As we start the second half of 2025, we are seeing some consistency with the stats for the year.

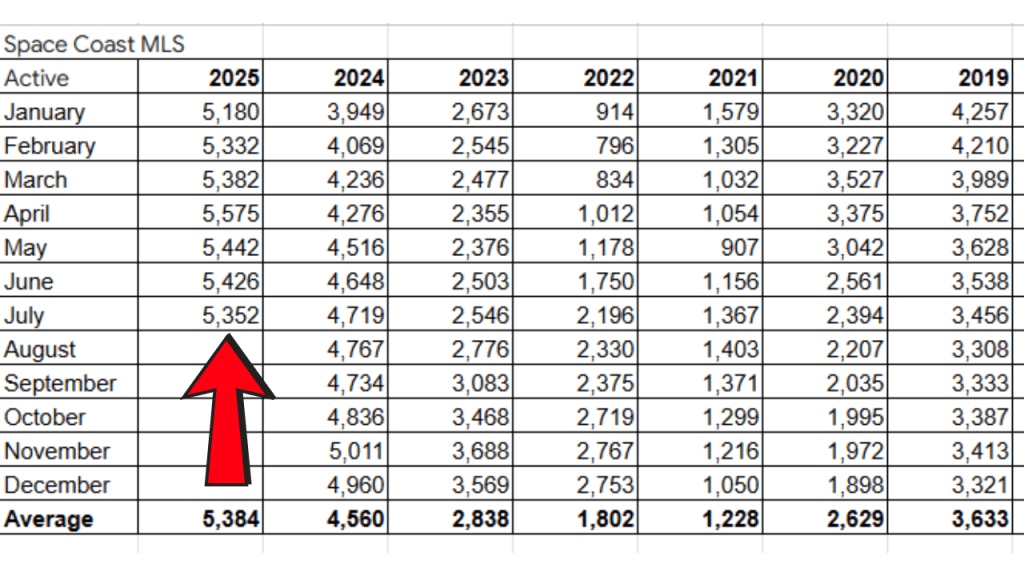

5300 is the new normal for active inventory

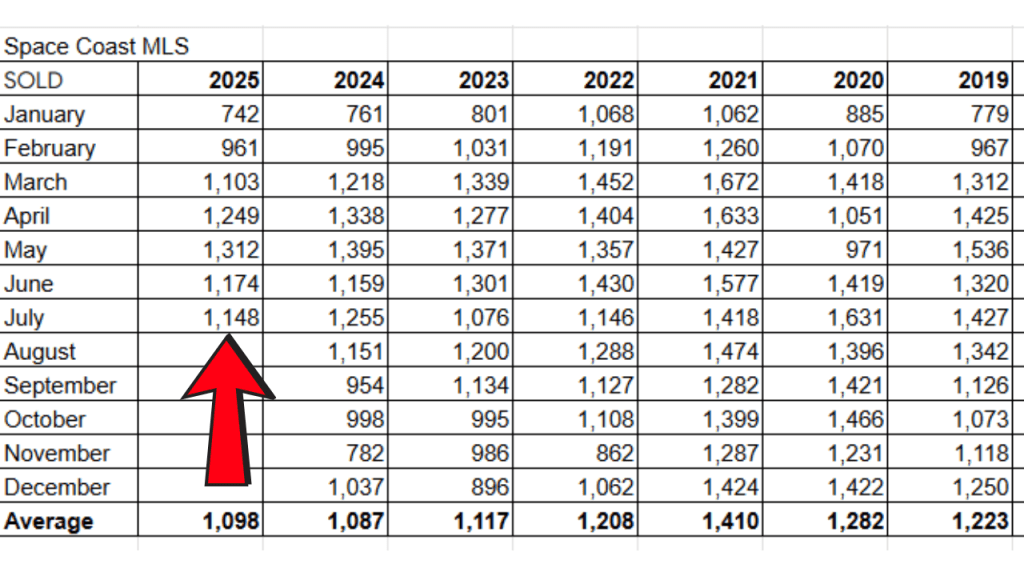

1100 is the new normal for sales

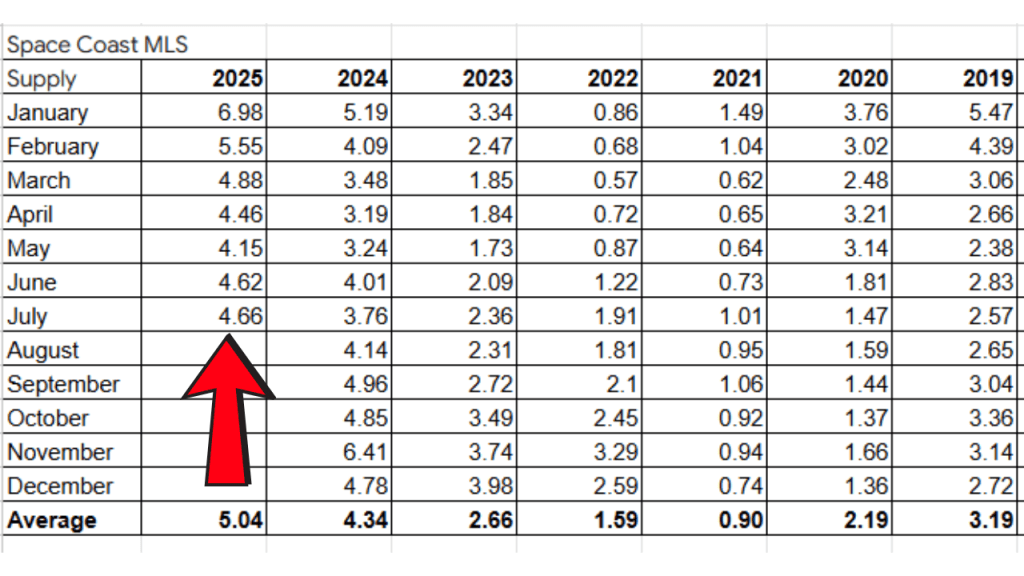

5 month supply of properties for Sellers to be competing with (or Buyers to choose from) is the new normal

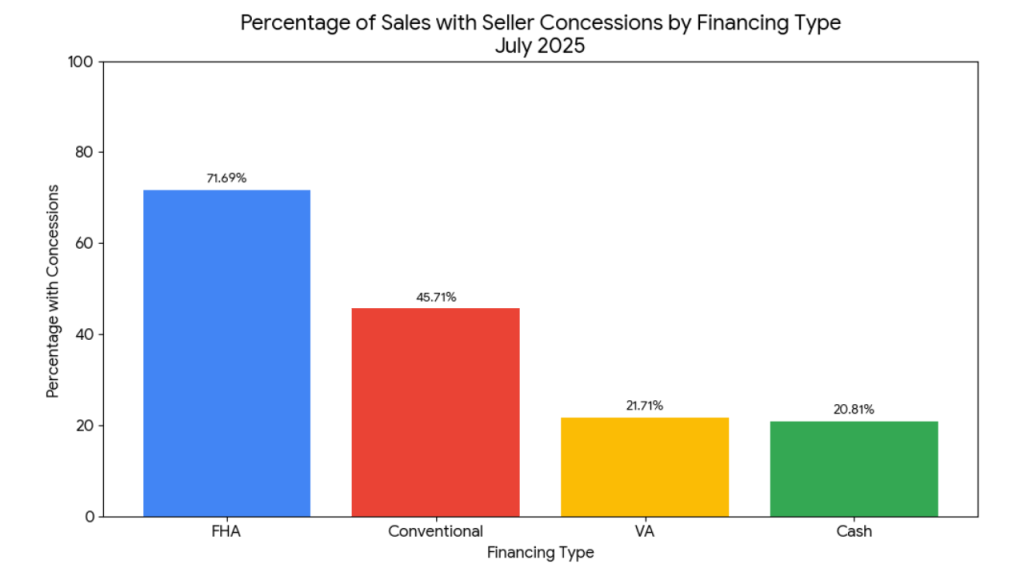

Here are some interesting stats from July’s sales on Seller Concessions

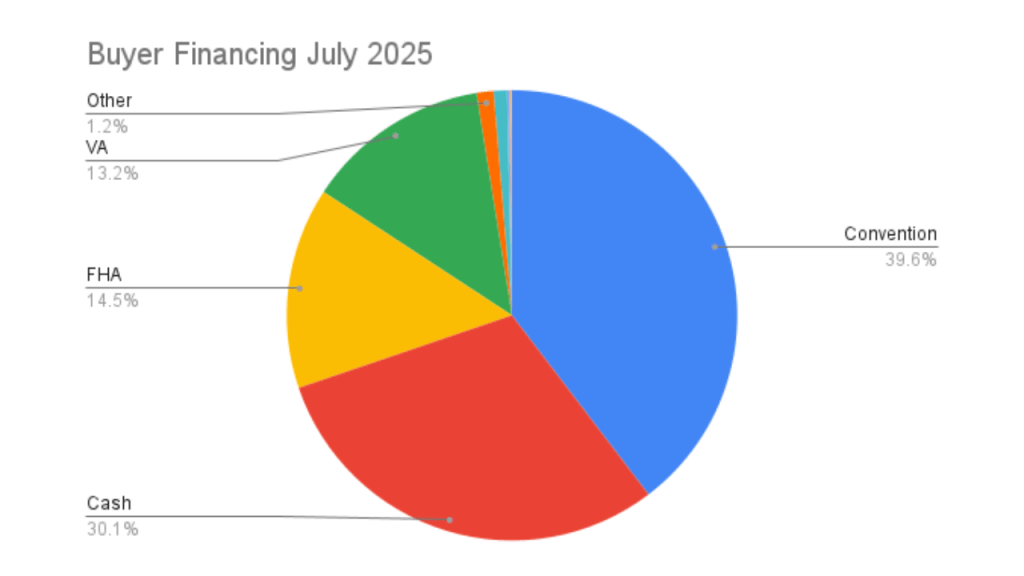

432 of the 1148 closings, the Buyer received some type of Seller concessions (about 38% of the closings)

71.69% of the FHA loans received a concession from the Seller

45.71% of the Conventional loans received a concession from the Seller

27.71 % of the VA loans received a concession from the Seller

20.81% of the cash closings had a concession from the Seller

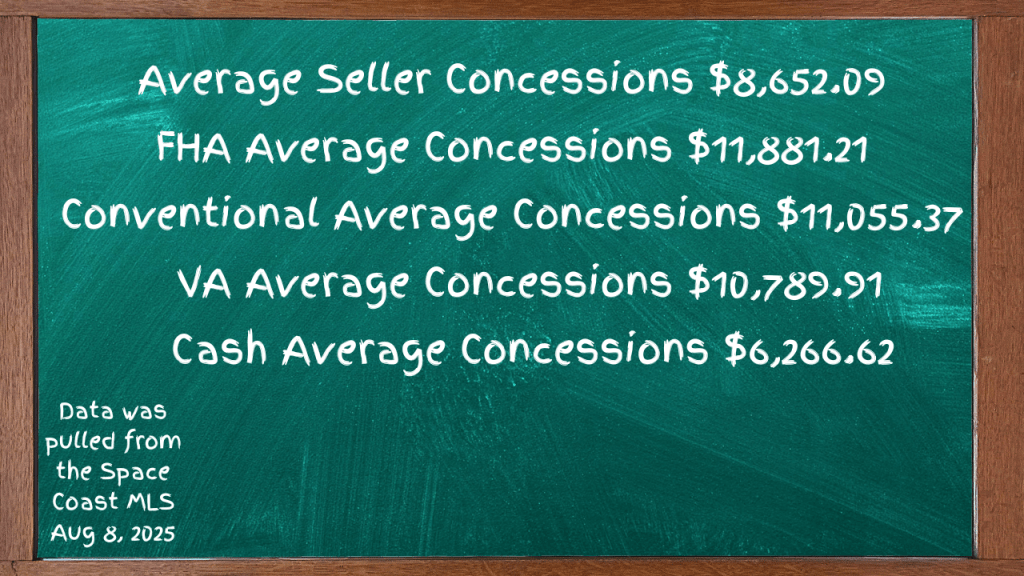

The average concession amount was $8,652.09

FHA average concession $11,881.21

Conventional average concession $11,055.37

VA average concession $10,789.91

Cash average concession $6,266.62

What we do not know from the MLS data are any repairs that were completed by the Seller for the transaction to close. What I hope you are seeing is that if you are looking to purchase a property, ask for the concession during your negotiations. I am seeing Sellers negotiating on the price, on repairs, and on concessions to help get their property sold.

A rule of thumb for the Seller concessions, each loan program has a maximum allowed. Conventional loans are 3%. VA loans are 4%. FHA loans are 6%. It is best to discuss these with your lender as you are getting pre-approved.

Some other stats from our July sales.

Price changes are up. We are seeing almost 2,000 price adjustments per month, with 1971 this July

Day on market is hovering around 70 days on market for a contract with 69.44 days in July

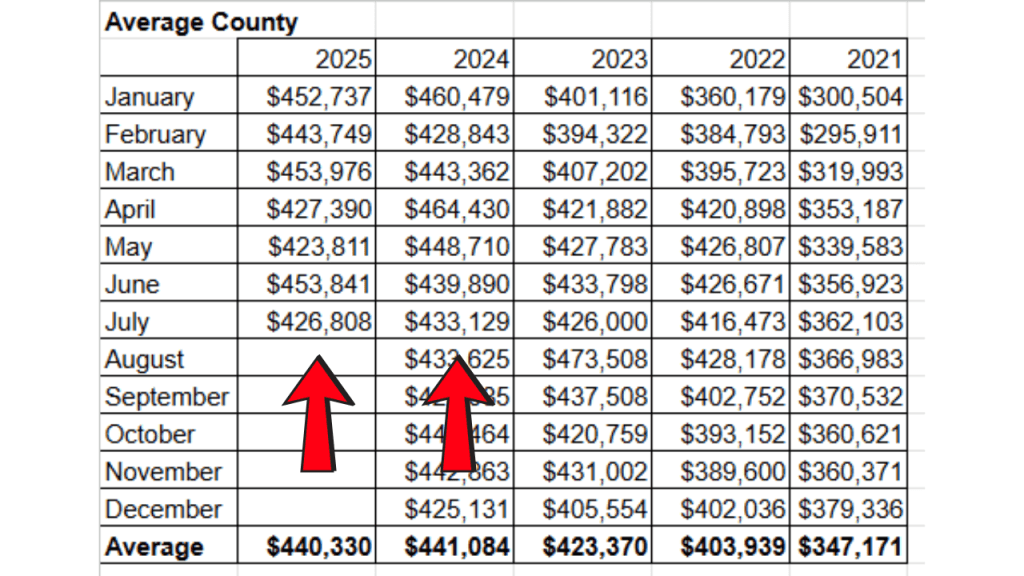

The average sales price is down slightly from July 2024, with 426,808 as the average sales price

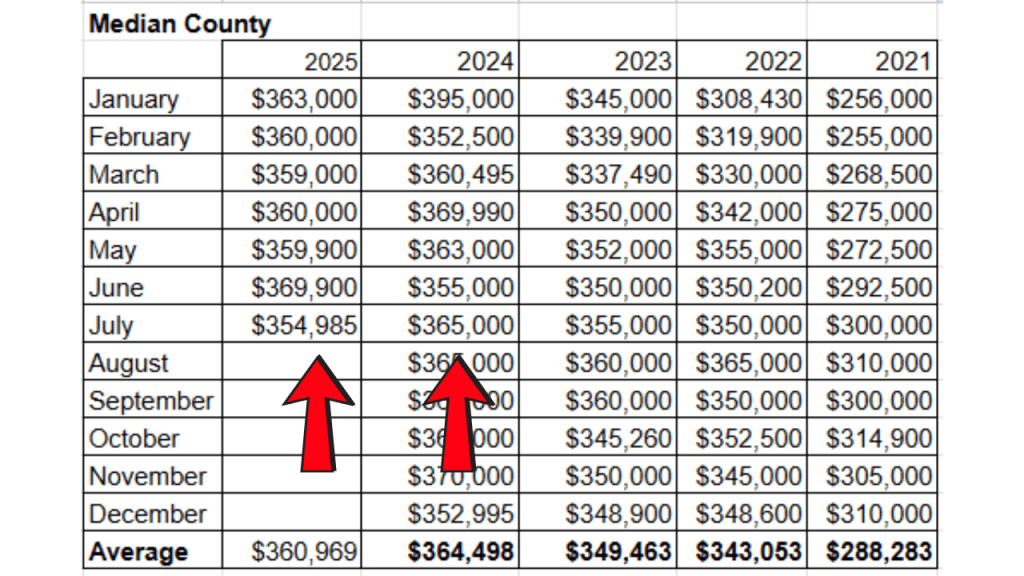

Median sales price is also trending down from July 2024, with $354,985 as the median sales price

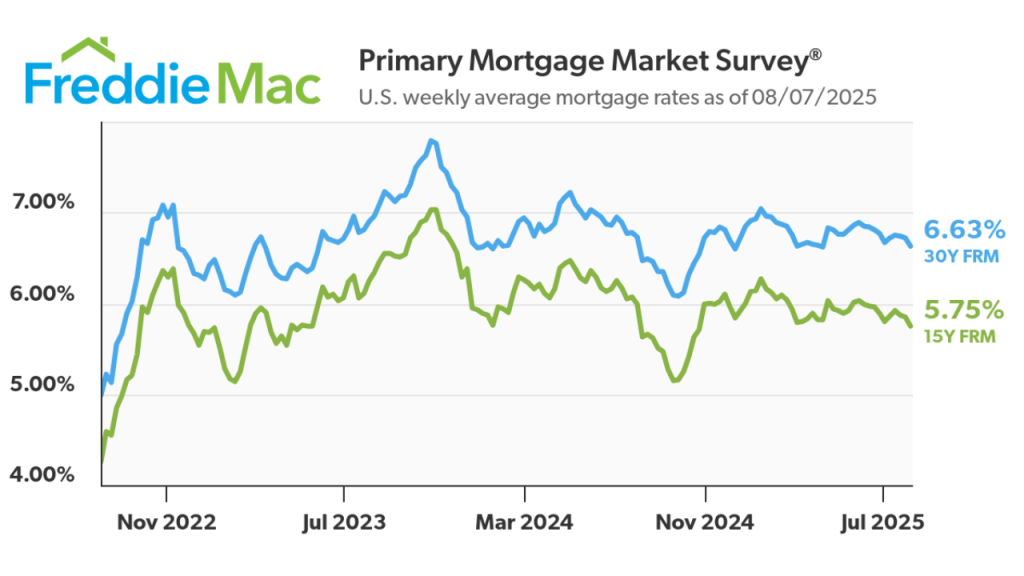

The biggest factor in what is happening with our housing market is the interest rates. Rates did pull back slightly last week. As you can see from the Freddie Mac graph, we are still in the upper to mid 6% range that we have been at for the past few years. There are quite a few buyers hanging out on the sidelines waiting for this to drop. Time will tell what happens here.

Brevard County

Active inventory 5352

Sold Property 1148

Months Supply 4.66 months

Average Price $426,808 2024 $433,129

Median Price $354,985 2024 $365,000

List/Sale ratio 92%

Average price per SqFt $228.49 SqFt

Days On Market 69.44 DOM

Property selling in less than 7 days 207 (18% of the sales)

Property selling over $1M 35

Highest price sale $2.7M Satellite Beach ocean front

Home sales under $200K 33

Cocoa Beach & Cape Canaveral

Condos in Cocoa Beach and Cape Canaveral are also showing some consistency with their trends.

300+ is the new norm for active inventory

36 sales per month is the new norms

9 month supply of inventory is also the new normal.

It is taking on average 100 days for a condo to sell

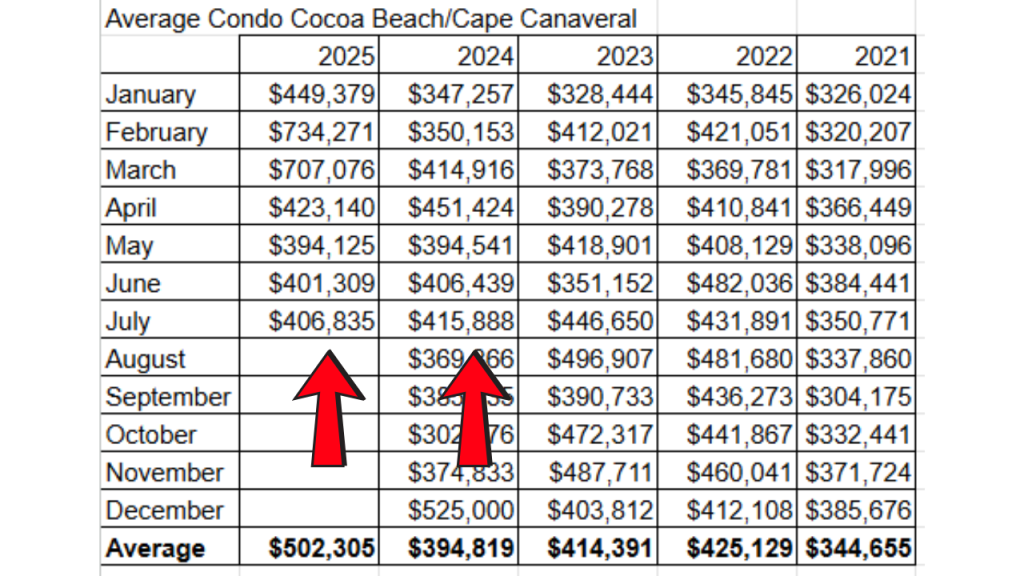

Average prices are trending down somewhat. July’s average sales price was $406,835

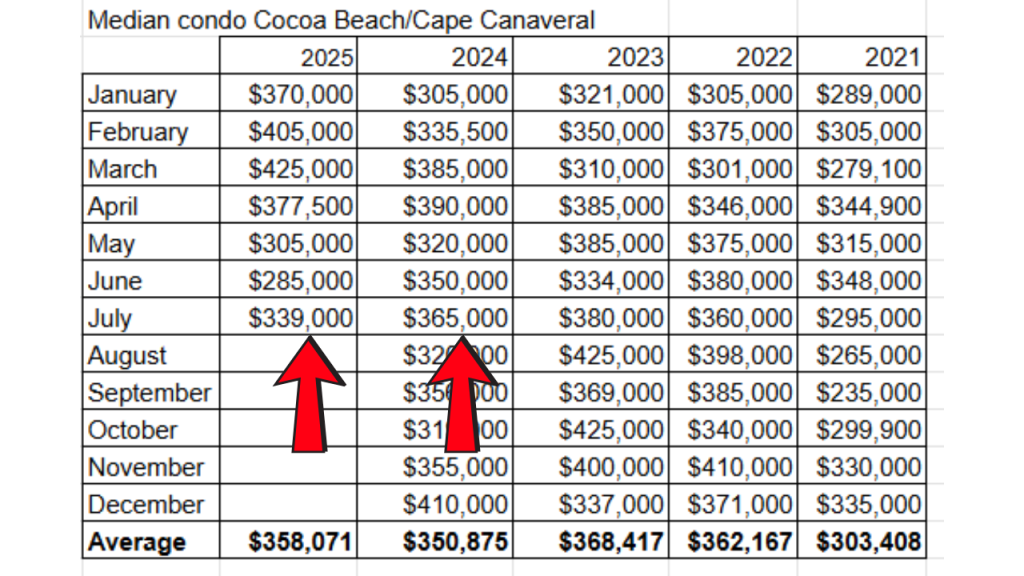

Median condo prices are trending down more. July’s median price was $339,000

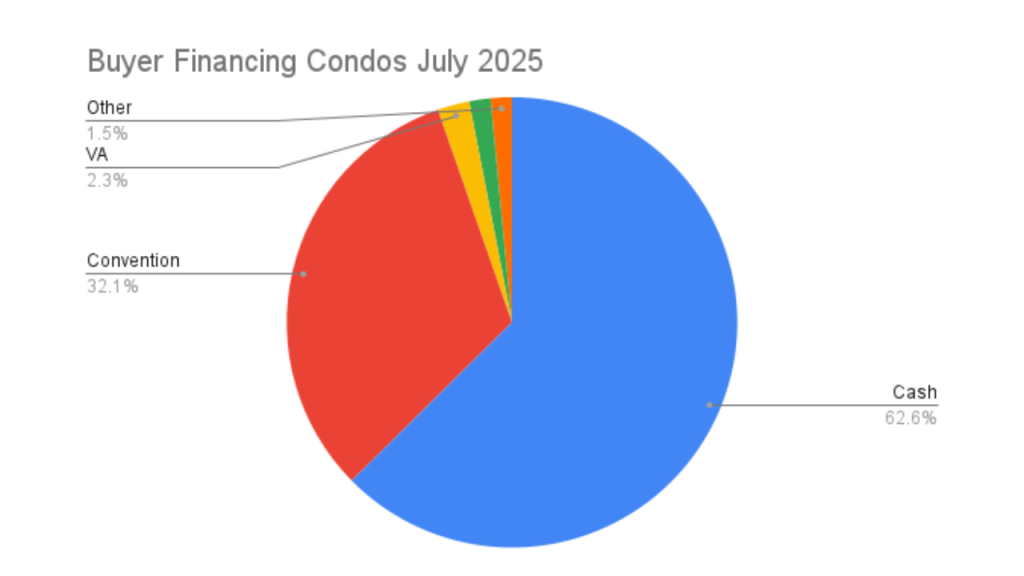

A trend that is not only happening in Cocoa Beach & Cape Canaveral, but across the whole condo market in Brevard is how Buyers are purchasing. We had 131 condo sales in July, and 82 were cash, 42 were conventional, 3 were VA, and the other 4 had “other” types of financing. We have seen over the last 18-24 months, condo loans being a little more complicated because of the new condo laws that have rolled out. The underwriters are asking to review the last 12 months of condo minutes, along with the milestone inspection study. If there is any talk of repairs that need to be done or if the condo is in the middle of any concrete work, it is hard for the condo complex to qualify for a Freddie or Fannie-backed loan.

Condos

| A: Price range $112.5 to $3.399M | S: Price Range $98K to $1.520M |

Active inventory 304

Sold condos 36

Months supply 8.44 Months

Average Price $406,835 2024 $415,888

Median Price $339,000 2024 $365,000

Average price per square foot $299.68 SqFt

Days On Market 96.72 DOM

Condos selling under $200K 7

Best-selling complex N/A-all were 1 or 2 sales per complex (no standouts)

Single Family Homes

| A: Price range $415K to $3.3M | S: Price Range $400K to $1.445M |

Active inventory 71

Sold homes 11

Months supply 6.45 months

Average Price $791,590 2024 $812,857

Median Price $720,000 2024 $805,000

Average price per square foot $396.17

Days On Market 72.91 DOM

Homes selling under $600K 4

Homes selling over $1M 3

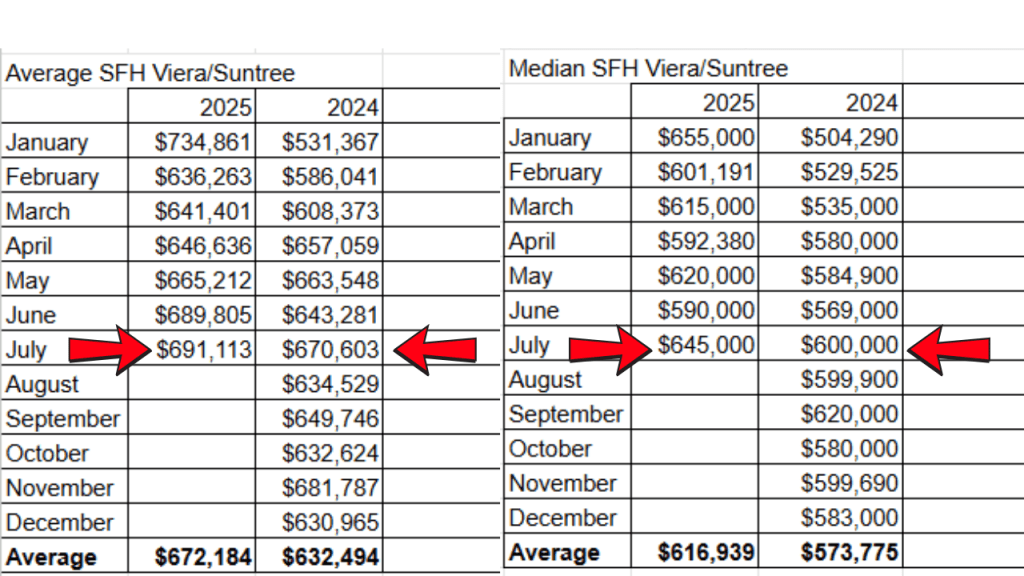

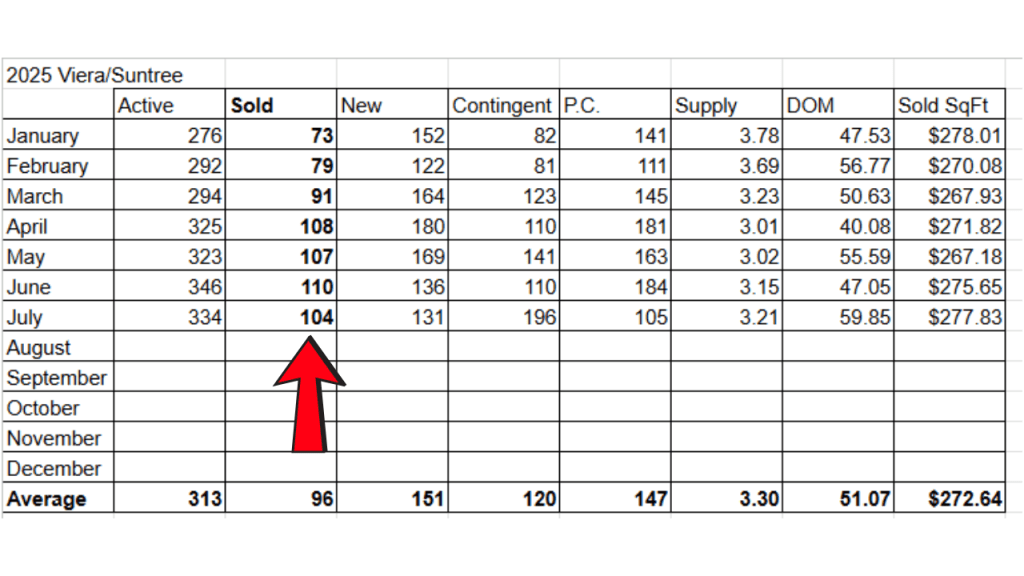

Viera/Suntree Area

The Viera area housing market is bucking the trends from what we are seeing across the country. Active inventory is higher today than we were last year, but the sales are slightly better than they were in 2024. July was the 4th straight month of 100+ sales in the Viera/Suntree area with 104 closings. We are at a 3.21 months supply of property available for sale in the area. The average sales price for July is $691,113, which is almost $20K higher than July 2024. The median sales price for July is $645,000, which is a $45,000 increase over July 2024.

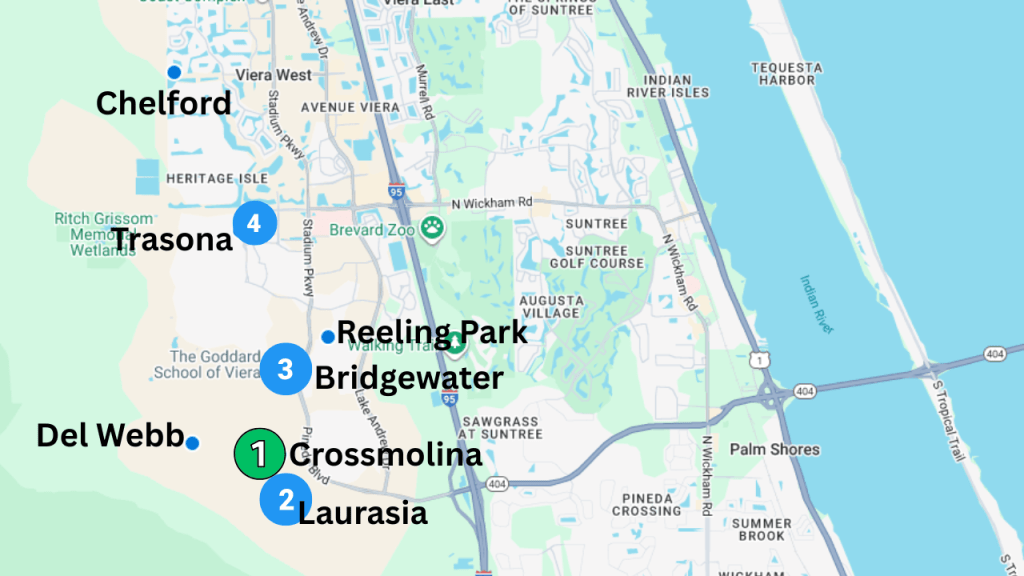

The 5 best-selling communities are all in Viera West:

Crossmolina 10 sales

Laurasia 6 sales

Bridgewater 5 Sales

Trasona 4 Sales

Reeling Park, Del Webb, and Chelford each had 3 sales

Single Family Homes

| A: Price range $ 299K to $5.5M | S: Price Range $280K to $2.4M |

Active inventory 334

Sold homes 104

Months supply 3.21 Months

Average Price $691,113 2024 $670,603

Median Price $645,000 2024 $600,000

Average price per square foot $277.83

Days On Market 59.85 DOM

Homes selling under $500K 28

Homes selling over $1M 9

Looking forward to the remainder of 2025, if you have plans of selling your property, just know there are over 5,000 other homes on the market too. It is worth it to take some time to prepare your home for the market. Do some repairs. Do a lot of cleaning. Consider painting inside and out. Freshen the landscaping and hire a pressure washer to clean your driveway, your walkways, and your patio &/or porch. Have the information available regarding your roof, AC, electrical, & plumbing. You want your home to stand out amongst the competition. Keep in mind the average days on market is 70 days. If you have questions about any of this, I am happy to meet and discuss what is happening in your city, your zip code, and your subdivision.

Eric Larkin is a Broker Associate with Real Broker, LLC. He lives, works, and plays in the Cocoa Beach area. If you have questions about moving or relocating to Cocoa Beach and the Space Coast, let me know! I get calls, texts, direct messages & comments on my posts every day about the real estate market and things that are happening in Cocoa Beach and the Space Coast that I love answering. Ask me your questions on moving, relocating here, or anything about the community. I am here to help. I have been helping buyers and sellers with their real estate needs since becoming a real estate agent in 2003. My focus is always on helping, answering your questions, and doing everything possible to make certain you have a smooth transaction from beginning to end.

Planning a move or have questions about our area? Eric Larkin with Real Broker, LLC can help! Schedule a call here https://www.ericlarkin.com/schedule-a-call

OR leave your info here and I will call you https://www.ericlarkin.com/contact-form