Were you expecting the condo market to crash in 2025?

A lot of buyers were. Between rising condo fees, insurance costs, higher interest rates, and new Florida condo laws around milestone inspections, concrete restoration, and large special assessments, it felt like condos were under pressure from every direction.

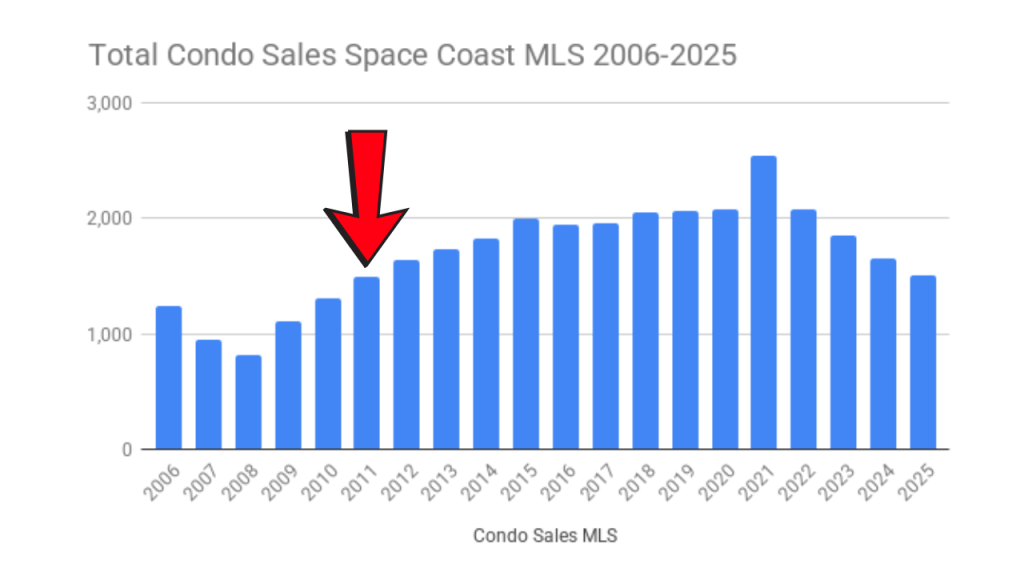

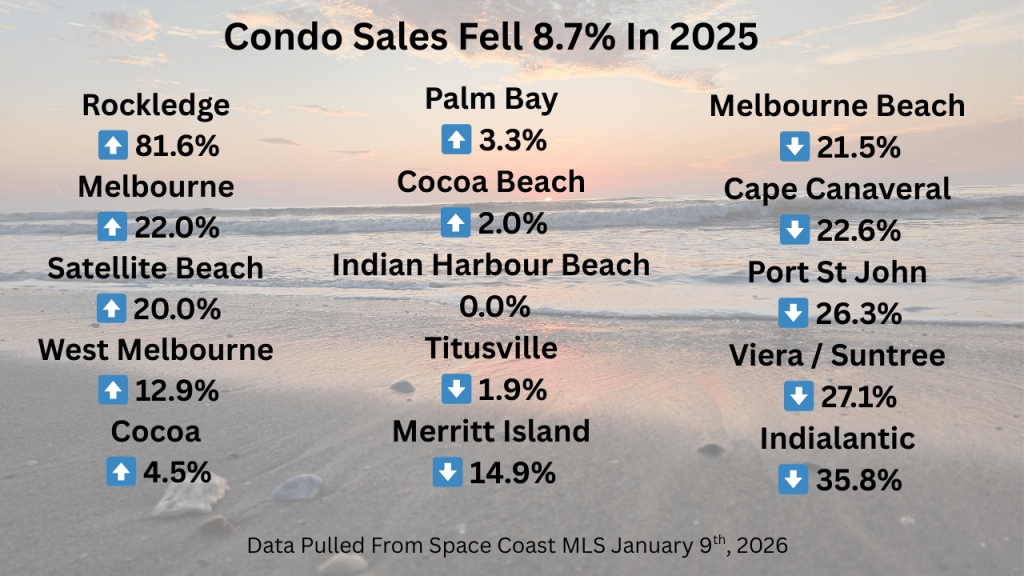

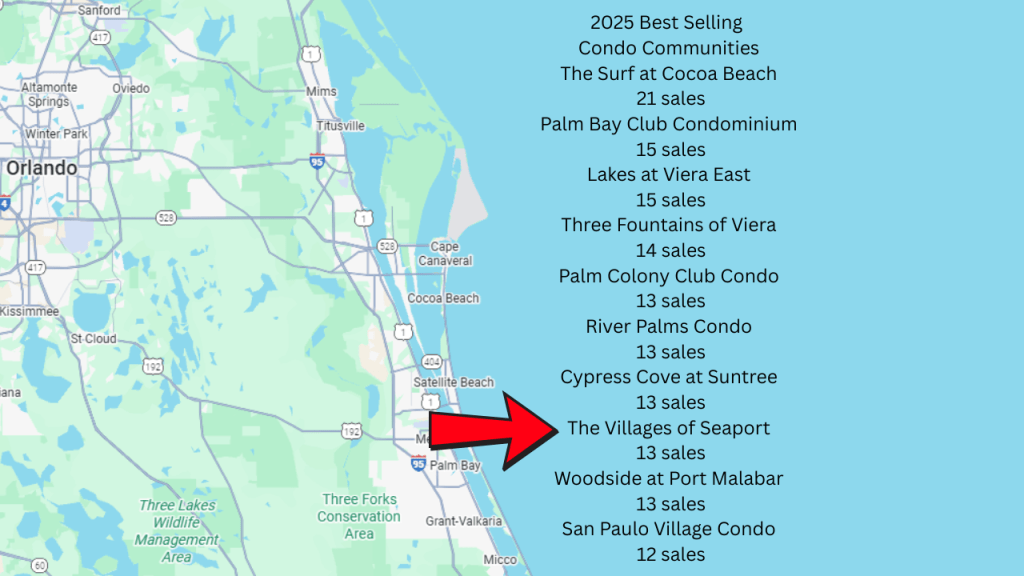

Looking at total sales for 2025, activity was definitely down. There were 1,506 condo sales in the Space Coast MLS, a decline of 8.7% from 1,649 sales in 2024. Condo sales have been trending lower since peaking during the pandemic years, and 2025 marked the slowest year for condo sales since 2011.

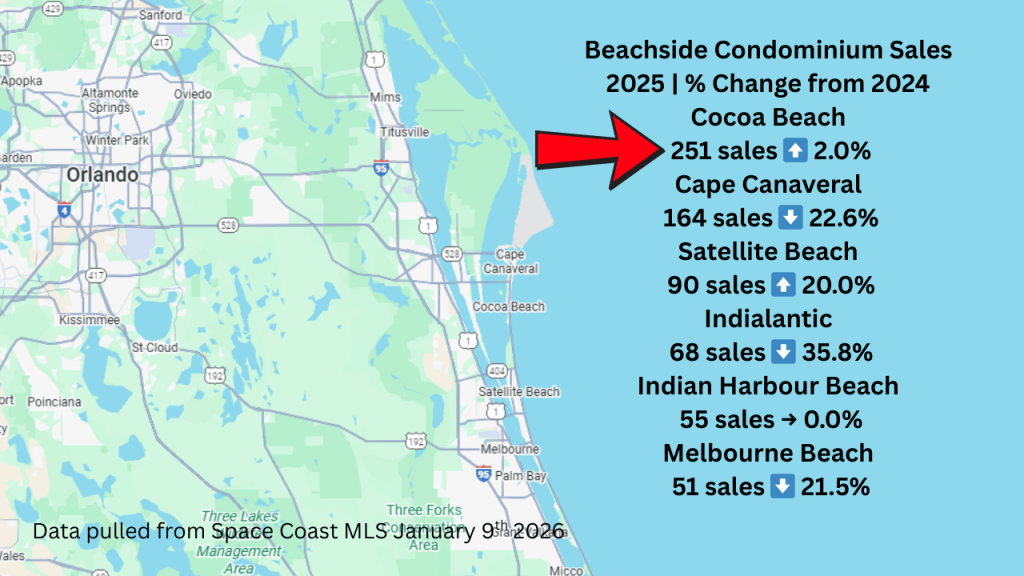

Most condo sales in 2025 were still happening beachside, with Cocoa Beach leading the way. Cocoa Beach recorded 251 condo sales, a 2% increase from 2024, making it the most active condo market on the Space Coast.

Other beachside communities, however, saw noticeable declines. Indialantic experienced one of the sharpest drops, with sales down 35.8% year over year. This highlights how uneven the slowdown was, even among barrier island markets.

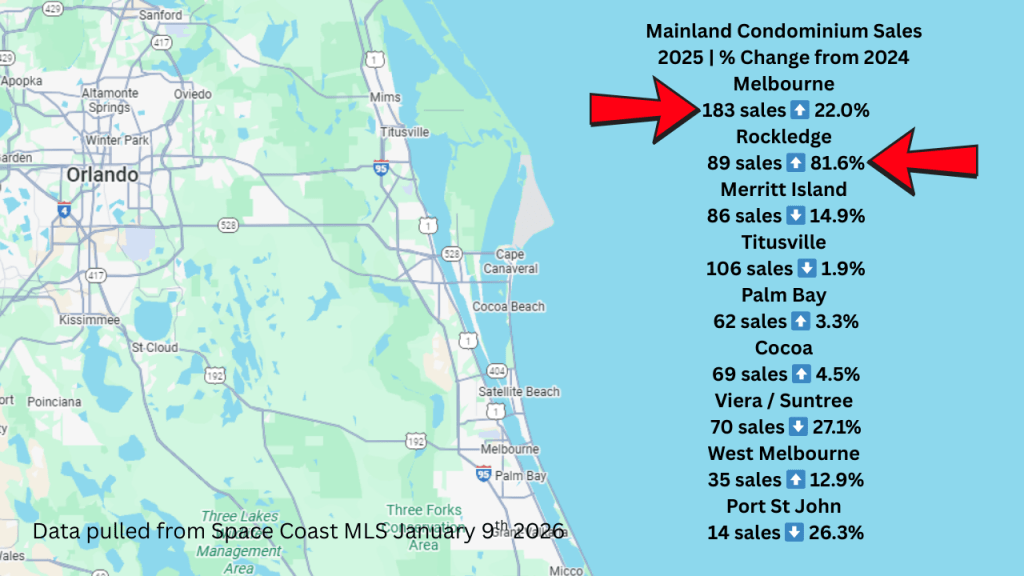

On the mainland, Melbourne ranked second in total condo sales, while Rockledge stood out with the largest year-over-year increase in sales, up 86%. Rather than buyers stepping away from condos altogether, the data shows activity shifting toward specific cities and buildings.

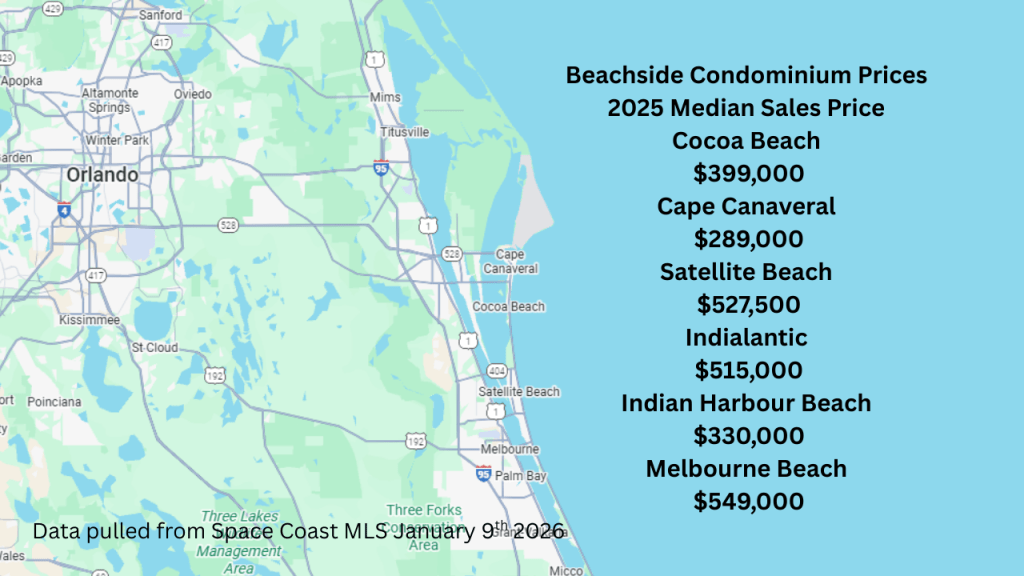

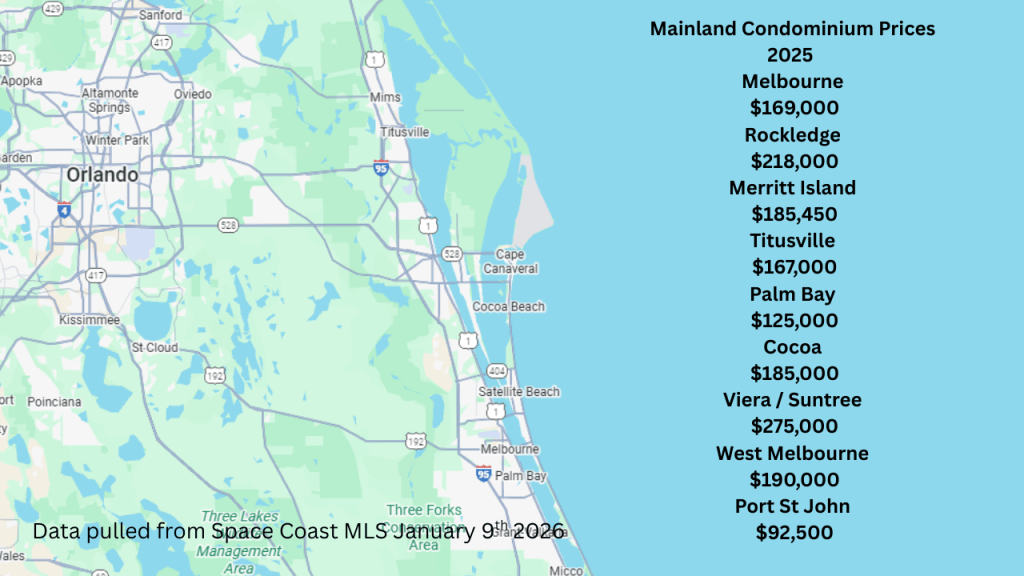

While condo sales slowed in 2025, pricing didn’t fall apart. Median condo prices varied widely by city, but across the Space Coast MLS the data shows softening rather than a collapse. Buyers were still willing to pay for the right location and condition, but they were no longer willing to overpay just to get a deal done.

Beachside, the median prices were between $289,000 and $549,000.

Mainland median prices were between $92,500-$275,000.

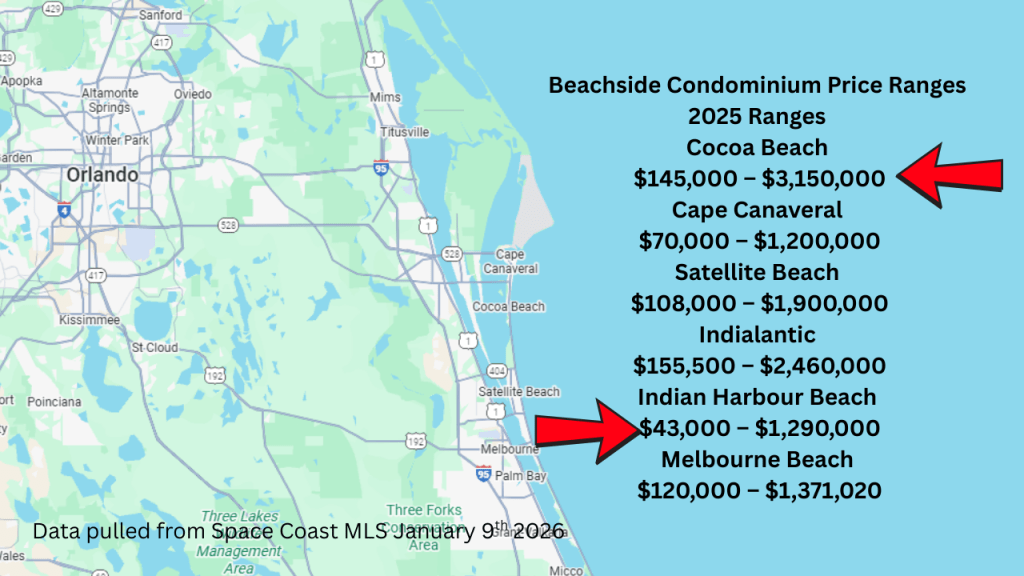

Median prices help show where the market actually settled in 2025, because they aren’t skewed by a handful of high-end or distressed sales. At the same time, medians can hide just how wide the price spread was within each city.

On the beachside, the range of condo prices in 2025 was especially wide. Ranging anywhere from $43,000 to $3,150,000. This shows that there are options for every budget to live close to the beach.

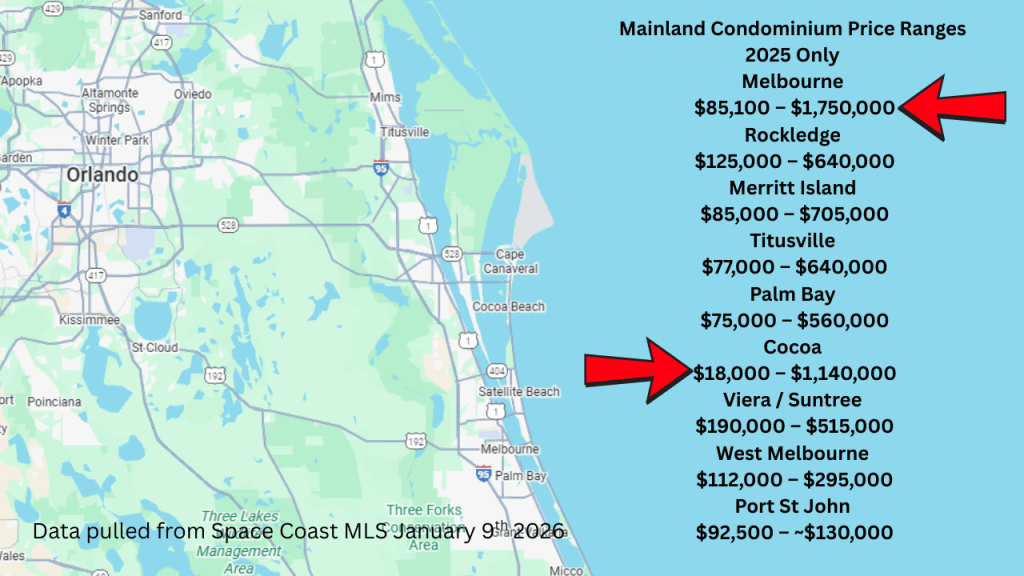

Mainland condo markets told a different story. While prices were generally lower, the ranges still varied widely depending on the city and the building. The range of condo sales on the mainland were from $18,000 to $1,750,000.

The wide price ranges in both beachside and mainland markets point to one clear theme in 2025: buyers had options and were far more selective. Updated condos in well-run buildings continued to sell at the top of the range, while dated units or buildings with higher carrying costs struggled unless pricing was adjusted.

Was 2025 a condo crash or just a reset?

A condo crash would show up as collapsing sales, steep price declines across the board, and widespread distress. Buyers would disappear, and sellers would be forced into deep discounts just to move inventory.

That’s not what the 2025 data shows. Sales declined, but they didn’t collapse. Prices softened in many markets, but they didn’t fall off a cliff. Buyers stayed active, especially in well-located or well-priced buildings.

What happened in 2025 looks much more like a reset than a crash. The condo market moved away from the pandemic-era frenzy and back toward a more selective, value-driven environment.

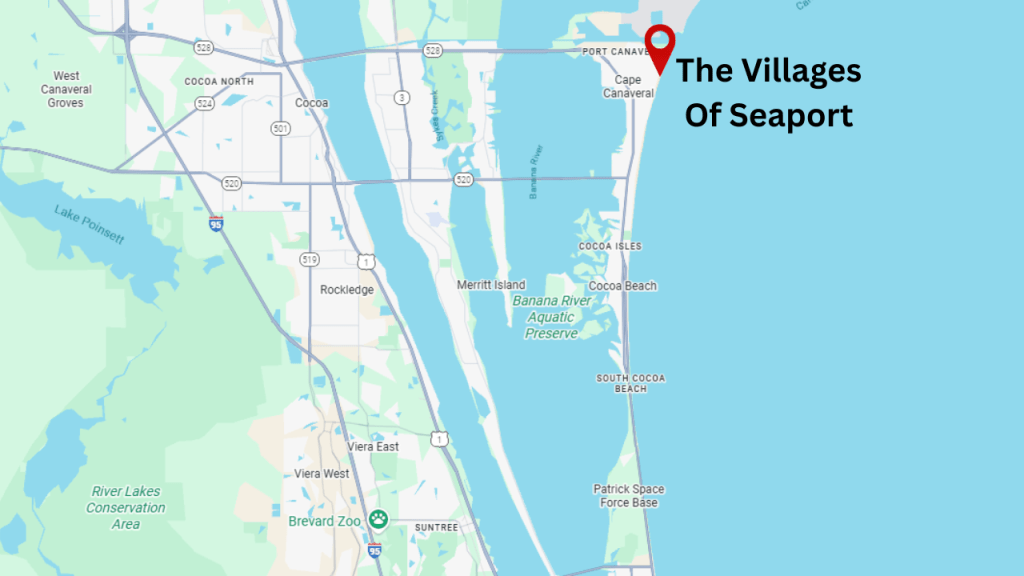

The Villages of Seaport in Cape Canaveral is a good example of this shift. As one of the largest condo communities in Brevard County, Seaport typically ranks near the top in annual condo sales. In 2025, that wasn’t the case. Instead of leading the market, Seaport barely cracked the top ten in total sales. That change doesn’t point to a broken market, but it does highlight how buyer behavior changed in 2025.

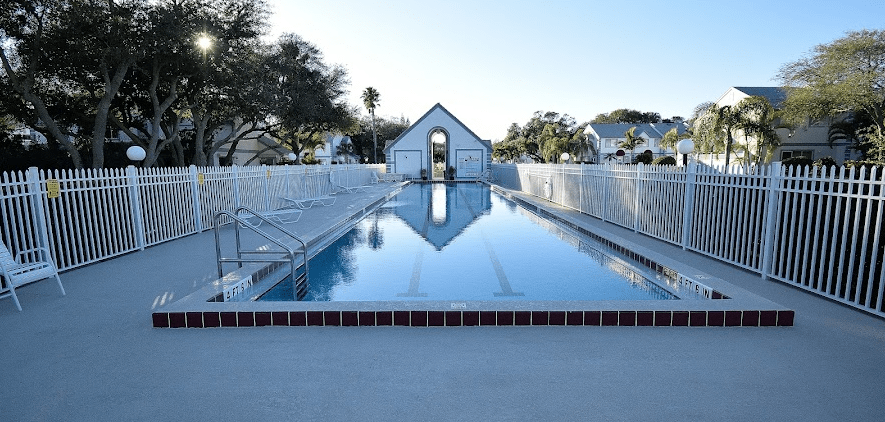

The Villages of Seaport offers a wide variety of floorplans within a gated, oceanfront community with resort-style amenities. It’s easy to understand why it has historically been one of the most active condo communities year after year. But in 2025, community alone wasn’t enough. Pricing and condition played a much bigger role, especially with inventory levels still elevated and buyers having more choices.

If a condo hasn’t been updated, pricing matters more than ever. And even for updated units, buyers are far more disciplined than they were during the pandemic years. In today’s market, value drives decisions.

What 2025 made clear is that condo buyers have more leverage heading into 2026. Inventory levels are higher, buyers are more selective, and pricing discipline matters again. This doesn’t mean every condo is a bargain, but it does mean buyers have options.

The condos that continue to sell are the ones that make sense on price, condition, and overall carrying costs. For buyers willing to be patient and selective, 2026 may offer opportunities that didn’t exist during the peak years.

The condo market didn’t break in 2025. It reset. And understanding that difference is key to making smart decisions in 2026.

Questions about buying a condo or an upcoming move? Let’s talk! Leave your contact info below or give me a call.

Eric Larkin is a Broker Associate with Real Broker, LLC. He lives, works, and plays in the Cocoa Beach area. If you have questions about moving or relocating to Cocoa Beach and the Space Coast, let me know! I get calls, texts, direct messages & comments on my posts every day about the real estate market and things that are happening in Cocoa Beach and the Space Coast that I love answering. Ask me your questions on moving, relocating here, or anything about the community. I am here to help. I have been helping buyers and sellers with their real estate needs since becoming a real estate agent in 2003. My focus is always on helping, answering your questions, and doing everything possible to make certain you have a smooth transaction from beginning to end.

Planning a move or have questions about our area? Eric Larkin with Real Broker, LLC can help! Schedule a call here https://www.ericlarkin.com/schedule-a-call

OR leave your info here and I will call you https://www.ericlarkin.com/contact-form