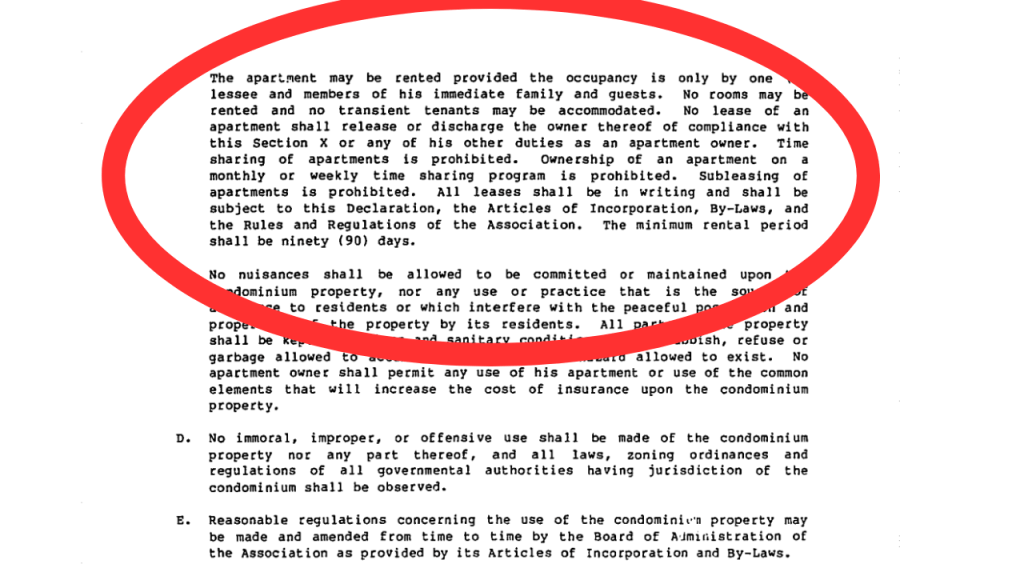

The rental restrictions are also important to review whether you are renting the property or not. If they allow daily or weekly rentals, you will probably have different neighbors throughout the year. If you want to use it as a short-term rental and they have a 6-month or 12-month minimum OR don’t allow rentals at all, this is not the right condo. Even if you are not buying the condo to use as a rental…you never know…you might want to start using it as a rental a few years from now…

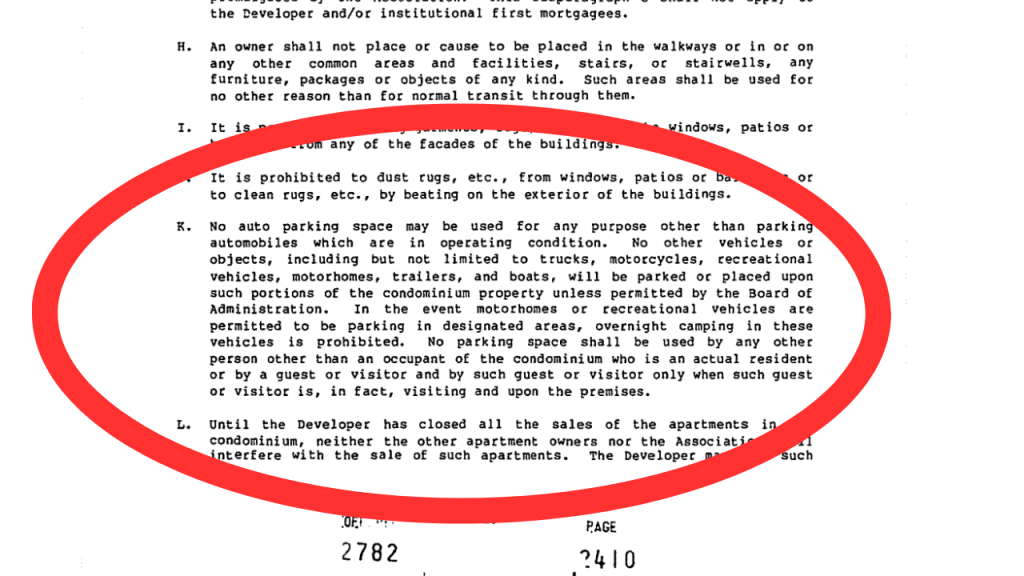

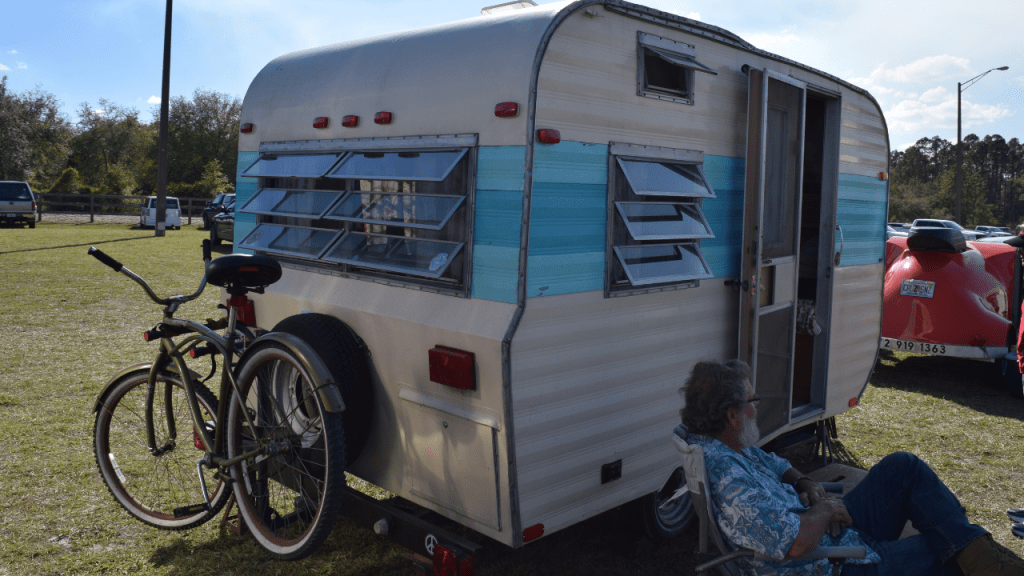

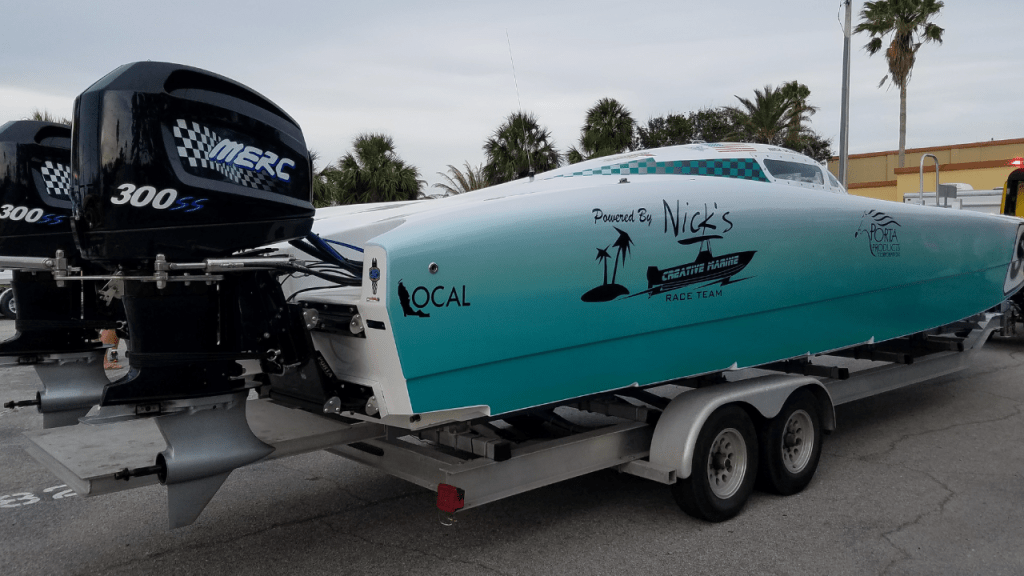

Check to see if there are vehicle restrictions (motorcycles, trucks, or commercial vehicles might not be allowed) RV’s, boats, or trailers might not be allowed.

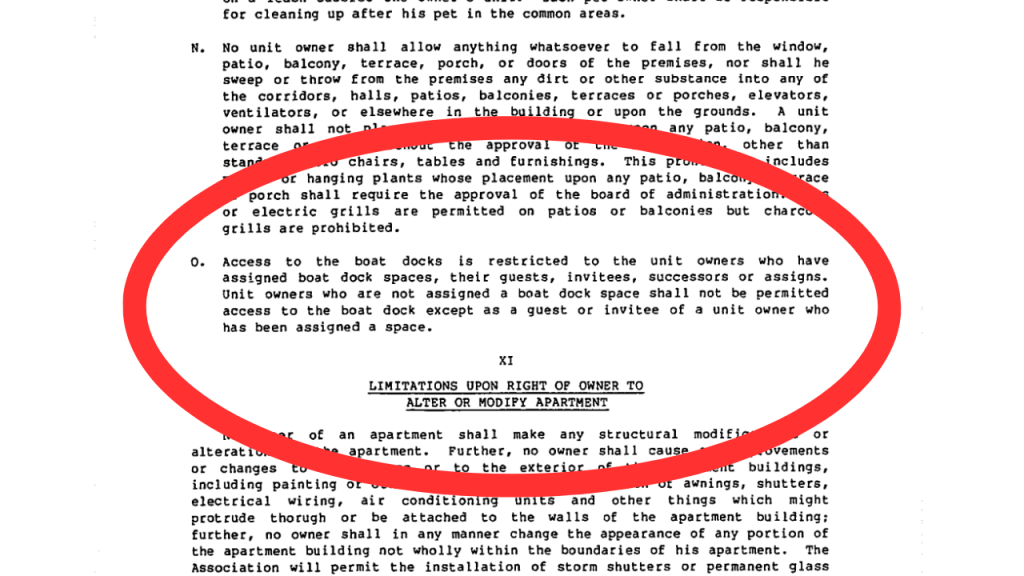

If the condo is on the river and there are boat slips…are these deeded or common areas? How can you get a boat slip and are there additional costs?

Whether you want to read through all the condo documents or not, it makes sense to hire a real estate attorney to review them for you. They are legal documents that you will need to follow once you are an owner in the complex.

Surprisingly, the condo minutes are not part of the condo documents on the FAR/BAR Condo rider. You still need to ask for them and read through them. You will be able to see how the association is run and you will also see what issues might be coming up too. This request should be part of the offer/contract.

If you weren’t aware, some changes in Florida Statutes with condominiums have occurred. Any condo that is 30 years or older (25 years or older if within 3 miles of the beach) and 3 stories or taller, will need to have a milestone inspection report done to confirm the building is structurally safe and sound. These will need to be completed by the end of 2024 and will need to be completed every 10 years. If the association has completed the inspection, the Buyer is entitled to a copy at the Seller’s expense.

The other change is that by the end of 2025, a Structural Integrity Reserve Study needs to be completed and the condo association is to be completely funded. It looks at the long-term expense items (roof, painting of the building, pool refinishing, concrete work, etc) and budgets what the association will need to replace these items without needing an assessment. I do have a video going over these two in detail that will be linked at the end of the video if you are interested in learning more. If you have any questions, let’s schedule a discovery call to discuss.

What’s surprising is that every real estate agent is aware of the documents needed for a buyer to purchase a condo. It’s Real Estate 101 and part of our education for licensing. You would think, if you were listing a condo for sale; you would get all the documents and information together to start the 3-day review process as soon as the condo goes under contract. What is surprising is how many agents are not proactive. They wait until there’s an offer. It takes days/weeks to gather…If you have plans to sell a Florida condo, have all the condo documents, financials, and integrity reports ready. It will minimize a loophole for a buyer to cancel the contract as we get closer to closing.

Whether you are Buying or Selling a condo this year…I am certain you have questions…and I am here to help. Here is a link to my calendar, let’s schedule a discovery call https://www.ericlarkin.com/schedule-a-call . You can give me a call or text 321.795.1854 or leave a message below.

Eric Larkin is a Broker Associate with Real Broker, LLC. He lives, works, and plays in the Cocoa Beach area. If you have questions about moving or relocating to Cocoa Beach and the Space Coast, let me know! I get calls, texts, direct messages & comments on my posts every day about the real estate market and things that are happening in Cocoa Beach and the Space Coast that I love answering. Ask me your questions on moving, relocating here, or anything about the community. I am here to help. I have been helping buyers and sellers with their real estate needs since becoming a real estate agent in 2003. My focus is always on helping, answering your questions, and doing everything possible to make certain you have a smooth transaction from beginning to end.

Planning a move or have questions about our area? Eric Larkin with Real Broker, LLC can help! Schedule a call here https://www.ericlarkin.com/schedule-a-call

OR leave your info here and I will call you https://www.ericlarkin.com/contact-form